As EvoEstate has intrigued us with its unique approach of aggregating offers from a number of P2P/P2B platforms, we have decided to follow up on our recent review with more information. We reached out directly to EvoEstate’s CEO – Audrius Višniauskas – and he was happy to accommodate our request for an interview.

Audrius, thank you for accepting our interview request. Let’s get straight to the questions. How did the idea to launch your own portal EvoEstate emerged?

We watched the crowdfunding industry grow into 10’s of platforms and quickly realized that it was very difficult to monitor and keep on top of all the investment opportunities. So we had the idea of bringing all of these projects onto one single crowdfunding site and making it easier for investors to search out the best opportunities that fit their investment criteria all from a single account. By creating EvoEstate we also resolved the complicated process of having to deal with

multiple income tax statements as investors get one tax statement for all their investments on EvoEstate, no matter the originator and we also managed to create a real liquid Secondary Market that includes projects from all our originators, no matter if the originator itself has a Secondary Market or not.

EvoEstate functions like an investment projects aggregator throughout Europe. If you were in investor shoes, what main advantages of this concept would you appreciate? Are there also some inconveniences resulting from this system?

EvoEstate is a real estate aggregator that facilitates access to over 15 project originators from over 8 countries. We are currently serving over 5000 investors from over 50 countries and our numbers are growing from month to month. The main reason for this growth in a relatively small amount of time is that we are different from the rest of the industry because we focus on transparency and our team understands investor’s needs as we are also investors ourselves with experience in crowdfunding and the real estate space. We always strive to offer a product that suits each investor’s needs and we are constantly looking for ways to improve the product. Our customer service is very dynamic and we listen to every investor’s request in order to further improve the user experience and maintain a clean product.

“We watched the crowdfunding industry grow into 10’s of platforms and quickly realized that it was very difficult to monitor and keep on top of all the investment opportunities.”

The main advantages of investing with EvoEstate are:

- Accessibility – some of our project originators don’t accept foreigners as investors on their platform. Therefore, a possibility to invest in their platform is by using a product like EvoEstate due to our legal structure.

- Low minimum investment – we have the same minimum investment amount for all our project originators, 100 EUR, while some of our project originators if you wish to invest directly with them, can have a minimum investment of up to 1000 EUR or even more. This helps a lot with diversification, especially with accounts that have a lower amount of funds available for investing.

- Diversification – you get access to over 15 project originators all from a single account.

You don’t need to manage 15 different accounts, learning each specific platform, how to use it, following each one, etc. This helps a lot with lowering the time needed to manage your investments as EvoEstate takes care of all the processes regarding communicating with originators, giving you project updates and everything related to the investing process. - Features – you get a lot of useful features such as a very liquid Secondary Market where investors can sell their investments before their maturity date. Even for projects and project originators that don’t actually have a Secondary Market if you wish to invest directly with them. 24H free cancel Auto-Invest, a complex Auto-Invest tool, encrypted bank accounts to further improve the security of the investor’s bank account and many other features that are meant to further improve the overall user experience.

- Customer Support – we believe that we offer one of the best Customer Support in the industry as we always put the investors first. We offer many communication channels for our investors and we are actually working on delivering another great way of communicating with us. We are always available and ready to help our investors with any issues that they might encounter.

There are not many inconveniences resulted from this system because we take care of all the processes and investors don’t really need to do anything besides pressing a few buttons. Therefore from the investor’s point of view, they get the same or even a better deal while investing with EvoEstate compared to investing directly with the project originator. Investors don’t need to manage multiple accounts on multiple platforms because all of this work is done by EvoEstate’s team while always putting the investor first.

How complicated is to start a cooperation with a new portal? Could you describe onboarding process a little bit? What benefits to lending platforms can EvoEstate offer?

It really depends on the project originator and how open are they regarding a possible collaboration with EvoEstate. From our experience, with some project originators is more complicated than others. Some project originators are demanding some specific rules and if we can’t get to a common ground where our investors are benefiting from this potential collaboration we normally choose not to proceed.

The onboarding process starts usually with a call with a representative from that particular platform. After we have a friendly talk where we ask various questions about the company, their experience, results and everything that might help us better assess if the project originator is worthy of our portfolio we move with asking the potential project originator to provide us with some requested documents.

After we receive the documents and verify all the information inside of them we move to actually check their team and experience with the available information that we can find. We also look for any potential information about the company/platform that could affect the overall verdict from our side regarding a potential collaboration.

Next, we move to actually analyzing the project originator with our EvoEstate Originators Rating that assigns a letter to each of our project originators based on various data about them. You can find more information about this process here.

Team experience and past/current track record are two of the most important aspects that we analyze when assessing the process of onboarding a project originator. We always strive to offer just quality projects and therefore we choose to work only with selected project originators from the industry. We put our investors in the first place and this is why we are always looking for quality, not quantity.

EvoEstate offers multiple benefits to potential project originators such as:

- Exposure to different markets/countries.

- The ability to fund projects faster.

- The ability to have a greater funding volume.

Could you elaborate how EvoEstate works technically? How is crowdfunding of the same project maintained in two places in real time? And how is the income from each project subsequently distributed?

The majority of processes are automated with a small number of areas still requiring manual oversight, however we are working towards automating the whole process. In most cases investors investing via our platform are able to see real-time data and this enables them to evaluate the opportunities more efficiently and accurately; for example investors can predict when the funding will be achieved and therefore make better investment decisions. Project income is distributed instantly and automatically to our investors.

Which criteria are considered during project listing? Do you aim to offer a wide diversification opportunity for your investors or quality aspects of each project must be assessed as well?

We partner with only reputable and trustworthy originators and offer a wide selection of differing risk and return profiles that are already carefully selected by our chosen originators. Therefore we act as a marketplace where we list most of the projects available on the originator’s platform and investors can have almost the same experience as investing directly with the originator from the diversification point of view. As part of our offering, we have developed in-house evaluated Risk Scoring results that help our investors evaluate project risk and choose projects most suitable for their investment needs. You can find more information about how our Risk Scoring works and the way it is structured by pressing on this link.

Ok, understood. However it is inevitable that, from time to time a project default occurs. What position does EvoEstate have here? Can investor expect a support activity during the financial settlement, or this is in the hands of the lending platform?

As of right now, in more than 2 years of activity, there has been no capital loss for our investors at EvoEstate. Currently, there are 7 projects that are late for principal repayment out of more than 430 projects that were fully funded on EvoEstate. None of these 7 late projects technically default because most of them got a period of extension due to the COVID-19 crisis or some of them are currently being refinanced. For most of the 7 late principal repayment projects, we expect a full repayment soon, especially for the projects that are being currently refinanced. You can find the real-time data of late projects for each originator here.

EvoEstate is constantly in contact with project originators regarding periodical updates of projects. This also includes late projects. We are taking part in the process of a defaulted project as an investor would while investing directly with the originator. We are making decisions and keep our investors informed exactly as they would be able to do while investing directly with the project origination. The whole process of a defaulted project is in the hands of the originator but we are acting, putting investors in the first place, in every aspect that we can get involved. In case we need to take legal action, our lawyers are prepared to do so in order to achieve the best results for our investors.

So investors can expect EvoEstate to do all the work for them when it comes to a defaulted project as we strive to offer nothing but the best outcome for our investors.

Many P2P platforms experienced an outflow of investors and capital in 2020 due to COVID-19. What was 2020 like for EvoEstate? Was there something you learned, for example?

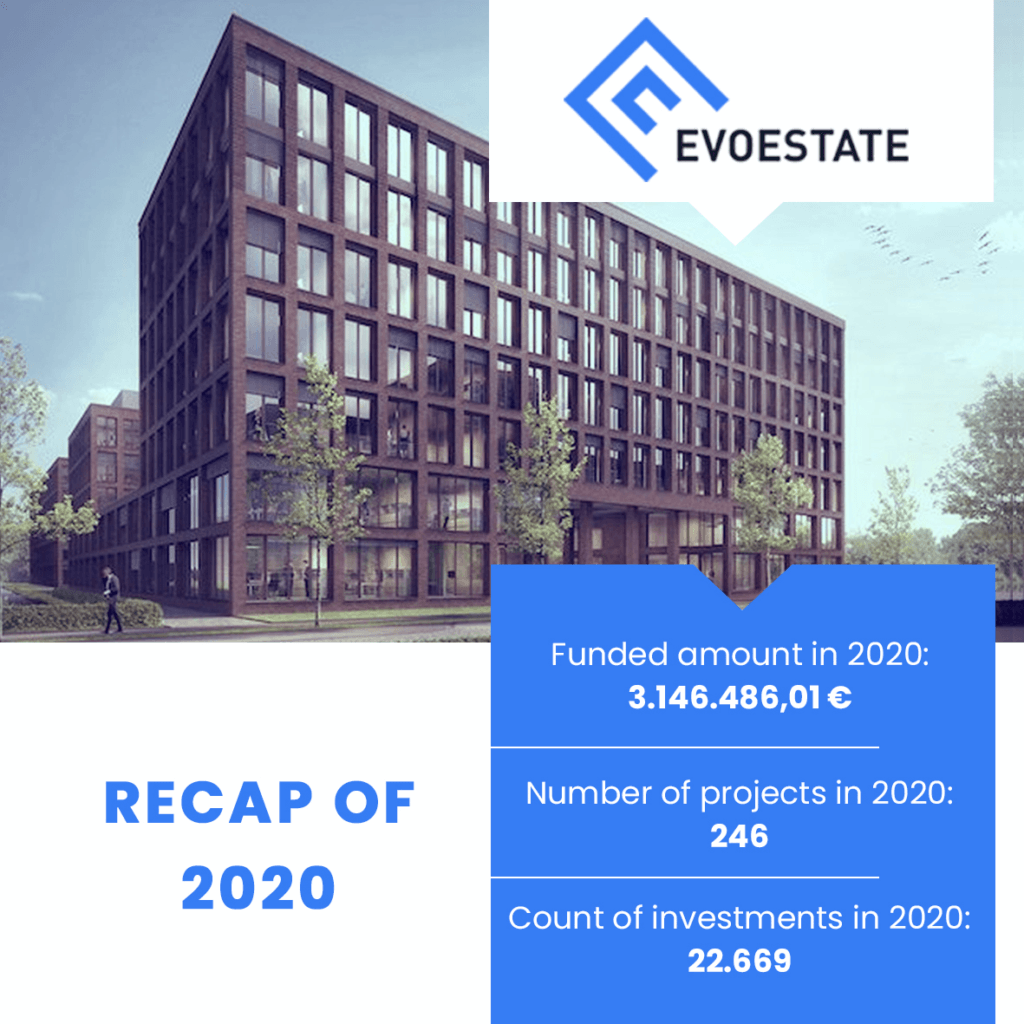

The world has changed significantly due to COVID-19. The pandemic has forced a change in people’s lifestyle and business activities all around the world. Luckily, those changes were beneficial to our business model. 2020 was a great year despite the COVID-19 implications. We have seen a constant growth in numbers of investors, and their investment amounts. However, the unforeseen COVID-19 situation taught us to work differently, stay flexible.

EvoEstate actually managed to have record numbers even during the COVID-19 crisis as our rapid month-to-month growth continued even in these challenging times. We are really confident that we will continue on the same path in the upcoming years due to our approach to investors that is different from the rest of the industry and the improvements that we will bring to our marketplace that will make the investing process an even better experience than it is today.

Could you share platform statistics? Which platforms and offers do investors prefer?

Investors are most attracted to short-term projects which forecast the highest interest rates, plus investors also appreciate first rank mortgage guarantees. We definitely see certain originators being more popular than others and as we roll out our originator score index which will allow our investors to rank originators based on their uniqueness, communication, execution, we expect to see more transparency and originators improve their level of the overall offering. We are also

working on delivering the Statistics Page where investors will be able to see all the important data about our marketplace, originator’s numbers and other important numbers that will help them have a better understating of how everything is evolving.

What are your nearest plans? Can investors look forward to any new technical improvements? Do you plan to offer opportunities from Asia or the USA, for example?

We are constantly working on new features and functionalities and closely listen to our investors’ suggestions on any improvements. At the moment, we are razor focused on our core European market, but over time we will look at other geographies.

You classify yourself as a “Real estate investment Marketplace”, not as a P2P platform, on your website. What does it mean for you to create a good marketplace? Is it a place with many offers or does it mean something more to you (e.g. community creation, education…)?

It is a little bit of both, a platform offering an excellent real estate marketplace as well as an inclusive social aspect, which connects our investors and like-minded people. The channel has become a friendly community where our investors can freely discuss the projects, originators, deepen their knowledge, share their experiences, give and get support. We are more than just a simple marketplace for our investors, we are a community of investors from all across the world

with one primary goal – transparency and a better investing experience for the industry.

Is there anything you would like to say to investors in the end?

If you wish to get in contact with any of our team members or you have any questions please feel free to contact us at any given time. We offer multiple ways of communicating such as live chat, direct e-mail or even a Telegram group that you can use by pressing on this link. Also, if you wish to make some suggestions on how we can improve our marketplace we will be happy to listen to your request.

Where to next?

- EvoEstate official website

- EvoEstate overview page at P2Ptrh

- EvoEstate: review of an European P2P offers aggregator (P2Ptrh EvoEstate review)

- Comparison table with more than 30 P2P lending platforms