One of the youngest P2P platforms on the market is the Bulgarian Afranga. We have registered ourselves shortly after its launch and after about half a year of experience, we definitely don’t regret it. The platform relies on the simplicity of the investment process and attracts seasoned P2P savants for diversification purposes, as well as beginners who are just trying to get their bearings in P2P investing. Let’s take a look at how it succeeds.

For the record, we only ever review platforms that we ourselves are active on and you can see how our portfolio is doing on a quarterly basis in our P2Preports.

How does the platform work?

Peer-to-peer (or “P2P”) lending allows investors to lend money directly to other people through a P2P platform, in this case Afranga. By skipping the bank in the middle, investors get a higher return on principal and interest repayments.

The investor first registers on the platform. This is relatively quick and like on other platforms, apart from having to fill in your personal details, you are only required to upload a scan/photo of your documents. After that, your account is activated and you can transfer your money. Ideally, we recommend sending funds directly in Euros – the only currency in which it is possible to invest on the platform. If you send funds in a different currency, an automatic exchange is made and your investment account is credited with Euros. However, the exchange fees are charged to you.

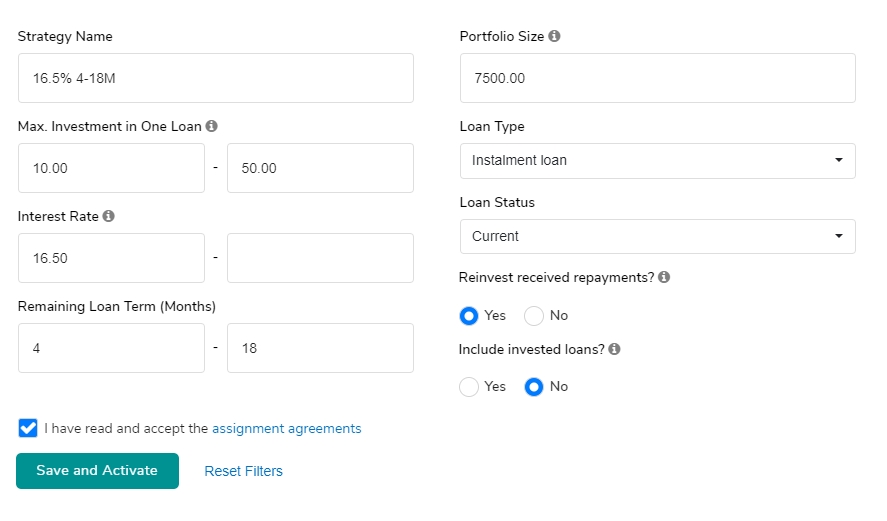

Afranga offers a simple Autoinvest (AI) feature that does the investment for you according to the criteria you set. You can set up as many AIs as you like, with the order determining their priority for investing. An example of our setup is shown in the screen below. For those who are happier choosing a particular loan themselves, it is possible to invest manually.

We currently use only one Autoinvest setting ourselves. All decision-making is now simplified by the fact that there is only one lending company on the platform – Stik Credit. It also stands behind the entire platform’s creation and it is therefore essential for its functionality that it thrives.

How does non-bank lender Stik Credit perform?

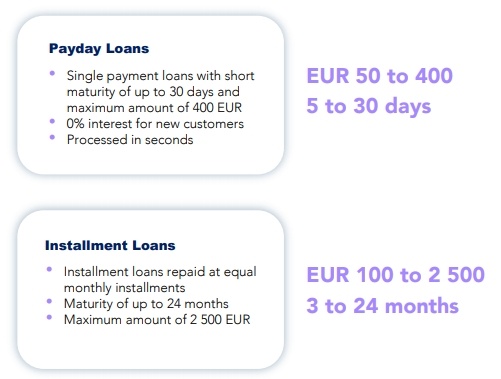

Founded in 2013, Stik Credit is a European FinTech company focused on consumer lending, offering short to medium-term loans from EUR 25 to EUR 2,550 for up to 24 months. As of January 2021, Stik Credit has originated more than EUR 30 million worth of loans and has granted nearly 36,000 loans in 2020 alone.

The number of unique customers has been growing by more than 8,600 customers per year for the past two years. Stik Credit has more than 129,000 unique applicants and more than 17,000 active clients.

It offers its clients two types of products, either a payday loan (a one-off loan before payday) or a short-term loan with a repayment period of up to 24 months. Currently, Stik Credit operates only in Bulgaria, but plans to expand soon to the markets in Macedonia, Kosovo and Albania.

Stik Credit is no newcomer to P2P lending, and more experienced investors may have already come across its loans on Mintos (which it withdrew from after Afranga launched), Bondster or Viventor. It is now clear that he will focus his efforts on maximizing volume on his platform, where he will avoid the fees of other marketplaces. Also, the highest returns for investors can be expected on Afranga.

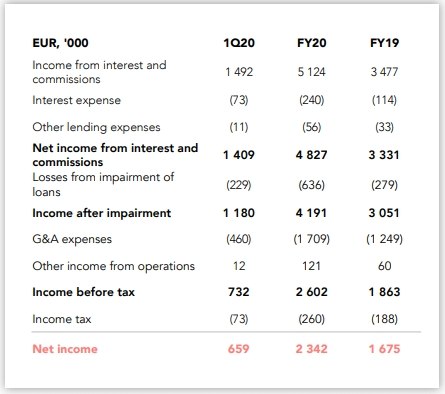

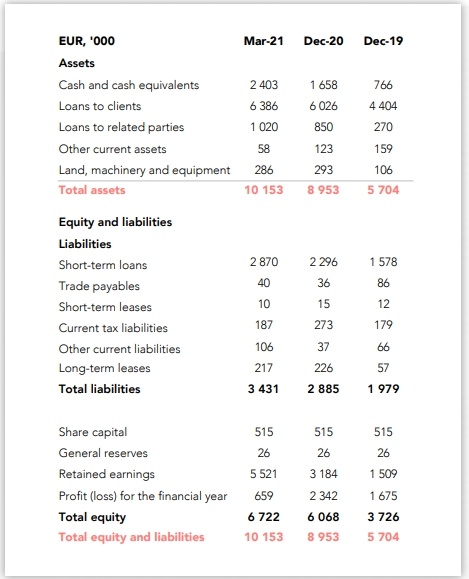

Stik Credit – rating and financial results

The independent website ExploreP2P, which deals with the rating of individual lending providers, awarded Stik Credit 65 points out of 100, which puts it among the highest rated providers. The rating on Mintos, before leaving the marketplace in February 2021, showed a score of 5/10, which on the other hand would have placed it among the lowest-rated providers. However, both ratings should be taken with a grain of salt and ideally the company’s statements should be monitored by investor himself from time to time.

For us, the biggest disadvantage of Stik Credit is that it is only a relatively small lender. Especially compared to, for example, Eleving Group (formerly Mogo), Creditstar or Aventus Group from other platforms, Stik Credit is more of a micro lender. On the contrary the company’s conservative funding structure and history of profitable operations (including during the Covid-19 crisis) are the most positive factors. Stik Credit has also recently improved its financial reporting. It regularly publishes its financial results on the Afranga website.

Marketplace Loan Offer

The platform has started with a “dreamy” offer of loans at 18% p.a. At a time when the returns for investors are falling on competing platforms, such an offer is suspiciously high. However, as we later learned from Afranga CEO Yonko Chuklev in our exclusive interview, this was more of a marketing event to promote the launch of the platform and a regular offer with such terms and conditions cannot be expected. Currently, the offered interest rate is still at a still beautiful 16.4%, however, we expect it to gradually drop further to 14%.

Loans are uploaded to the marketplace in batches, always once or twice a week. Their quantity is regulated and Afranga thus keeps the balance between supply and demand aside. This is nice for the investor because there is no risk of accumulating free funds in the investor account that he will not have anything to invest in (so called cash drag).

In the future, the platform plans to accommodate loans from Stik Credit’s new markets and also keeps the door open for the possible intermediation of loans from another, unrelated provider. Currently, however, all loans are from the Bulgarian market, differing only in the terms of maturity and whether the loan is a single repayment loan or a loan with regular repayments.

It is possible to invest from EUR 10 and a Buyback Guarantee applies to all loans.

Guarantees/obligations for investors, theoretically and practically

The concept of P2P lending includes various types of buyback guarantees. At Afranza it is no different and you can find a buyback guarantee there.

The buyback guarantee means that if the loan is more than 60 days past due, the non-bank company rebuys the investor’s share and adds an amount equivalent to the interest for the entire holding period.

However, for all guarantees – and not only on Afranza – beware. Many newcomers to P2P investing interpret the concept of guarantees to mean that it is virtually impossible to lose money by investing. Any guarantee is only as strong as the one giving it, and so – although Afranga and Stikcredit have reported good results so far – it may happen that the provider does not live up to its commitment and investors suffer losses.

Other Afranga platform functionalities

Afranga operates on a responsive, simple interface in which the investor will not get lost. Menu tabs safely navigate you to all the essentials.

Investors will be pleased to know that there are no fees on the platform. Investors will also appreciate the fact that there are no “grace periods” or any other periods where the provider does not pay interest to the investor. So a simple equation applies to calculating your profit:

Interest rate / 360 x Invested amount x Number of days

The calculation is the same for both properly repaid loans and those in default. This has no effect on the yield due to the Buyback guarantee for defaulted loans.

The platform is working intensively on the launch of a secondary market (expected to be operational during the summer of 2021), which will facilitate the sale of loans before their maturity and thus ensure greater liquidity of investments.

Afranga has not yet created a webpage to provide statistics on the number of investors and volumes invested, but this is understandable given its youth. For now, statistics are replaced by an occasional newsletter that reports on important milestones.

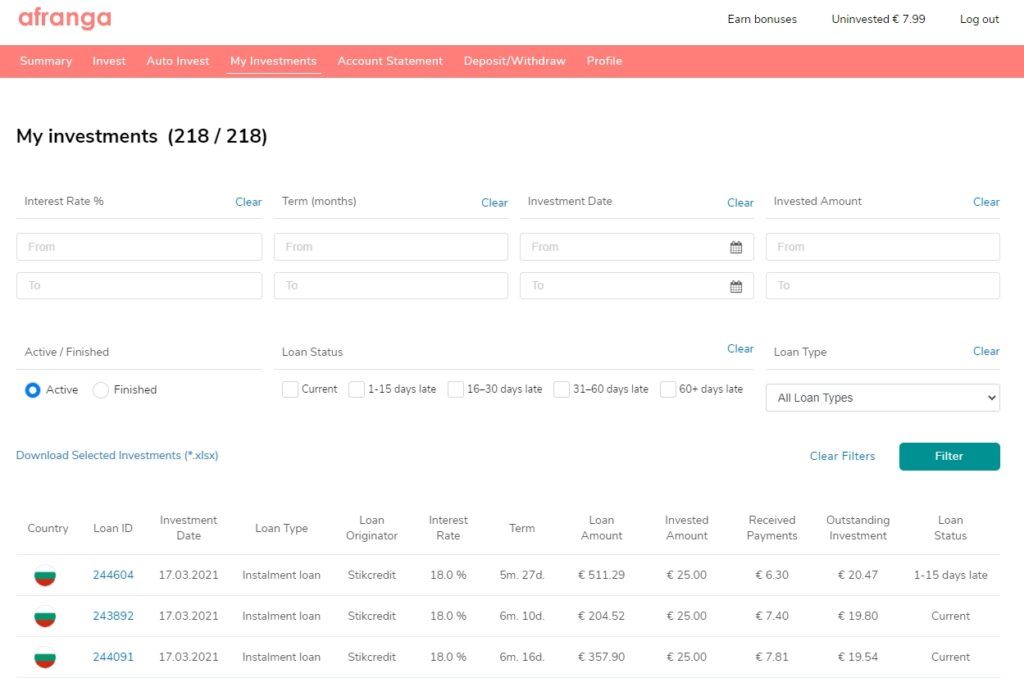

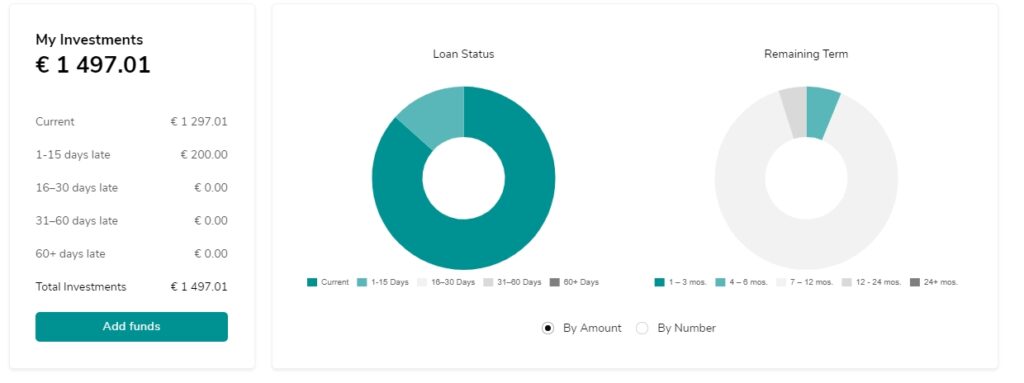

Our Afranga portfolio

As a test investment after registration, I have sent a lower amount to the platform – to get a feel for the platform and see if I am comfortable investing on it. Since I was also satisfied with the responsive and open communication of the support (I especially appreciate real answers to questions and not just marketing “prescribed” phrases that I have experienced elsewhere), I increased my investment significantly. The development is shown in screenshots from our regular P2Preports.

I do not plan to increase the amount invested on the platform for the next period. Afranga is a good diversification for me from other P2P platforms and rather than investing in Stikcredit loans on other portals, I prefer to use the investment directly and at a higher interest rate.

So far, the company’s results look very good and it is obvious that it is attracting investors. In fact, in June, in its second quarter of existence, Afranga celebrated surpassing the €2 million mark on the platform’s outstanding loan portfolio.

However, given the youth and unproven nature of the platform, as well as the severely limited diversification opportunities directly on the platform, I would be cautious about a higher percentage representation of Afranga in the distribution of the investor’s P2P portfolio.

Afranga – investor experience

Within the P2Pmarket, we collect the experience of other investors. We also accumulate other interesting information and links about platforms and non-banking companies, so that a potential investor can get a decent picture in a short time. If you have your own experience with the Afranga platform, we would be grateful if you could share it with other investors to help them in their potential decision making.

Afranga summary – advantages, disadvantages

Advantages

- High interest rates offered (up to 18% p.a. on promotions).

- Possibility of diversification to traditional assets or to other P2P platforms.

- Easy to use platform, investing is almost maintenance-free.

- Fast and factual support.

- Stik Credit reports solid results, annually in black numbers.

Disadvantages

- Stikcredit is a smaller non-bank provider dependent on the Bulgarian market, so Afranga is not backed by a strong multinational group.

- Young P2P lending industry, a number of relatively unpredictable risks.

- Weaker possibility of diversification within the platform (loans only from Stik Credit group).

Conclusion

Afranga is a young platform that still has a long way to go to grow to the size of some of its competitors. Still, we have to say that it has started very sympathetically and from the right direction. So, although some features are still missing and the diversification offer is not what we would have liked, the platform has bet on honest, not overdone by marketing, communication and offers every P2P investor an interesting opportunity where to put part of their funds and participate in the industry’s superior returns.

Attention should be paid to the potential deterioration in the performance of the Stik Credit group, which is crucial to Afranga and prosperity of both goes hand in hand.

You can go to Afranga website here.

As usual, we’d be happy to receive feedback, any questions about the platform or anything else you’re interested in. To contact us you can use e.g. comments below the article.

Where to next?

- Lendermarket: Creditstar’s P2P platform review

- Afranga: Interview with COO Yonko Chuklev

- Regular quaterly updates on our P2P portfolio

- Afranga overview page

Hi,

I’d have the question that the profit formula from your article where does that come from? :

“Interest rate / 360 x Invested amount x Number of days”. Could you describe each parameter from here please?

Thank you, Robert

Hi Robert,

Sure no problem. We have taken the formula from the Afranga website – specifically, you can find it under “Help” > “Investing” > “How to calculate the interest rate”.

https://afranga.com/help

Afranga states here: “The interest rate offered to investors for a particular loan is quoted on an annual basis. Interest is calculated daily based on the amount you have invested in the loan. Interest is calculated based on the following formula:

Interest rate / 360 x amount invested x number of days.”

Interest rate = loan interest rate offered on platform (e.g. 16,8%)

360 = number of day in financial year – 360 is a standard used in accounting

amount invested = how much have you invested in the loan (e.g. 25 EUR)

number of days = How many days you have owned a share in the loan

If there is anything unclear or needing deeper clarification, just let us know;)