Esketit – Platform Introduction

Esketit is an Ireland-based platform established in 2020. However, don’t be misled by this, this is only for legislative reasons and the company’s physical headquarters can be found in Latvia. Esketit’s owner, Creamfinance, a well-known non-banking finance company from Mintos, is also based there and specialises in providing consumer, especially unsecured, loans. Esketit is thus another platform after Lendermarket or Afranga where the lender has decided to cut its offer on competing marketplaces and set up its own.

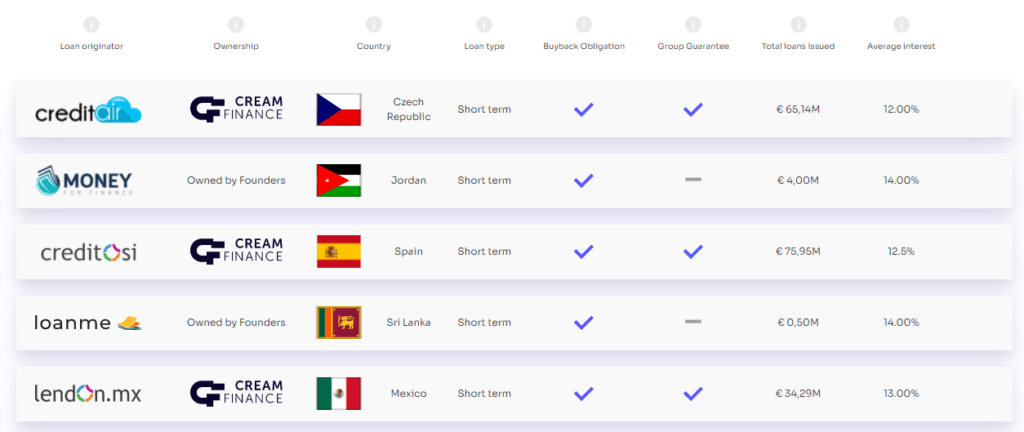

On the Esketit platform, you will find loans from companies belonging to the Creamfinance group and also two providers that technically do not belong to the group, but have the same owners – Matiss Ansviesulis and Davis Barons. The interest rates offered range from 12% p.a. to 14% p.a. All loans offered on the platform have a buyback obligation in case the loan falls into default for more than 60 days. However, the obligation may not be honored if the lender is in trouble, so it’s a good idea to keep an eye also on the group guarantee that only some lenders provide – see image below.

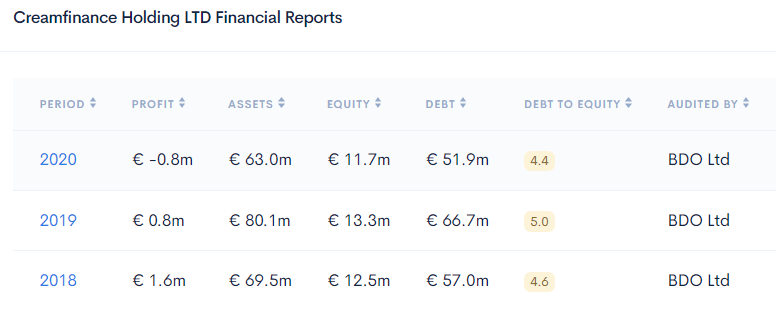

For a platform owned by one financial group, its results are extremely important, so let’s just mention that Creamfinance Holding LTD Financial ended 2020 with a loss of EUR 0.8M, thanks to the influence of Covid-19. In terms of ratings, ExploreP2P gave it a score of 55 out of 100 and Mintos, on which Creamfinance continues to operate, rates it 5/10 for Spain and 7/10 for Latvian branch.

Esketit does not surprise any active investor in P2P and is equipped with all modern functionalities – auto-invest or secondary market. It is possible to invest from 10 EUR and Euro is the only currency in which the investment can be made. Investing is free of charge for investors and this includes the secondary market. You will also be pleased to know that there are no interest-free periods (such as grace periods or pending payments) and the investment is interest-bearing from the day it is purchased until it is repaid (or sold on the secondary market).

Esketit – Basic Overview

- Establishment: 2020

- Supported currencies: EUR

- Average interest rate: 13%

- Average maturity: 1 day – 90 days

- Minimal investment per participation: 10,- EUR

- Investor fees: X

- Auto Invest: ✔

- Secondary market: ✔

- Buyback obligation: ✔

- Option to sell participations prematurely: ✔

- Official website: https://esketit.com/

- Official blog: https://blog.esketit.com/

More information – Interview with Esketit’s CEO Vitālijs Zalovs

Esketit – People

Vitālijs Zalovs – CEO

Vitālijs has nearly 10 years of experience in the financial industry. What’s more, most of it has been gained directly in the P2P industry, having worked for many years in Mintos.

Investors rating

Esketit – Experience and Investors Ratings

Reviews, links

Esketit – Reviews and Other Links

P2Ptrh information:

Other sources information:

- 04/2021 – Esketit blog – Interview with Esketit CEO Vitalijs Zalovs

Did you know?

Esketit – Did you know?

Downloads

Esketit – Downloads

Bonus

Esketit – Bonus

Esketit offers 1% cashback to new investors for their invested deposits during 90 days after their registration. To receive the bonus the registration through the link below is sufficient.

By registering through the link below, you will also support this project.

If you want to learn about active bonus campaigns or just to check if there is no better offer at the moment, write to us and we will be happy to to get back to you.

Esketit – Alternatives

This page was last updated on 05/2022.