P2P platforms emerging as a proprietary solution for another channel of their financing are being used by more and more non-bank lenders. One of the latest ones is Esketit. It was created for the needs of entrepreneurs Davis Barons and Matisse Ansviesulis, whose main activities include the P2P provider Cream Finance Holding Ltd. To learn more about the platform, we reached out to its CEO Vitalijs Zalovs for a short interview.

Hi Vitalijs, thank you for accepting our interview request. Esketit was founded in December 2020, so it has already completed its first six months of existence. How do you evaluate this period of time? Have you managed to fulfill all your plans or is there something you want to work on more in the future?

Hi Zbynek, thanks for inviting me. My pleasure to answer your questions and tell more about us to Czech investors.

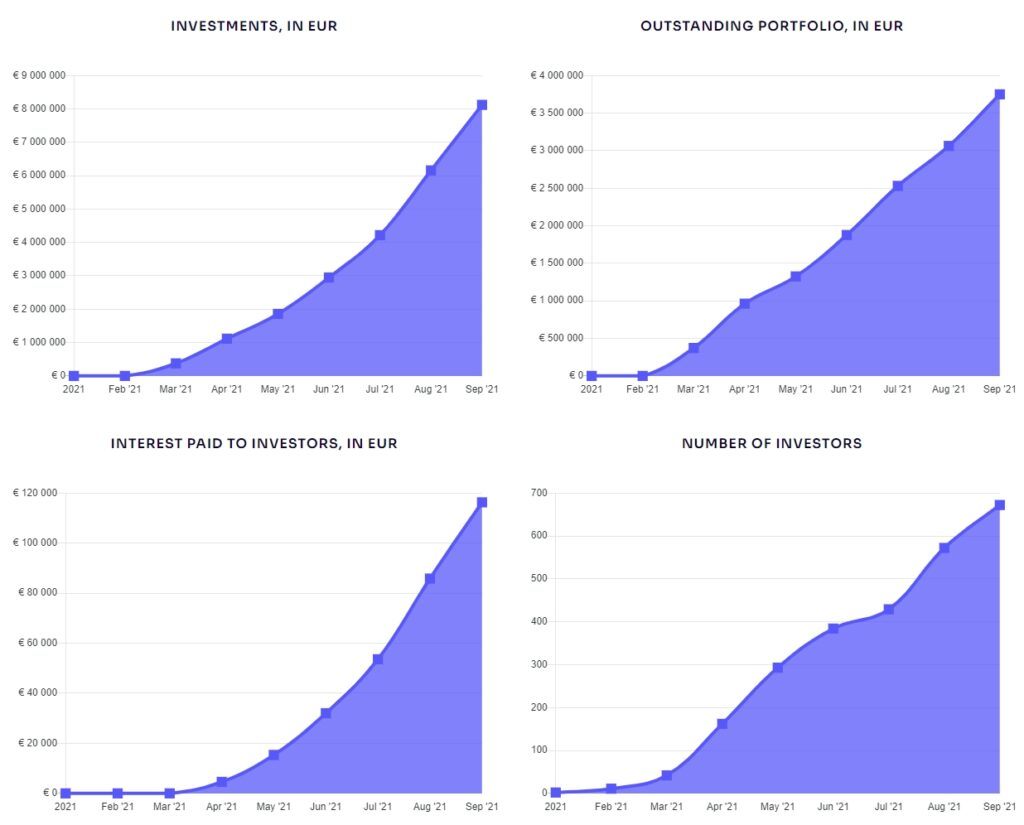

The first half of a year has been good for us. We clearly see that investors like our product, they know that CreamFinance and our Founders team are great professionals to have business with and they vote with their money for it.

We have managed to fulfil our plans, more than 7 million already funded via us and we are happy about this result.

To enhance these results we are continuously working on developing the platform and deliver investing environment according to what investors want, what they ask from us and what we think is best for them.

We want to offer a possibility to invest in new interesting geographies, we already have loans from Jordan, we will have loans from Sri Lanka.

How did the name Esketit come about and what does it actually mean?

It means a simple slogan – let’s get it.

We were intrigued by the fact that although Esketit has a physical office in Riga, legally the company is based in Ireland. Can you explain to our readers what led you to make this move?

When Founders start their business, they always check where to do that and where it makes the most sense from business, legal and tax perspectives. As you maybe know, CreamFinance has a holding company in Cyprus, an IT hub in Austria, operations in many different countries. The same was with Esketit – many different countries were considered and the decision was made about Ireland.

“Esketit – let’s get it”

Sounds very cosmopolitan and we agree the Esketit team is widely known to be made up of experienced people working in the P2P business for many years. You yourself have a rich experience from positions at Mintos. Can you tell us more about how many people you have in your team and if they are full-time at Esketit or if they are seconded from Creamfinance, for example?

We now have more than 10 people in our team, most of them in engineering. Just to remind you, Esketit was founded by CreamFinance founders Matiss and Davis. In their 10+ years of experience, they have never lost any investors funds and now they want to offer also retail investors to participate in their entrepreneurial journey and gain from it too. All our people are concentrated on Esketit and all our operations are separated. Esketit work as a standalone company.

To what extent will Esketit be based on Mintos? Whether in platform management or in features. Alternatively, whether there will be any individual features that you would like to do differently.

CreamFinance is still planning to use both platforms as our funding sources. All the features are developed and added according to investor requests and according to what we think is needed to have a pleasant investing environment.

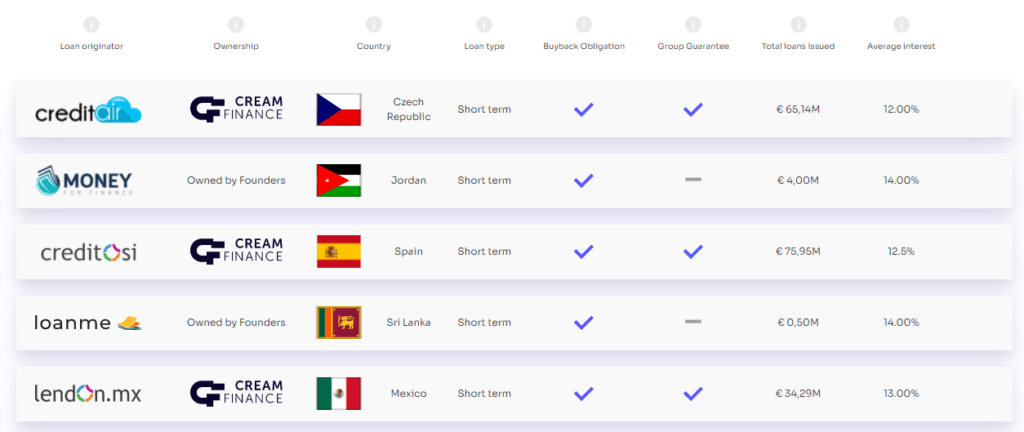

There are now 2 other providers on the platform besides Creamfinance affiliates. However, they are also owned by the same owners as Creamfinance. Do you plan to add more providers with a completely different ownership structure in the future or was Esketit primarily created as an in-house solution for your own platform? Do you plan to continue to place your offerings on other marketplaces or can we expect to see a reduction in volumes once Esketit’s funded volumes increase?

No, we don’t plan to add loans from companies that are not owned by Founders. We want to be fully confident about the quality of loans we deliver to investors and also their safety, that’s why we don’t plan to add any other LOs. Esketit was created to fund loans of Founders` companies.

Are there any new features coming soon that you’d like to share?

We are constantly developing and adding new features and functionality. I want to one more time to stress that at our stage the main driver for new features is investor feedback so I want to encourage investors to share feedback with us so we better understand what is demanded and what to prioritize.

The new trend in P2P investing seems to be the rise of smaller platforms that are tailored to a specific lender. Do you think the number of platforms will continue to grow? How do you see P2P investing evolving from a wider perspective?

I think few more platforms for the most experienced and best-performing Loan originators could be launched. P2P investing is here to stay and it will become a common investing direction for more and more investors.

A number of platforms have recently seen a decline in offered interest rates. For you, rates are now in the 12-14% range. Do you see this number as sustainable in the long term?

Yes, for the first years of our platform we have budgeted such rates and we definetely see it sustainable and that it could make all stakeholders, investors, loan originators and founders included, happy about results.

Where do you stand with investments yourself? What assets are you investing in and what percentage of your portfolio is in P2P?

I invest in property, ETFs, some stocks and P2P. Actually I have more than 50% in P2P and I don’t really suggest to others to have such exposure there. I have it like that just because I am very familiar with P2P and understand the market and its risks.

Thank you for your time and all the answers. Finally, is there anything else you’d like to say to our readers?

Share your feedback with us and try our platform. It has one of the highest rates now for one of the most experienced and successful loan originators` loans.

Where to next?

- Esketit overview page at P2Ptrh

- Esketit official website

- Comparison table with more than 30 P2P lending platforms