The EstateGuru platform offers new investors a bonus on all investments made within 90 days. Upon registration, verification and subsequent investment, the investor receives an extra 0.5% cashback on top of the investment, which is calculated after 30, 60 and 90 days. However, the bonus can only be received once on each deposit. There is no need to enter a promo code to receive the bonus, just register through the unique link below.

By registering you also support the further development of this project and the P2P forum community.

Bonus amount and crediting methodology

The terms and conditions of the EstateGuru program are described in this article, and it only works when you log into the platform.

The investor will receive an additional 0.5% of all investments in the first 3 months – the referring party will also receive 0.5%. If the investor invests EUR 1000, both the investor and the referring party will receive 1000 * 0.005 = EUR 5. The bonus can only be received once on each amount and is credited in 30 day cycles, directly to the investor’s investment account.

About EstateGuru

- EstateGuru overview page – platform information, management, links to other resources and user reviews

- EstateGuru – Estonian P2P portal review – our experience of using the platform

- Discussion about the platform on the P2P forum

Summary

Advantages

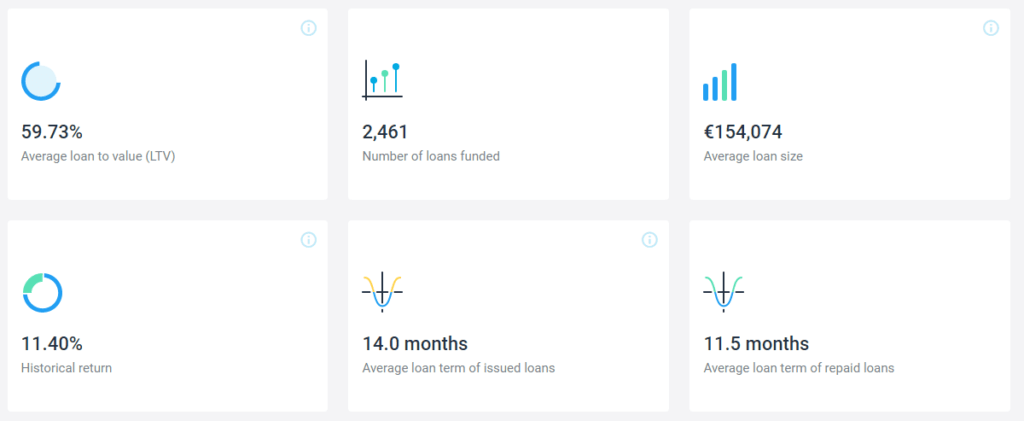

- Projects backed by real estate or other collateral with an average LTV of around 60%.

- Historical yield 11.4% p.a.

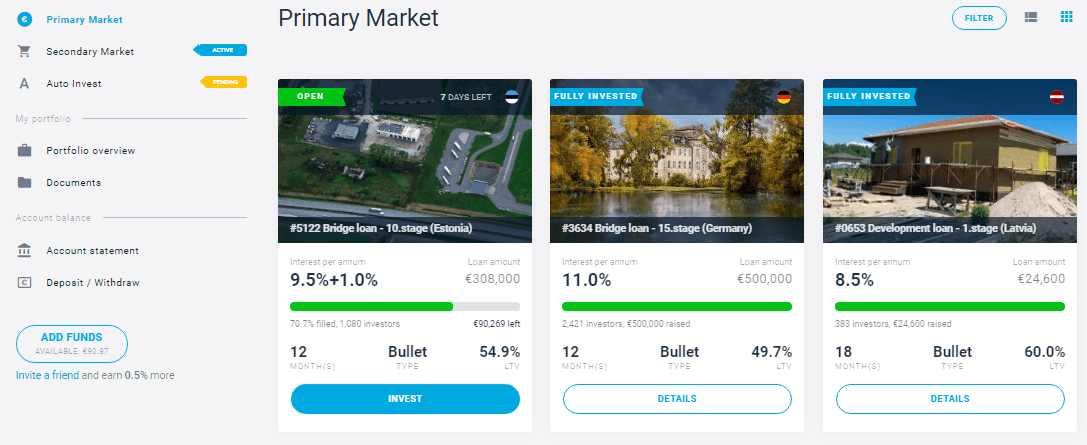

- Both Auto Invest and Secondary Market instruments are available. Secondary Market

- Loans are for an average term of 14 months, repaid approximately 2.5 months early.

- Quite a varied selection of participations, which are increasing at a decent rate (historically around 1 per day).

- There has been zero loss of funds (0.00% capital loss) over the several years EstateGuru has been in operation, but this is partly due to the postponement of problematic patricipations awaiting resolution.

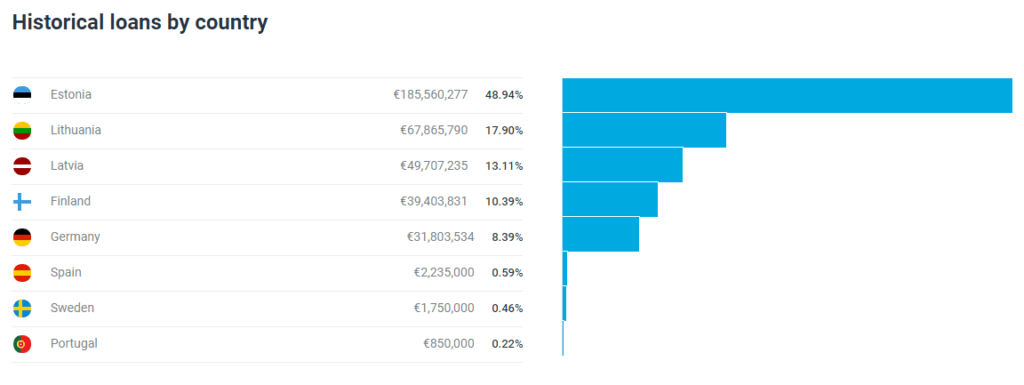

- There is the possibility of diversification into more countries, with the bulk of the loans coming from Estonia, Lithuania and Latvia.

- Current statistics can be found on a separate page.

- For registered users there is an extensive Loanbook, which is well worth going through before investing to see the parameters of loans that have historically (not) worked.

Disadvantages

- Investments in EUR only – currency risk must be taken.

- Withdrawal fees apply (1 EUR)

- Larger investors can take advantage of the extended parameters of Auto Invest. However, these are only available from a minimum participation of EUR 250.

- Loan defaults can extend over a longer period of time. This means that the invested funds do not work for the investor and, in addition, there may be a partial loss of principal.

- Investments in EUR only.