Heavyfinance – Platform Introduction

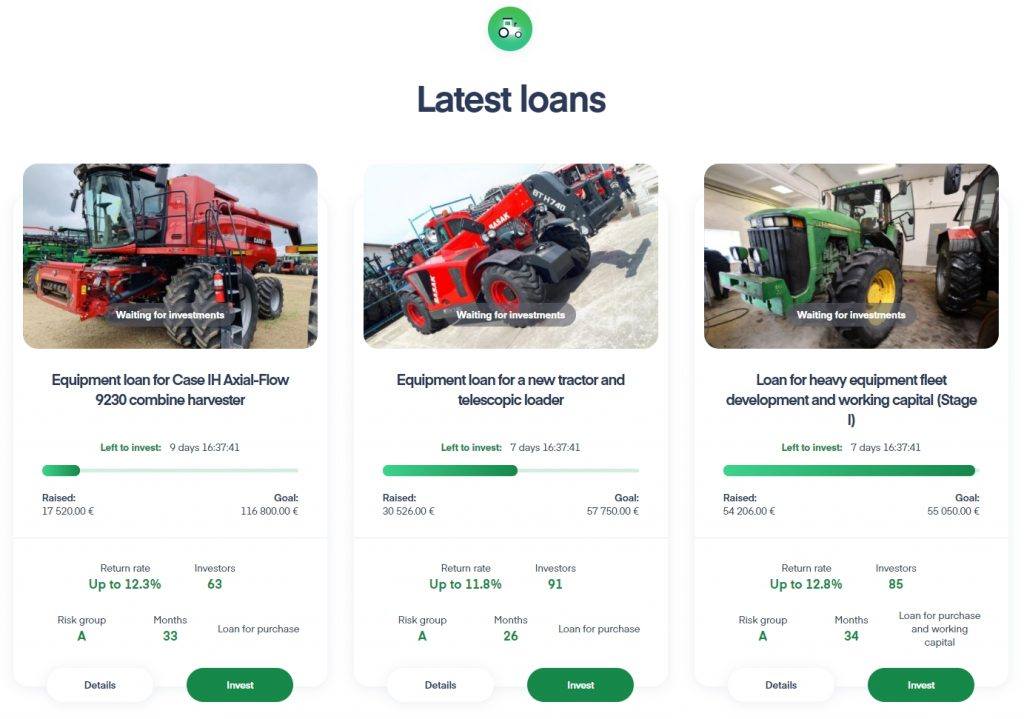

Heavyfinance is a Lithuanian P2P platform offering investments in loans to farmers mainly for the purchase of agricultural equipment. The loans are then backed by this equipment. The platform was only established in 2020, but the team behind it has a lot of experience with P2P, but especially with the agricultural sector.

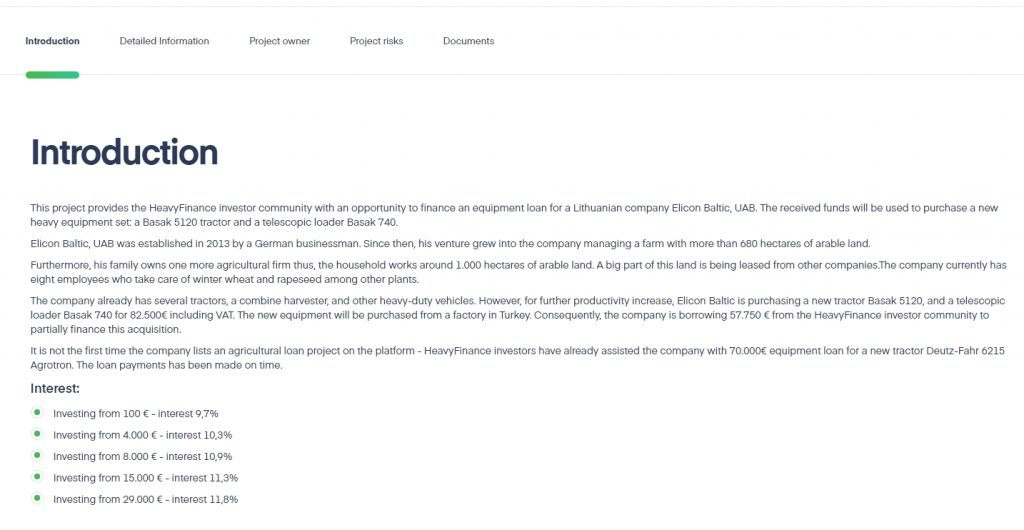

You can find a lot of information about each project on the platform and the offers are quite detailed. Investment opportunities are always a specific loan to a client in the agricultural sector. If the stated amount is not collected in full and the borrower does not agree to a lower amount, then the loan is not realised and the investors receive the money invested in the project back into the investor account. A less standard issue in P2P is the fact that interest is scaled for the investor according to the amount they put into the loan.

There are no guarantees on the platform – not even buyback. The guarantee here is a pledge of the borrower’s agricultural equipment or other assets, which is always described in the project. The pledge is legally covered for Heavyfinance. In the event of default, the collateral is sold and the investors paid out. This process is handled by the platform itself. If the sale of the guarantee does not cover all liabilities, the amount due is claimed from the borrower itself. On each occasion, the platform also provides its internal scoring of the borrower – project risk rating (A – lowest risk). The minimum possible investment in the project is 100 Euro. At the beginning of 2021 Heavyfinance implemented a simple autoinvest.

In order to provide more liquidity to investors, loans can be sold on the secondary market (the selling fee is 1% of the amount sold).

The platform is new, the projects come slowly and are often sold out soon. Logically, there are no historical statistics yet. The platform currently operates in Lithuania, Bulgaria, Portugal and Latvia.

For investors, it is also important to know that since Heavyfinance is a Lithuanian platform, it is subject to local tax laws, which stipulate that a Lithuanian tax of 15% is payable on any interest income. So for example if you have a loan with 10%, you as an investor are paid 15% less of the ten. So the real income is lowered in this way. In order to avoid the 15% withholding, investors can be advised to invest in loans on Heavyfinance exclusively through the EvoEstate platform, which acts as an aggregator of offers from several portals and is not subject to similar tax obligations.

Heavyfinance – Basic Overview

- Establishment: 2020

- Supported currencies: EUR

- Average interest rate: 9 - 13%

- Average maturity: 10 – 36 months

- Minimal investment per participation: 100,- EUR

- Investor fees: ne (1% fee for secondary market sale)

- Auto Invest: ✔

- Secondary market: ✔

- Buyback obligation: X

- Option to sell participations prematurely: ✔

- Official website: https://heavyfinance.eu/

Heavyfinance – People

Laimonas Noreika – co-founder

Laimonas is a fintech entrepreneur and one of the leading alternative finance experts in the CEE region.

In 2015 Laimonas founded a direct lending peer-to-peer platform FinBee, which earned more than 5 million Eur in profit to those who invested into loans in only four years. Before starting FinBee, he was the board member of Viena Saskaita, a utility bill consolidation provider. Now he is on the mission to open a new asset class – investments in loans backed by heavy machinery.

Laimonas holds a BA degree in Business Administration from the International School of Management in Vilnius.

Rytis Darginavičius – co-founder

Rytis is a heavy machinery business guru with more than 13 years of experience in the field starting from Product Line Manager to Commercial Director, to an entrepreneur.

Before starting his first company, Rytis spent almost a decade working for Dojus Agro, the largest supplier of Western agricultural machinery in Lithuania. In 2011 he established agricultural machinery rental and retail companies Nova Rent and Litrental. Later on, in 2017, he started road infrastructure company Kauno Kelių Statyba.

Rytis talks to farmers and infrastructure companies on a daily basis, therefore, he knows every single detail of their business and how to help them. Consequently, he is one of the top experts in evaluating the risk of investments in business that needs heavy machinery for their daily operations. He is here to bring new opportunities to companies that are still misunderstood by banks.

Rytis has MBA from Vytautas Magnus University. He also graduated BBA from the University of Utah.

Investors rating

Heavyfinance – Experience and Investors Ratings

Review, links

Heavyfinance – Reviews and Other Links

Other sources information:

- 05/2021 Heavyfinance website – Introduction of Latvian agriculture sector

- 02/2021 Heavyfinance website – Introduction of Portuguese agriculture sector

- 02/2021 Heavyfinance website – Heavyfinance expands to Portugal

- 02/2021 Heavyfinance website – Introduction of Bulgarian agriculture sector

- 12/2020 ExploreP2P – Interview with Laimonas Noreika

Relevant links:

Did you know?

Heavyfinance – Did you know?

Downloads

Heavyfinance – Downloads

Bonus

Heavyfinance – Bonus

Heavyfinance offers +2% cashback to new investors for their invested deposits during 30 days after their registration. To receive the bonus the registration through the link below is sufficient.

By registering through the link below, you will also support this project.

If you want to learn about active bonus campaigns or just to check if there is no better offer at the moment, write to us and we will be happy to to get back to you.

Heavyfinance – Alternatives

This page was last updated on 06/2021.