Afranga – Platform Introduction

Afranga is another P2P platform set up by one of the lending companies – in this case the Bulgarian Stikcredit. The lender has decided to leave the Mintos marketplace and is placing most of his loans – with a higher interest rate for investors – on the Afranga portal now. Afranga was launched in 2020 and gains investors favour fast.

Unlike Lendermarket and the strong Creditstar Group in the background, it is necessary to mention here that Stikcredit is a relatively small provider. Therefore there is not such a robust group behind the entire portal. Maybe that’s why Afranga does not list Stikcredit as the only provider on the website, but it obviously plans to add more over time.

Stikcredit was founded in 2013 and shows relatively good reporting with solid results – including the covid period. ExploreP2P assigned a rating of 65/100 to Stikcredit, on Mintos just before leaving it in March 2021 it was awarded 5 points out of 10. You can find out more about Stikcredit from the reports in the download section below.

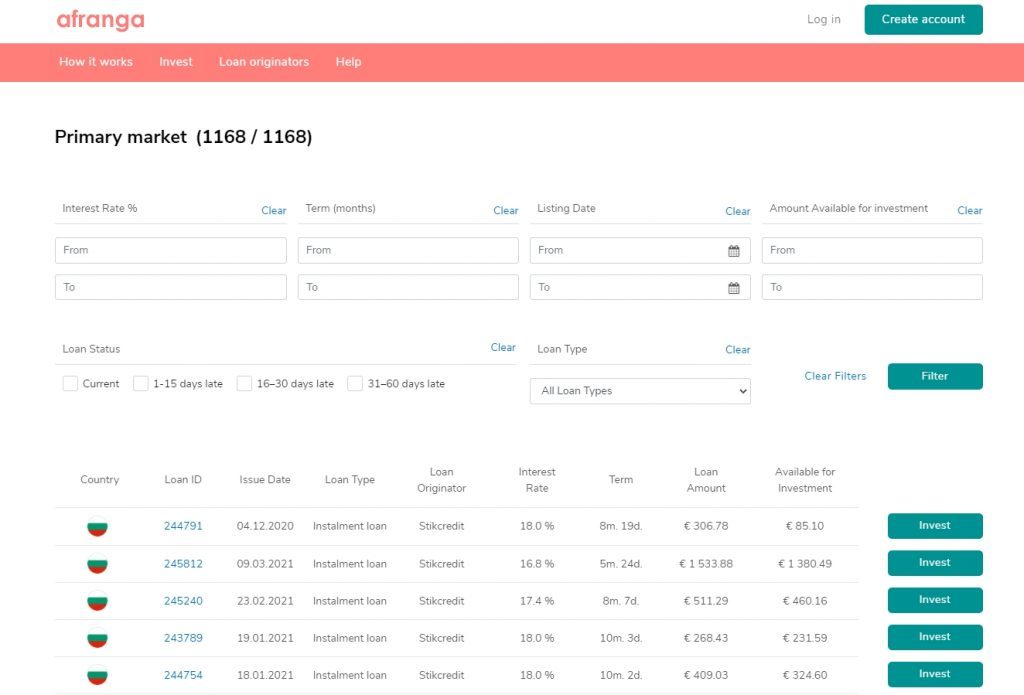

At present, Afranga offers loans with a maturity of 5 to 24 months, with regular installments or short-term one-off loans of up to 30 days. The offered yield reaches a staggering 18% p.a., which raises questions about the sustainability of the model with the stated buyback obligation. On the other hand, it is quite possible that this is a kind of promo event at the beginning of the platform’s life, and we can expect the revenue to fall down gradually.

The interface of the platform is simple, we can compare it to the beginnings of Mintos. The platform is equipped with autoinvest, so investors can set it up and let it work without any other manual intervention. However, the secondary market is missing at the moment, so when investing in a more monthly loan, it is necessary to count on lower liquidity. Afranga plans Secondary market implementation in coming months. The platform does not charge any fees to investors.

Afranga – FAQ

We have gathered several interesting questions thanks to our active community at related P2Pforum project (Thank you Namor). You can read it below supplemented by answers.

- Will secondary market be implemented?

Yes, Afranga confirmed that Secondary market is one of the priorities and will be implemented in near future.

- Is the interest paid for the delayed payment?

You do receive late payment interest. The interest, late payment interest, contractual penalty, and other ancillary claims are all included in the claim amount you are entitled to receive according to our Afranga User Agreement, General terms and conditions.

- Are there any grace periods defined by Stickcredit or by the government and is interest paid to the investor for these grace periods?

There are no grace periods defined by Stickcredit or by the Bulgarian government.

- Is there any limit for prolongation of the loan – limit in days total, limit in number of prolongations?

Short-term loans can be extended at the borrower’s request an unlimited number of times, whereas installment loans cannot be extended. This is detailed in Stikcredit’s loan agreements.

- If the payment is done by the final consumer but paid to the investor with a delay (= delayed by the platform/loan originator to the investor). Is there any interest for pending payments?

Interest for pending payments is not due.

- Many loans finishes prematurely, why is that happening so often? Does StikCredit repurchase some loans intentionally?

The nature of the loans which Stikcredit issues is short-term. The majority of the loans are repaid before maturity, even the 24 month ones. The average loan issued by the company is fully repaid within 5-6 months. This behaviour is nothing new about the loans issued by Stikcredit and the performance has been the same across every platform the company’s been listed before. We can’t guarantee that a loan will be repaid by the borrower as per the repayment schedule and not be repaid earlier. We’ve never abused the system and never will risk our reputation and good standing to gain 2-3% advantage p.a.- it won’t make much of a difference to the net profit of the company. Anyone that claims Stikcredit is repurchasing loans intentionally and re-listing them at a lower interest rate I am willing to prove otherwise by providing a copy of the payment documents for the incoming repayments by the respective borrower behind the loan.

Afranga – Basic Overview

- Establishment: 2020

- Supported currencies: EUR

- Average interest rate: 13 - 14%

- Average maturity: 30 days – 24 months

- Minimal investment per participation: 10,- EUR

- Investor fees: X

- Auto Invest: ✔

- Secondary market: ✔

- Buyback obligation: ✔

- Option to sell participations prematurely: ✔

- Official web: https://afranga.com/

- Afranga: review of young and fast growing P2P investment platform

- More information: Interview with Afranga’s COO – Yonko Chuklev.

Afranga – People

Yonko Chuklev – COO

We interviewed Yonko recently and we took the opportunity to let introduce himself:

“Currently I’m the Chief Operating Officer of Afranga. My experience includes working in the fields of corporate finance, legal and compliance advisory. I’ve managed to build some multi-domain expertise and work on projects in Sofia, London, and New York. I’ve also been featured as an analyst in some of the leading media in Bulgaria covering economics and finance. Two of my biggest passions are finance and technology and I do like the opportunity to cover both in Afranga’s operations.”

Investors rating

Afranga – Investors Experience

Reviews, links

Afranga – Reviews and Other Links

P2Ptrh articles:

- How is our Afranga portfolio performing can be reviewed on a quarterly basis in P2Preports.

- 07/2021 – Afranga: review of young and fast growing P2P investment platform

- 04/2021 – Interview with Afranga’s COO – Yonko Chuklev.

Did you know?

Afranga – Did you know?

- Afranga has surpassed €1 million in outstanding investments only 2 months after platform launch.

Downloads

Afranga – Downloads

Bonus

Afranga – Bonus

Unfortunately, the Afranga platform does not currently offer a bonus for new investors. Only the recommending party is rewarded.

By registering through the link below, you will support this project.

If you want to learn about active bonus campaigns or just to check if there is no better offer at the moment, write to us and we will be happy to to get back to you.

Afranga – Alternatives

This page was last updated on 03/2022.

Offered interest has decreased to 14% in August.