Another quarter behind us and I am happy to say that I managed to avoid problems with loan originators defaults or even entire platforms within my P2P portfolio. The summer months for me were all about maximizing my time outdoors. This favours platforms where I haven’t had to spend much time on administration, but auto-investment can manage on its own.

The second most significant element of the past period for me is the accelerated portfolio reduction on Mintos and, on the contrary, the increase in deposits on almost all other platforms.

Mintos

Although I don’t actively sell my portfolio on Mintos, thanks to early redemptions combined with (for me) unattractive new loan offers, I have accumulated free funds. I have gradually distributed them across other platforms where a simple interest formula applies:

Interest rate / 360 x Amount invested x Number of days

New loan originators on Mintos

This time, Mintos has stepped on the gas and managed to bring a number of new providers to the marketplace, especially from Mexico (Alivio, CAPEM and GoCredit, to name a few). However, it is with most of these providers that the practice of not paying any interest when the borrower is in delay has become common. This, in the worst case scenario, means that the investor buys a short-term loan with a yield of 10% p.a. with a maturity of 30 days. However, the borrower does not repay it on schedule, but only at a maximum delay of 60 days. These 60 days are non-interest bearing, so that after 3 months of holding, the investor will receive interest equivalent to the interest for holding only the first 30 days that the loan was not in delay. The annual return thus changes from 10% to just 3.33%. Yes, this is an extreme example, but as the key point here for me is that I don’t want to constantly be watching which lender is paying interest in default, which has long grace periods and/or which is abusing pending payments. This all costs a lot of time and makes it impossible to predict future real returns.

Obtaining an investment license and its impact on the future of Mintos

The other big news on Mintos is its acquisition of investment firm and electronic money institution licenses. This, in my opinion, brings many positives for investors, starting with the insurance of investor account balances up to EUR 20,000. Mintos, as a P2P leader, is the first platform to bring the process of becoming a regulated marketplace to a successful conclusion. It promises, among other things, the possibility of expanding its investment offer (there is talk of offering ETFs) and, perhaps sometime in the distant future, its own payment cards linked to the investment account. A six-month “transition” period will now begin. I expect that only during this period will many things that are now cloudy become clearer and the functioning of the modified system be fine-tuned. The bundling of loans into Notes has raised a number of questions so far. The fact that even Mintos itself is not sure about some of the procedures was recently demonstrated when the announced calculation of the interest rate for buying/selling on the secondary market was changed. The announced system that Notes would be purchased including all outstanding yields was changed to the previously operating procedure where the interest on the loan (Notes) is split between the seller and the buyer, in the exact proportion corresponding to the date of the sale. For some investors, it may also be important to know that the minimum investment will be raised from EUR 10 to EUR 50.

In the context of the changes, investors can only hope that the already complex system will not be further complicated, but rather simplified so that the investor transparently knows where he stands.

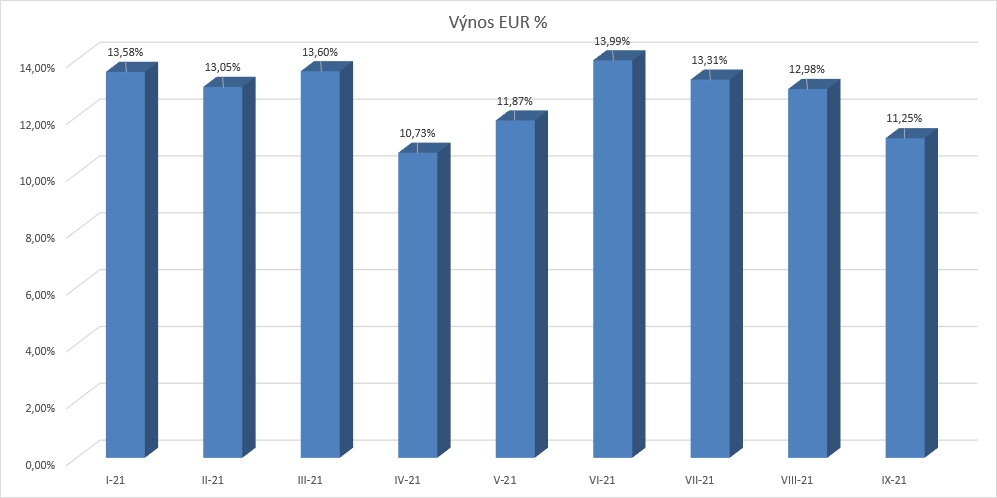

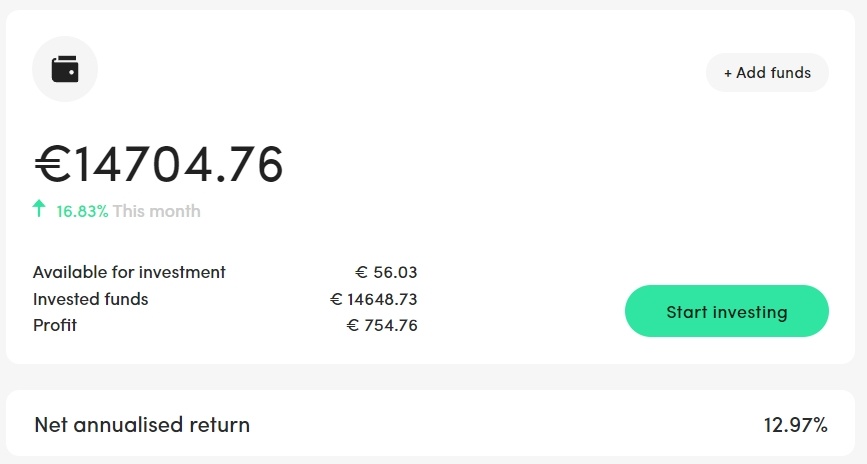

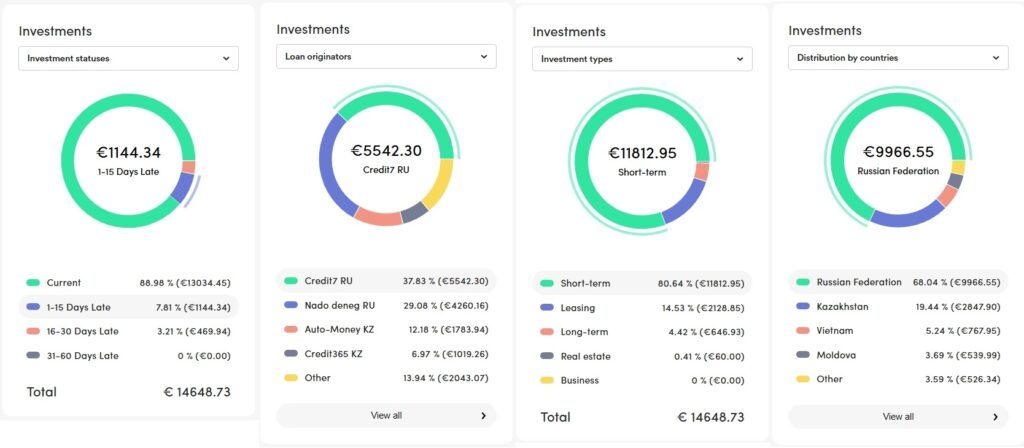

Despite the steady decline in yields, I have managed to keep profits on Mintos at around a nice 12% p.a. This is mainly due to previously purchased loans and occasional purchases of higher interest loans on the secondary market. Unfortunately, I don’t expect it to stay this way for a long time and I expect another drop in the last quarter of this year.

You can find our overview page with everything about Mintos on P2Ptrh here and our review from January this year here.

Peerberry

I stepped on the gas significantly on the Peerberry platform and more than doubled my previous deposit.

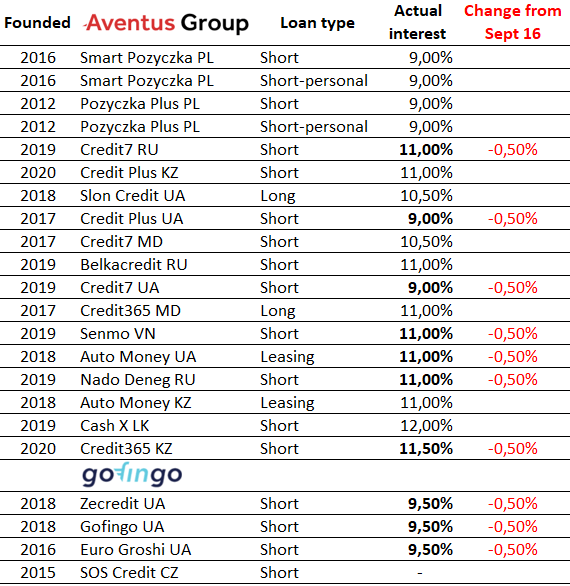

The interest rates offered were stable in the summer months (10-11.5%). And since Peerberry offers a loyalty program with a first milestone of 10k Euros invested, I decided that 12% (11.5% +0.5% loyalty bonus) would be more to my liking 🙂 In the absence of interest-free periods, I would be happy with this.

Unfortunately, my satisfaction didn’t last long, because in mid-September I received an unpleasant email informing me about the increasing surplus of investors’ money supply over lenders’ demand. This resulted in a 0.5% reduction in the interest rates offered by most loan originators. So I double my deposit, I get the bonus, but as a result I am where I was before…

I will mention one more experience about the loyalty program. Enrolment in the loyalty programme always takes place on the 1st day of the month. So if you deposit money into your investor account at the beginning of the month, even though the amount invested has already exceeded the required limit, you have to wait for those tenths of a percent bonus.

You can find a page with everything about Peerberry on P2Ptrh here. We have also reviewed Peerberry platform here.

Lendermarket

Throughout the summer, investors have been anxiously awaiting the promised release of Creditstar’s audited results. On the first of September, Lendermarket sent out a newsletter informing that the audit would take a little longer due to additional documents requested by the Danish FSA (Financial Supervisory Authority). Investors have no choice but to wait. On the positive side, at least the whole situation surrounding the audit is now so public that Lendermarket is forced to communicate about it openly (and therefore the chances of a “blowout” are down to zero).

During September, Lendermarket managed to pull off one more stunner. This was when their system automatically rebought out most of the loans from Sweden, Finland and Estonia without them being really bought out by Creditstar. Investors who looked at their account at the time found that they had high free funds in their account. Some invested them, some asked for withdrawals. Subsequently, LM went into maintenance for an entire weekend as programmers tried to return it to its pre-bug state. In the end, all was well, buyouts were cancelled, as were any purchases of new loans with the redeemed money. Withdrawals were then handled individually by LM with each investor who requested them. I am not one of them, my portfolio is back where it should be, but a slight aftertaste remains. Not because of a technical error. Mistakes happen. But mainly because of the way the communication of the problem was handled. There was no official communication. So, investor you need to go through support to find out what really happened…

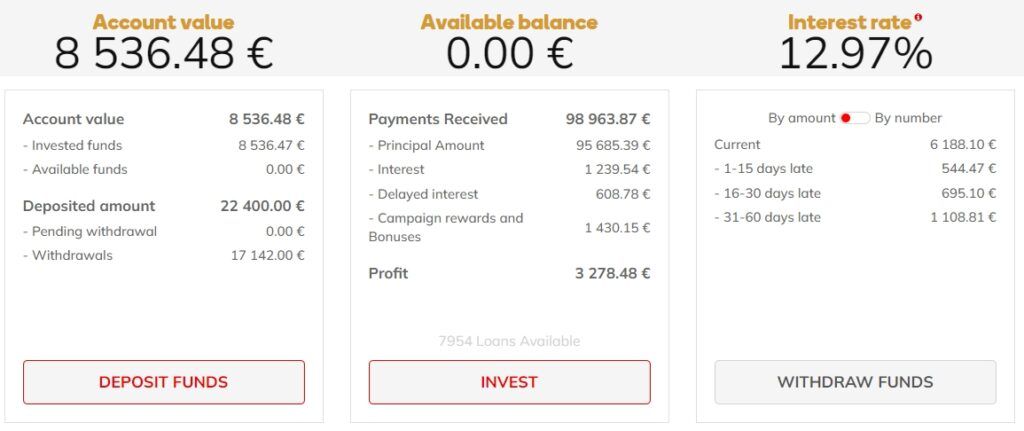

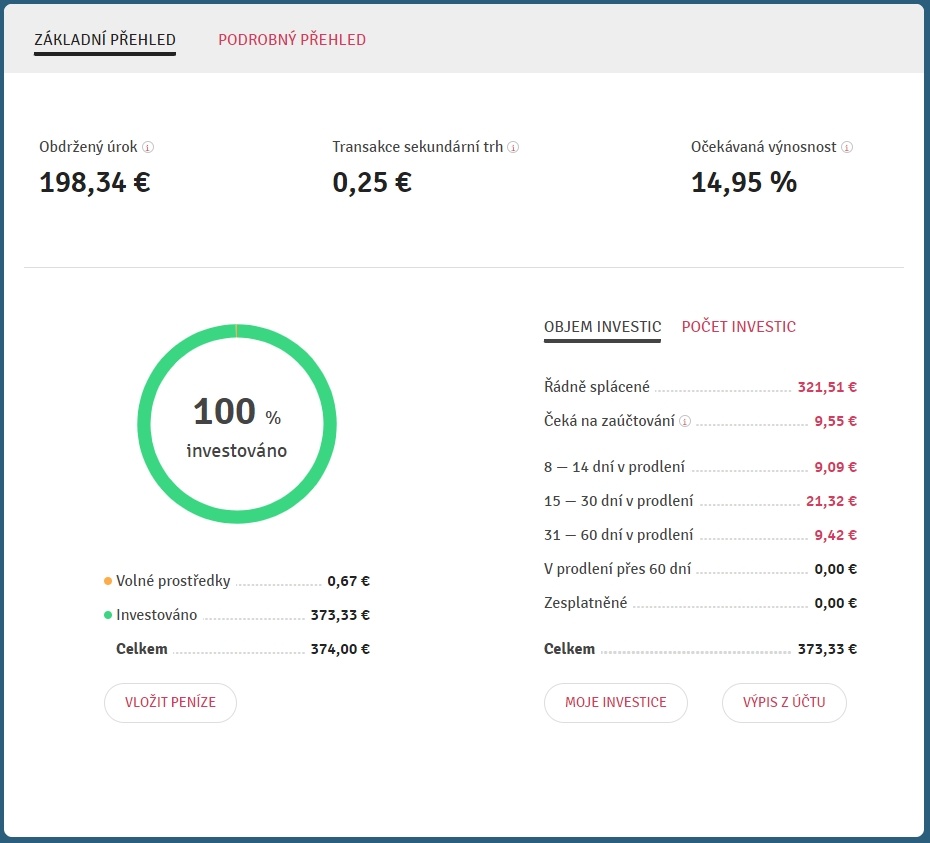

On the other hand, the interest on new loans is still at 14%, autoinvest works without manual intervention, and with minimal effort, my interest rate jumps nicely. In the next quarter, I believe I will already surpass the average historical yield of 13%.

For more information about Lendermarket, you can read our review or visit the Lendermarket overview page.

Robo.cash

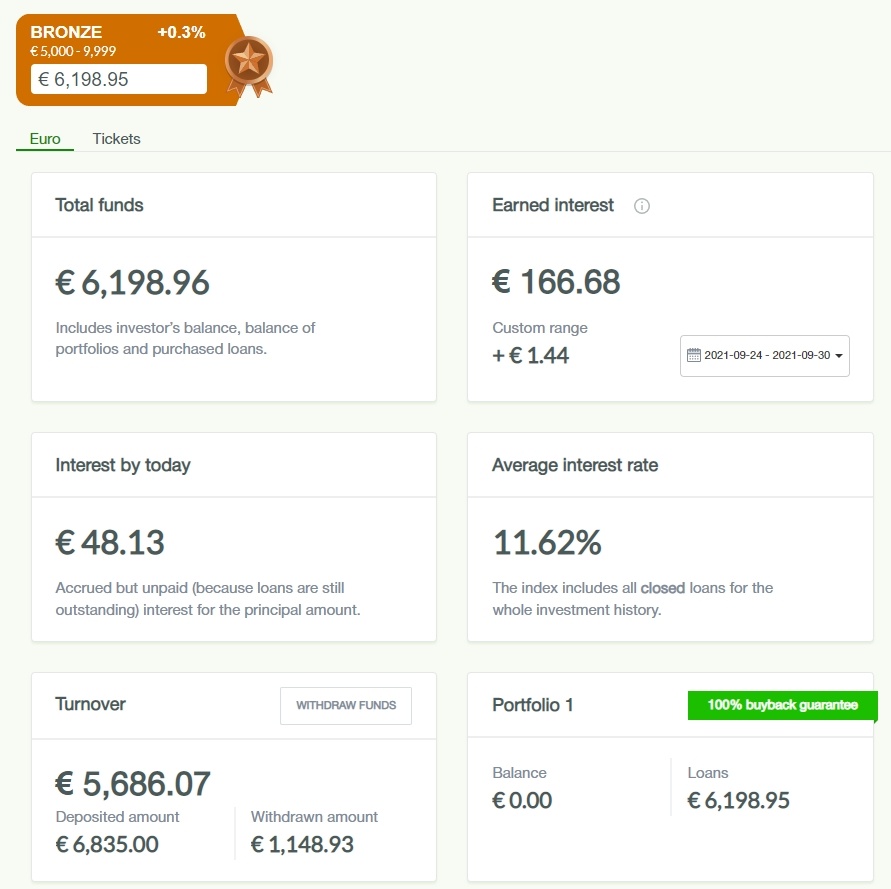

Finally we are getting to a platform where there is no need for long essays:) On Robo.cash, I increased my deposit, got the first level of loyalty bonus (which, by the way, unlike the aforementioned Peerberry, is applied to newly purchased loans immediately after reaching it). The group’s results for 1H2021 are very good and everything else is taken care of by the reliable Autoinvest.

I also reviewed the platform in August, you can read my observations here. An informative page on P2Ptrh is here.

Afranga

I will also keep Afranga brief, as I have written in more detail in my July review.

Interest on the platform has gradually fallen to 14%, where it could hopefully stay. Even under these conditions, this is a strongly above-average offer given the flood of investment money in the market. September also saw the number of loans on the marketplace start to decline (absolute sell-offs of everything available also happened), which could lead to uninvested funds (so called “cash drag”). The platform management itself is aware of the current excess of demand over supply and intends to address this through increased lending volume. For investors, it is positive that there is unlikely to be a reduction in interest rates below 14% in the near future, on the other hand, there is a legitimate concern that the increase in the number of loans granted will lead to a deterioration in the quality of the loan portfolio. Either way, this is something that is better to monitor going forward.

The launch of the secondary market, which has been announced for a long time, was a definite pleasure. This significantly increases liquidity. The investor does not pay any fees for issuing a loan and can choose the discount or premium at which he wants to offer his loans. The current offer correlates with the stripped primary market, so all loans offered can be purchased with only a small premium.

We have an overview page about the Afranga platform on P2Ptrh here.

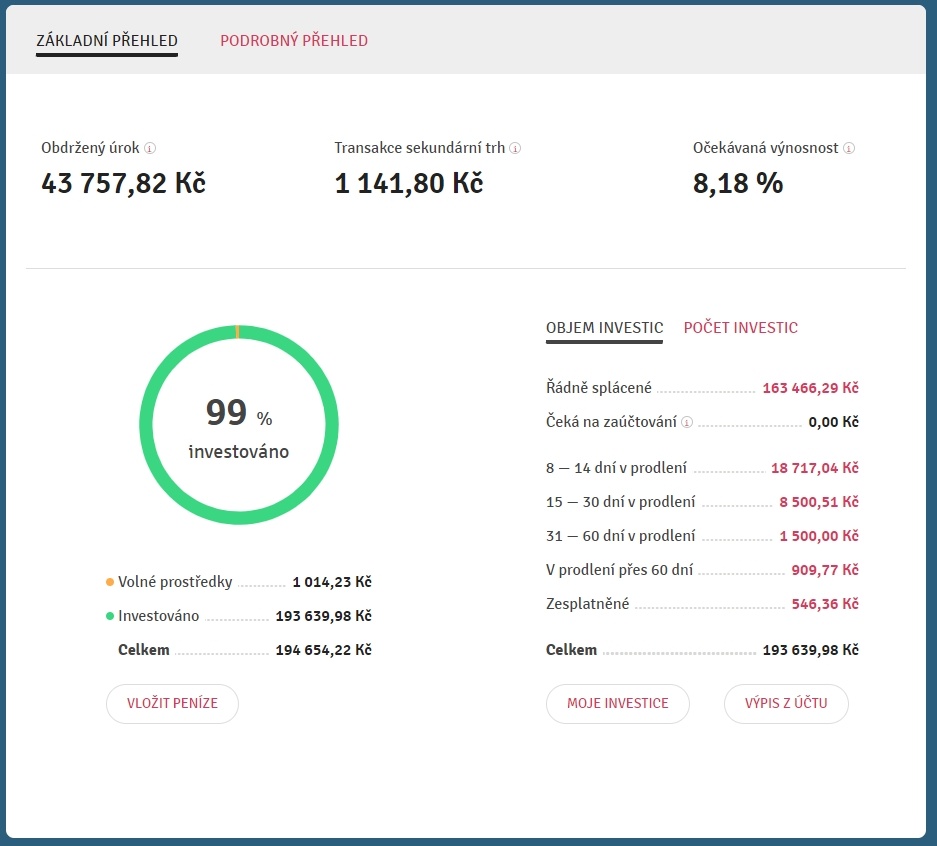

Bondster

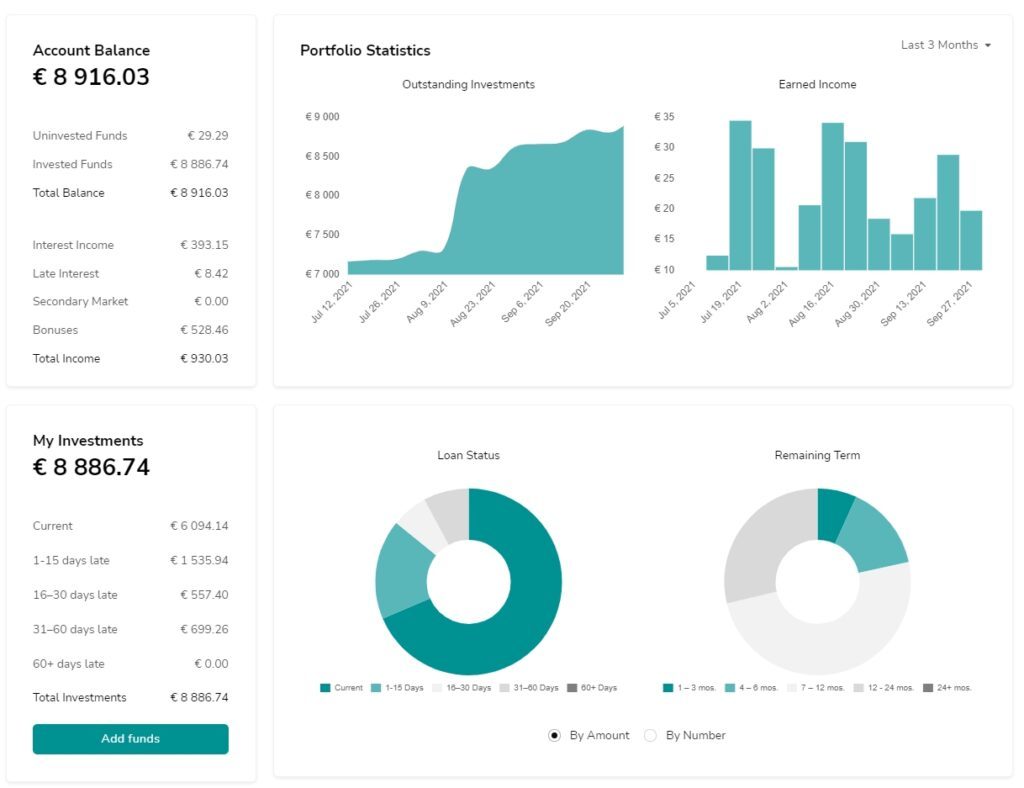

Also at Bondster, the most significant development was clearly the introduction of the secondary market on the first of July. I have actually doubled my portfolio thanks to this progress. Particularly in the early days of trading on SM, it was evident that many people no longer wanted to continue on Bondster and were selling all their holdings, often without any premium. This, given that the loans have been running for some time and the borrowers are “established”, gives these loans more credibility. At the same time, the original LTV has also already fallen due to a number of past due repayments. That’s why I’ve been shopping around significantly. I have mostly been able to buy ACEMA loans in CZK at between 7%-10%, which I consider solid when secured by real estate. I added a couple of pieces of business invest that, while not having this collateral, were sold at a discount by the original owner.

Currently, there are not so many new loans on SM, respectively often only those with a high premium. Buying under these conditions, where the investor does not know whether the loan will be repaid early, does not make sense from my point of view. Anyway, I have Autoinvest set up and when something comes up, I don’t resist buying.

The platform has also launched a cryptocurrency-backed loan offer, but I haven’t embarked on that adventure yet.

If you are active on Bondster, you can check out our overview page and leave a short summary for other users.

Are you missing something in our regular reports? Is there something you’d like to see covered in more detail next time, either from the platforms mentioned above or some of the others? Write to us – perhaps in the discussion below the article or even by email – and we will be happy to discuss the topic, either in the next P2Preport or in a separate article.

Zbyněk