Creditstar Group, a well-known lending provider from Mintos, decided to launch its own platform in 2019. Its main goal is to reduce the group’s cost of funds received from P2P investors. The Lendermarket platform is now well established and we can look deeper whether it pays off to open an investor account here.

Creditstar Group

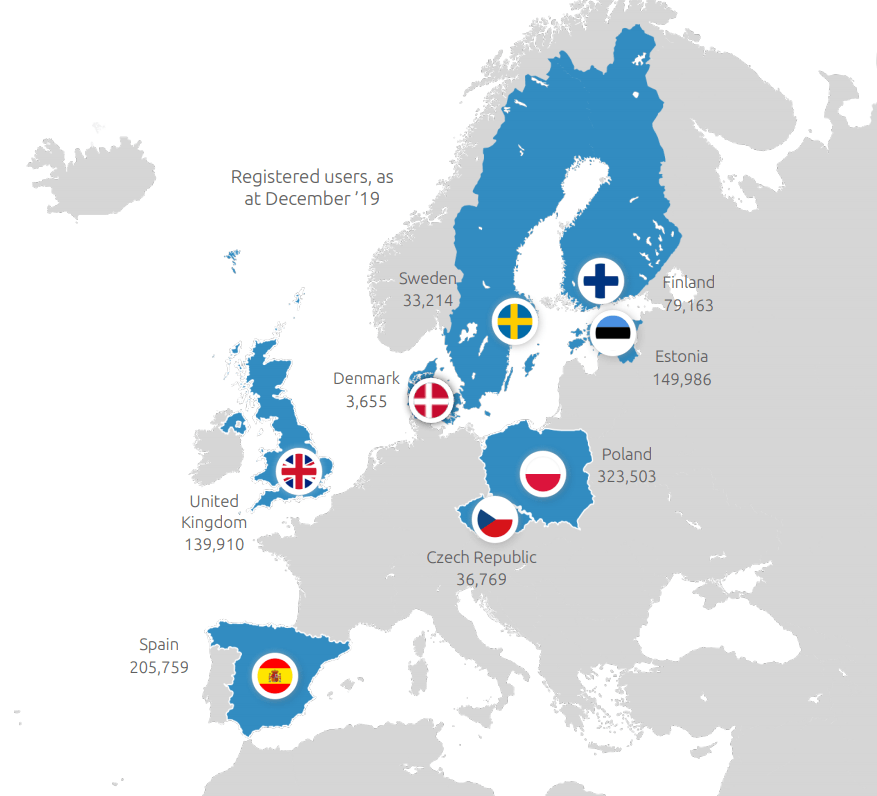

Creditstar, a provider of non-bank consumer loans, was established in 2007 in Estonia. The company currently operates in 8 countries – Estonia, Lithuania, Poland, the Czech Republic, Finland, Sweden, Spain and the United Kingdom.

The group geographical expansion is shown in the figure below. So far, the only country where Creditstar has tried to succeed and failed is Lithuania.

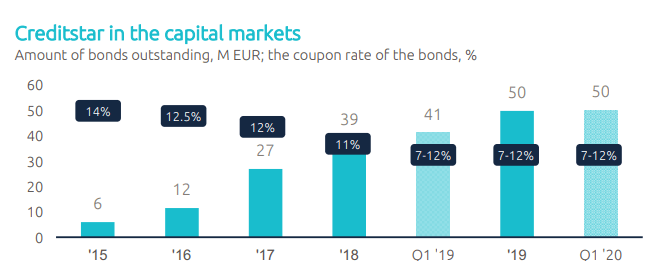

In addition to P2P, the Creditstar Group is active in raising capital within the field of bond issuance. The company has successfully placed bonds more than 25 times during its history. Raised bond capital provides the lending company with greater stability and thus increases investor security. On the other hand, tense cash flow periods when one bond issue matures and a new issue has not been completed yet, has to be taken into the consideration by investors as well. Unfortunately, we have witnessed withdrawal requests stretched beyond the standard 2-3 days during such periods. You can find an overview of issued bonds on the Nasdaqcsd website.

Creditstar’s financial health

According to the well-known ExploreP2P website, Creditstar is the fourth highest rated provider on Mintos – with a score of 72 points. It has a slightly lower rating on Mintos – depending on the country, it ranges from 5 to 7. Creditstar regularly publishes its results and these are also placed on the Lendermarket website. Nevertheless, we would like to draw your attention to the fact that the group’s financial results are audited, but the auditor is not one of the large companies (let’s name the top four Deloitte, Ernst & Young, KPMG and PricewaterhouseCoopers), but only a “no name” micro company. Well know P2P bloger Kristaps Mors addressed this topic in more depth on his blog. Creditstar has promised that the next audit will already be carried out by a reputable company, and if this did not actually happen, it could shake investor confidence. (Update 12/2021 – The KPMG audit has finally been released after several complications and delays and you can see it here.).

The Lendermarket market was established in May 2019 and, after a start slowed down by the Covid crisis in early 2020, announced very solid growth in the 2020’s third quarter. However, the blog of the platform with statistics has so far been updated only sporadically and the LM team still has a lot of work to do in this regard. Unaudited results for 4Q published in February show that the group’s profitability remains untacted in the last quarter – a reported profit of EUR 1.37 million for 4Q and a year-on-year growth in lending volume of 28% to EUR 144 million. Thus Creditstar continues its expansion with sustained profits so far, despite Covid-19 crisis.

How to invest at Lendermarket

Lendermarket was established as a response to the success of Mintos and with Creditstar’s efforts to optimize the cost of raising P2P capital. Creditstar is one of the most popular lending companies at Mintos, and from this point of view the logic is clear. At Lendermarket, Creditstar places loans provided by its subsidiaries to their clients around the Europe.

The marketplace is very easy to use, even P2P newcomers will not be lost.

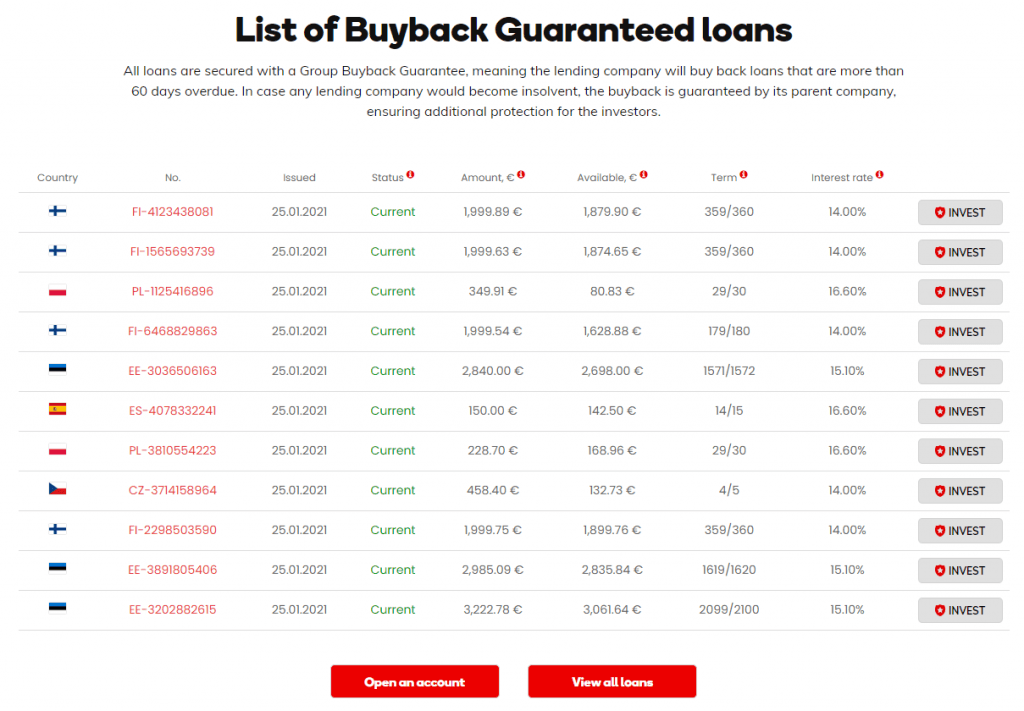

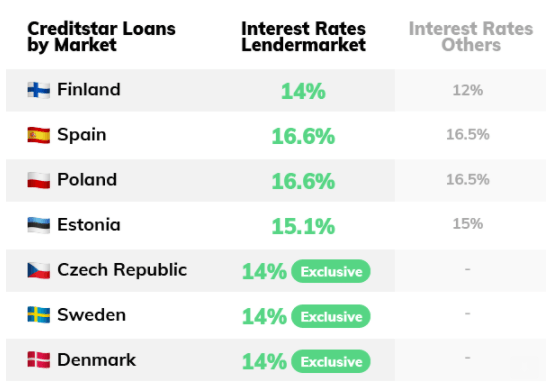

It is possible to invest only in loans of the Creditstar group, which is favored by a higher interest rates compared to Mintos. The offer is also exclusively extended with some countries where Creditstar operates (Sweden, Denmark and the Czech Republic). Investments can only be made in Euro, from a minimum amount of 10 EUR to each loan.

Maturity ranges from a few days (Poland, Spain), over a medium-term horizon of around 1 year (Finland, Sweden) to multi-year loans (Estonia).

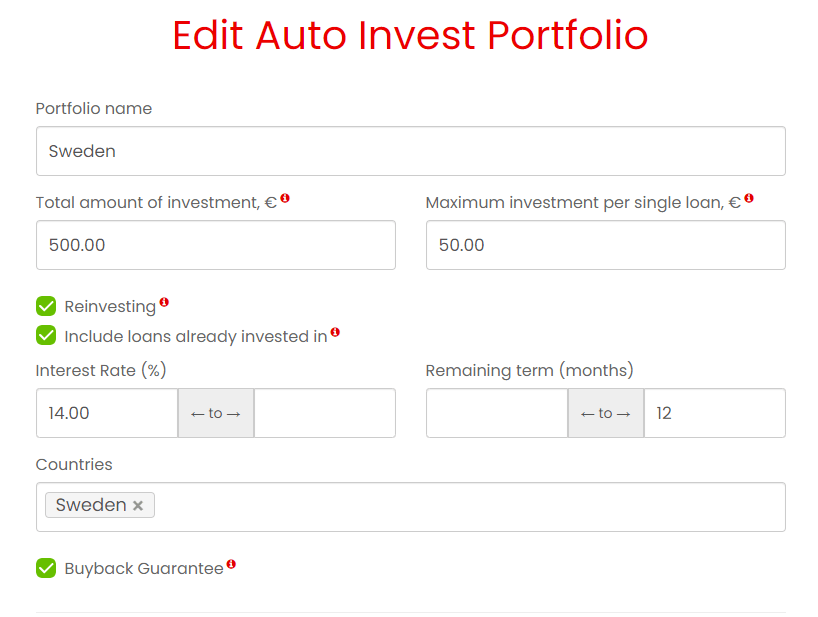

It is possible to invest manually or with the use of autoinvest. Both possibilities are intuitive and don’t surprise with anything unexpected. You can name each Autoinvest strategy, set criteria for interest, maturity, maximum amount for one loan and for this autoinvest in general. Finally, you can choose prefered countries. The Buyback guarantee check box is placed here only as a marketing, because all loans at the platform have this guarantee.

Buyback guarantee/obligation in theory and practice

There are various types of guarantees as part of the P2P lending concept.

This is no different at Lendermarket, and you can find a “buyback guarantee” and a “Creditstar Group guarantee” here.

The Buyback guarantee (BBG) means that in case the loan is overdue for more than 60 days, the non-banking company will repurchase its share from the investor and add an amount corresponding to the interest rate for the entire holding period. The 100% fulfillment of this guarantee did not take place in the spring of 2020, when Creditstar was to repay the bond issue and the Covid-19 crisis also came into play. There was a delay in the repayment of late loans and out of 60 days, the result was more than 90 days. However the situation calmed down during the summer. Creditstar issued new bonds and investors were compensated with the increased interest rate for the extended maturity period. Nevertheless, it is a clear example that the guarantee cannot be trusted blindly and investors may lose their money.

The Group guarantee then means that the individual subsidiaries (in our case countries of operation) within the group pledge each other’s obligations. In the event of difficulties, for example in Finland, group members from other countries guarantee compliance of BBG. However, it is clear in common sense that if, for example, the Polish or Spanish part of the group (which are crucial in their performance) gets into trouble, then the guarantee will be hard to fulfill for other smaller subsidiaries.

Lendermarket features

The platform tries to keep things simple. The pleasant GUI (graphical user interface) and a smaller number of functionalities correspond to this. Investors will not find any “grace period” or “pending payments” there and interest is paid without any hitches from the day of the investment till the day of its repayment.

After logging in, the investor will see a menu with an overview of his account and a few tabs, where he can look at the statements, the current primary market offer, auto-investment settings and the investor’s profile data.

Of the features that we miss at the platform, it is necessary to mention the secondary market. So expect that if you buy long-term Estonian loans, you will lose liquidity. In general, it is a good approach to invest money that you will not need immediately.

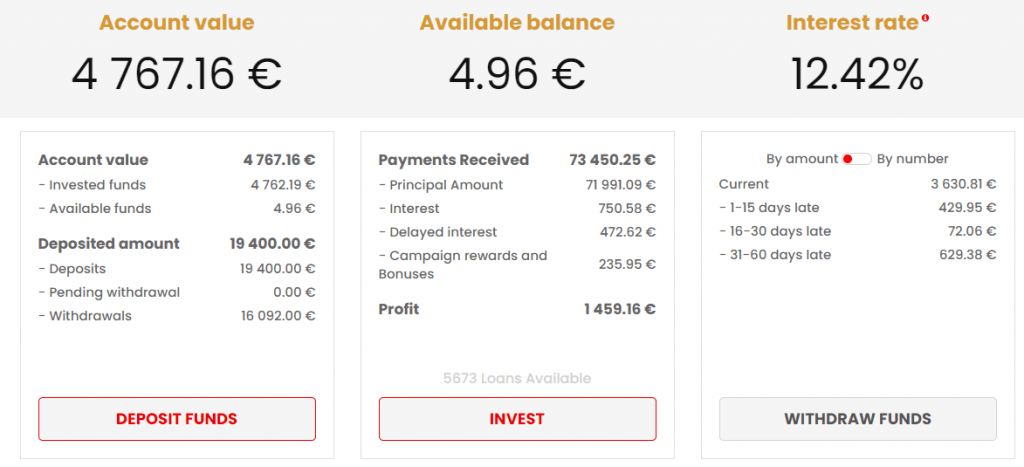

Our Lendermarket statistics

Since we have registered at the platform, the yields on loans ranged from 12% to 16.6% per year, which is a very nice number for a relatively highly rated lending company. In addition, investors can also improve with an occasional cashback campaign, which offers a bonus to a new deposit (increase in funds at the platform). Brand new investors can then apply a 1% bonus when opening an account.

We perceive positively that during 1,5 year of our active investments at the platform we haven’t experienced situation that there are no available loans. Creditstar continuously regulates the amount of listed loans and the supply and demand side is balanced. Thus there is no accumulation of uninvested funds in the investor’s account (so called cash drag) and a consequent reduction in yield.

Lendermarket – bonus 1% for new investors

Lendermarket offers 1% cashback to new investors for their invested deposits during 60 days after their registration. To receive the bonus the registration through the link below is sufficient.

By registering through the link below, you will also support this project.

If you want to learn about active bonus campaigns or just to check if there is no better offer at the moment, write to us and we will be happy to to get back to you.

Lendermarket – investors experience

We collect the experience of other investors within the P2P market. We also collect other interesting information and links about platforms and lending companies, so that a potential investor can get a decent picture in a short time. If you have your own experience with the Lendermarket platform, we will be happy if you share it with other investors.

Lendermarket Summary – pros, cons

Pros

- High interest rates of up to 16.6% p.a.

- Possibility of investment with a small amount from 10 EUR.

- Possibility of diversification to traditional assets, or to another P2P platform.

- Easy to operate platform, investing is almost maintenance free.

Cons

- Young P2P lending industry, a number of relatively unpredictable risks.

- After the experience of 2020, it is not possible to fully rely on the function and application of guarantees. This applies to Lendermarket and other portals.

- Weaker diversification within the platform (loans only from the Creditstar group).

- In the event of problems with the Creditstar Group, Lendermarket cannot be expected to be fully at investors side due to interconnectedness of CS and LM.

Summary

Unless there is a major setback, we expect the Creditstar Group to gradually withdraw from the “competing” Mintos and focus its activities on the Lendermarket. Currently, there is a clear effort to attract investments to higher returns, cashback campaigns and other various competitions (for example, recent iPhones competition). Of course – this effort can cease once the platform acquires higher number of investors.

The user interface of the Lendermarket is ideal for initial setup and then letting funds to work. Interest rates are currently very attractive and if you only invest in short-term loans, then the investment is also liquid.

It is necessary to pay attention to the possible deterioration of the results of the Creditstar group, which is crucial for Lendermarket and the prosperity of both goes hand in hand. Creditstar Group stays profitable for now and you can find more details about their results in the last Interim Report 1Q2021 here.

We plan to continue investing at Lendermarket as part of the diversification in the P2P portfolio. From our point of view there is no reason to keep our investments to Creditstar Group at Mintos as we can invest to it with better terms at Lendermarket. However we will keep majority of our funds at Mintos as there are much better diversification options.

Visit Lendermarket official website.

Where to next?:

- Lendermarket overview page

- Comparison table with more than 30 P2P lending platforms

- Interview: Ambitious P2P platform Lendermarket aims to grow 10 times

- Afranga: Interview with COO Yonko Chuklev