Peerberry has grown from an inconspicuous offshoot of Mintos founded by one non-bank lender to become the second largest P2P marketplace in continental Europe. What’s behind this and is it worth investing on the platform?

Peerberry was founded in 2017 by Aventus Group, which was previously one of the providers on Mintos and decided to create its own platform. However, in 2018 the platform was sold and now 4 lenders (Aventus, Gofingo, Lithome, SIBgroup) place their loans on the platform, with loans from Aventus accounting for over 3/4 of the volume.

Peerberry has so far managed to emerge from the corona situation without any default and unlike others to grow. In 2020, investors invested 36% more on the platform than in 2019. This is very unique among P2P platforms and it shows that investors value a transparent and communicative approach. Indeed, this is where Peerberry has made great progress and, in addition to regular information on how the platform is performing, it also makes available to investors the financial statements (for 2020 here) of its own or of the providers present on the platform.

The second important fact is that there were no loan defaults or extensions during the spring 2020 crisis at Peerberry, something that almost none of its competitors did. Stability and compliance with terms and conditions subsequently led to an increase in investor confidence. They have increased their deposits and many new ones have also registered (currently about 30,000).

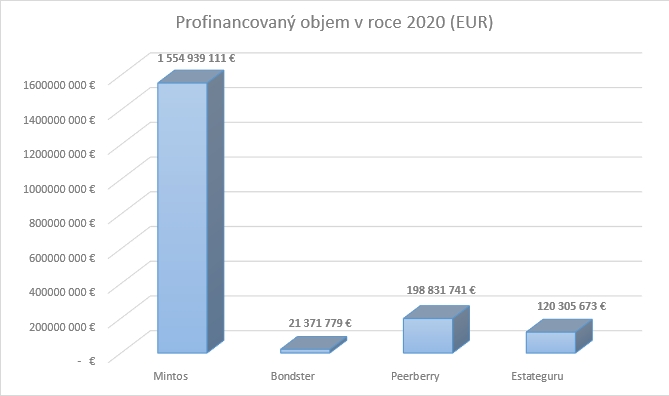

Despite this growth and success in a problematic year, it is important to note that Peerberry still lags far behind market leader Mintos.

Investing on Peerberry

As on other P2P marketplaces, loans are placed on Peerberry every day by type (short, long, business, real estate…), country (Poland, Latvia, Ukraine…), maturity (from a few days to many years) and many other criteria, according to which they can be filtered. The investor can then invest in these loans.

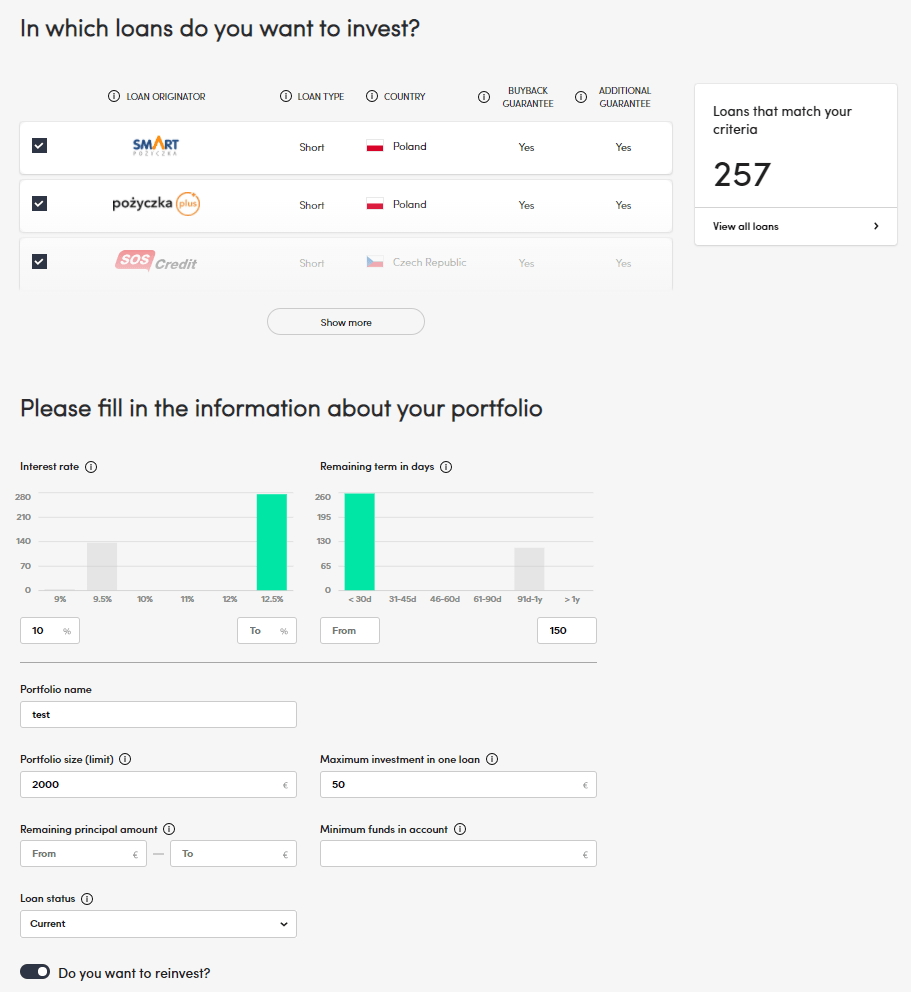

Investments can only be made in Euros with a minimum of EUR 10,- per loan. The investor can choose between manual or autoinvest approach.

Peerberry has worked on the autoinvest setup in recent months and although it is obviously inspired by Mintos, the result works well. The investor doesn’t get lost in a series of settings and choosing the desired terms is a matter of a few clicks.

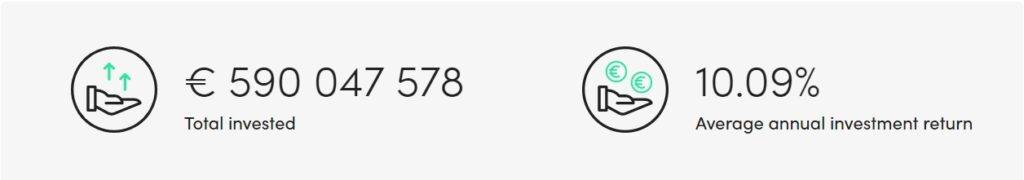

The average yield on the platform is a bit lower than investors might be used to from elsewhere, and has oscillated from 9.5% to 12% this year. Peerberry’s website then currently reports an average return of 10.09%.

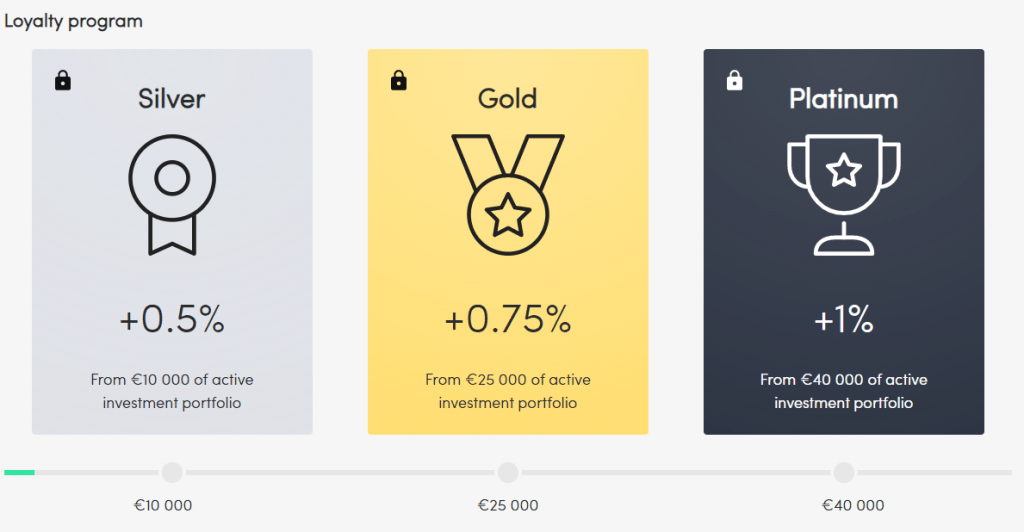

Peerberry offers investors the opportunity to increase their returns thanks to its loyalty bonus. The only condition for inclusion in the loyalty program is the amount of invested funds. The bonus is graduated into 3 levels.

Unfortunately, the limits are set quite high for our taste and are not easy to reach.

Loan originators on Peerberry

At first glance, it may seem that there are dozens of providers active on Peerberry. However, upon deeper investigation, you’ll find that there are 4 groups operating on the platform that offer loans from a number of their affiliates.

| Poskytovatel | P2Ptrh | ExploreP2P | Mintos | Země | Štítky |

|---|---|---|---|---|---|

| Aventus Group | 0 / (0 ) | 75 | - | Zahraničí | Peerberry |

| Gofingo | 0 / (0 ) | 60 | - | Zahraničí | Peerberry |

| Lithome | 0 / (0 ) | 31 | - | Zahraničí | Peerberry |

| SIBgroup | 0 / (0 ) | - | - | Zahraničí | Peerberry |

For example, the largest Aventus Group has the following brands represented on the platform:

Therefore, those who do not want to put a higher amount in one group have limited diversification options on the platform.

What the current distribution of loans looks like is illustrated in the charts that Peerberry provides.

For each sub-provider, the platform provides a range of information on their size and regularly updated financial statements.

Additional information can be obtained from the well-known ExploreP2P website, but the rating compiled by them falls far short of the comprehensiveness of the one from Mintos. This is due in large part to the Aventus Group’s group guarantee, which the group lends to all its providers.

Guarantees for investors, theoretically and practically

Various types of buyback guarantees are part of the P2P lending concept.

This is no different at Peerberry, where you can find a “buyback guarantee” and a “group guarantee”.

The buyback guarantee means that if the loan is more than 60 days past due, the non-bank company rebuys the investor’s share and adds an amount equivalent to the interest for the entire holding period.

A group guarantee, such as the Aventus group on Peeberry, means that the individual providers within the group guarantee each other’s obligations. Thus, in the event of a sub-provider’s difficulties, the other members of the group guarantee the fulfilment of its obligations on its behalf. Andrey Trofimovas, CEO of Aventus, described how the whole concept of group guarantee works nicely on the Peerberry blog.

Many beginners in P2P investing interpret the concept of guarantees to mean that it is virtually impossible to lose money by investing. However, any guarantee is only as strong as the person giving it, and so – although Peerberry has so far managed to avoid a similar story – it may happen that the provider does not live up to its commitment and investors suffer losses.

Functionalities on Peerberry

The platform benefits from the simplicity of the entire operation. Autoinvest, already mentioned, is a matter of course. Together with it, the graphical interface has been worked on and the platform now (at least for us) looks more friendly than it did a year ago.

What is clearly to be criticised is the absence of a secondary market, which significantly reduces the liquidity of the invested funds. The investor thus manages his cash flow only by choosing the maturity of the loans in which he invests, and this is insufficient in the event of a sudden need to withdraw.

On the other hand, we welcome the absence of the grace period and pending payments from Mintos. The absence of such “hooks” gives the impression of greater transparency.

Our Peerberry numbers

We have been investing on Peerberry since August 2018, about a year late since the platform was created. However, for a long period of time, we only had a first trial deposit invested. We have increased this slightly in 2020 by moving funds from other p2p platforms.

Our yield is lower than, for example, Mintos. This is mainly due to the fact that there have been periods of “cash drag” on Peerberry, i.e. a lack of loans and therefore a failure to invest available funds in the account. The amount of loans on offer has increased recently, but the oscillation of yields during the year remains. The chart below shows the yield calculated in a custom excel spreadsheet and takes cash drag into account.

Peerberry seems to be a good alternative to diversify away from Mintos at the moment, so it is possible that we will increase our funds here in 2021. However, we are discouraged by the lack of a secondary market here and the limited choice of providers, where internally we take all providers belonging to the Aventus group as one.

Don’t forget that you can track the current development of our P2P portfolio with our transparent quarterly P2Preports.

Peerberry bonus

Peerberry offers 0,5% cashback to new investors for their invested deposits during 90 days after their registration. To receive the bonus the registration through the link below is sufficient.

By registering through the link below, you will also support this project.

If you want to learn about active bonus campaigns or just to check if there is no better offer at the moment, write to us and we will be happy to to get back to you.

Peerberry – investors’ experience

Within the P2Pmarket, we collect the experience of other investors. We also accumulate other interesting information and links about platforms and non-banking companies, so that a potential investor can get a decent picture in a short time. If you have your own experience with Peerberry platform, we would be glad if you share it with other investors.

Peerberry summary

Advantages

- The way of communication towards investors, transparency.

- Possibility to invest with as little as 10 EUR.

- Possibility of diversification to traditional assets or to other P2P platforms.

- Simplicity of investment, almost maintenance-free when setting up autoinvest.

Disadvantages

- After the experience of 2020, the functioning and application of the guarantees cannot be fully relied upon. This applies to Peerberry and other portals.

- Weaker possibility of diversification within the platform.

- Lower yield than some competitors.

Conclusion

Peerberry is a good choice for investors who want to invest in P2P, set up auto-invest and not worry too much about anything else. It is also suitable for someone who would not like to have all P2P eggs in the same basket and is looking to complement one of the other platforms.

On the other hand, for investors who want to choose only one P2P platform, pour a larger amount into it and diversify within that platform, the comparison is worse. The clear dominance of Aventus Group and the low number of other providers does not allow this.

Check out the Peerberry website here

Other links you might be interested in: