The second quarter has flown by, so it’s time to take a look at the performance of my P2P portfolio between April and June. For those who missed the first quarter evaluation or want a refresher on what I wrote about a quarter ago, they can do so here.

In the second quarter, I didn’t end up trying any new platforms, and I didn’t completely exit any of them. So the ride continued on the already established tracks. The market situation has stabilized, and platforms are placing more emphasis on investor awareness. Maybe it’s the fact that European regulation is coming and everyone is preparing for it, but there are no other new ideas or useful functionalities to invigorate the P2P sector. The drop in interest rates offered across the P2P market will not make us happy either.

Let’s take a look at the results of the P2P part of the portfolio platform by platform.

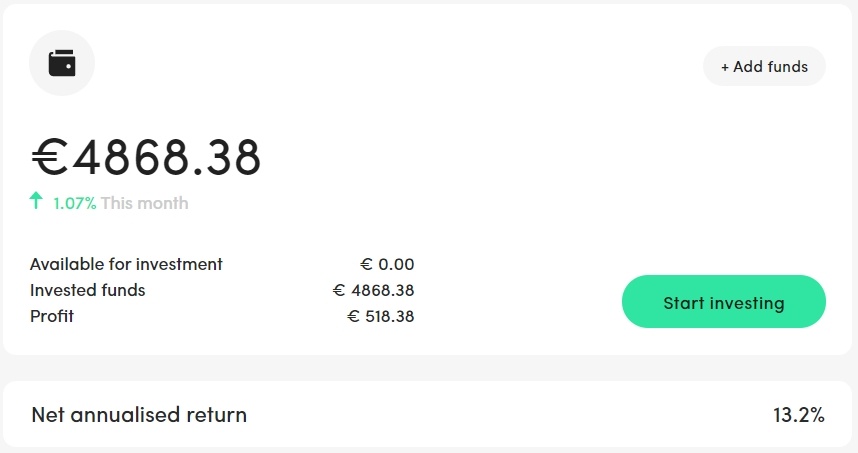

Mintos

There were no major news on Mintos in the past quarter. However, I was not happy with the smaller announcements this time. The provider E-cash was suspended from both the primary and secondary markets. I have no money invested in the provider myself, and I stay away from Ukraine and such questionable companies after the experience of Alexcredit or Dinero.

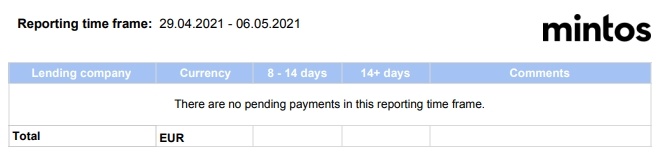

Mintos has also changed the format of the data provided regarding Pending payments, and clearly for the worse. The new report is completely unusable and I have a hard time believing Mintos that the change came because investors complained about the report being too complex. Personally, I would guess that the main problem is the time required to create it. Either way, our lending companies comparison table has lost a source of information that I used to use when deciding which lenders to invest in.

Delfin Group (all above 11%), Mogo (now Eleving Group) as well as Creamfinance and Esto increased their loan repurchases significantly. Overall a large inflow of funds back into the account. When you add to that the fact that almost all lenders don’t immediately cash out their loans on repurchases, but abuse Pending Payments for a few nice non-interest bearing days, I eventually started withdrawing money and moved some to Lendermarket and some to Afranga.

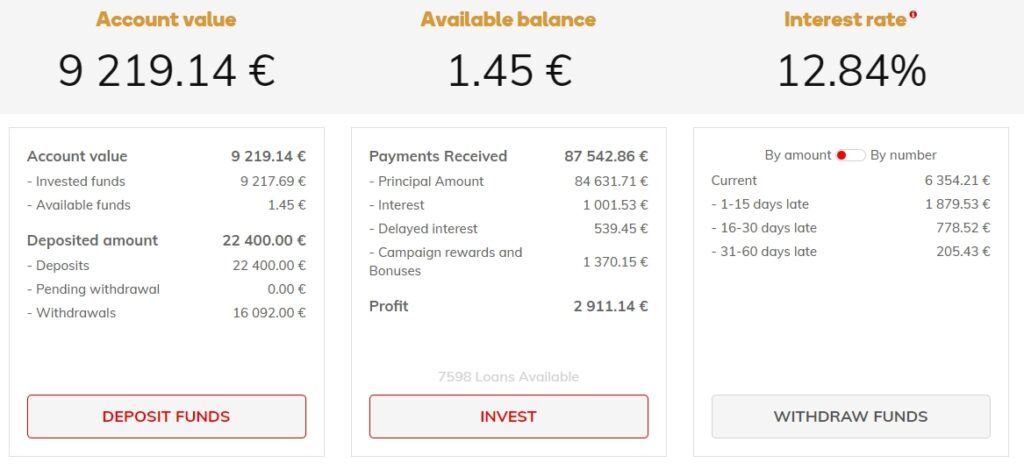

My yield has fallen hand in hand with falling interest on new loans, an increase in no interest pending payments and also a higher uninvested account balance. June, according to the chart, might suggest an improvement, but don’t be fooled. This is only the effect of the withdrawal of some funds from the Mintos and therefore lower invested capital.

You can find an overview page with everything about Mintos on P2Ptrh here and our review from January this year here.

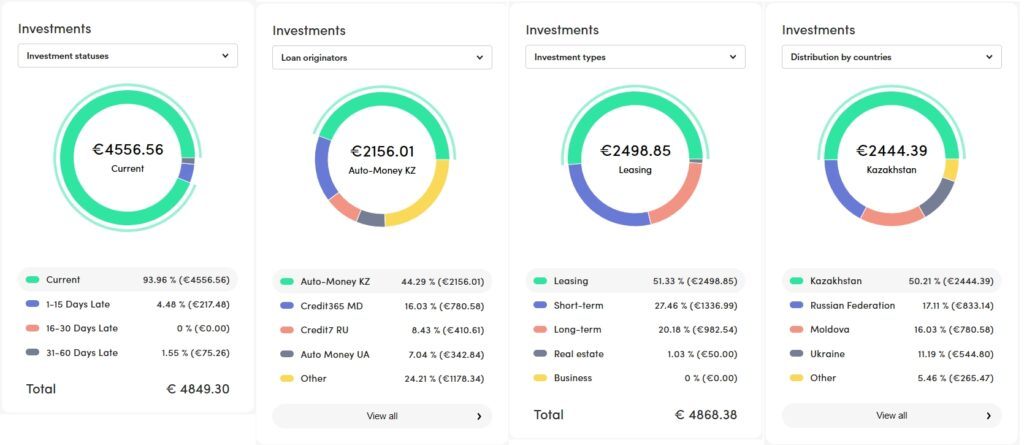

Peerberry

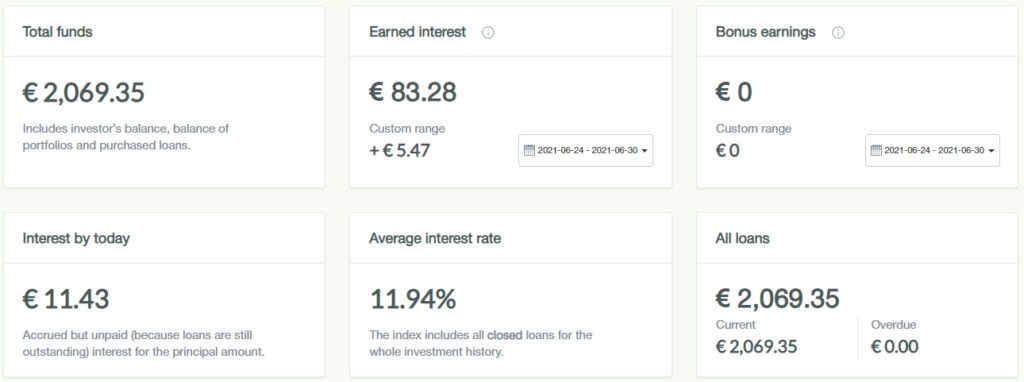

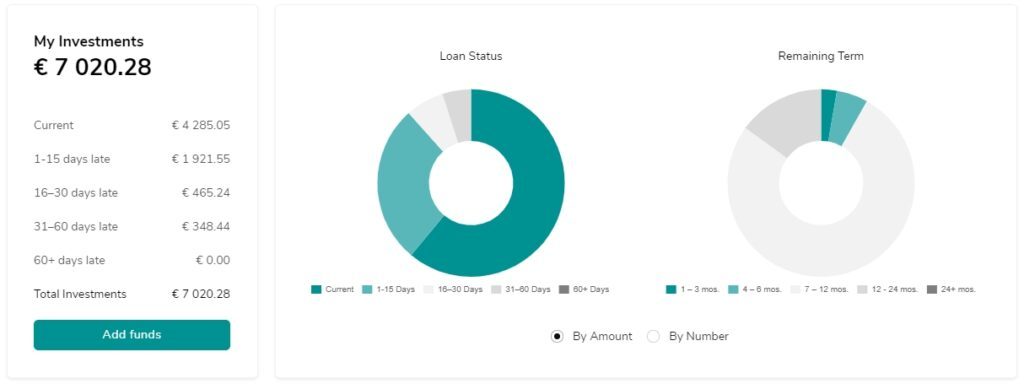

On Peerberry, I ran out of the +1.5% interest on all investments marketing promotion launched last year. Coupled with the fact that the returns are dropping in a similar way to other platforms – I’m happy to invest at 11.5% now – so I’m not considering increasing my funds at all at the moment. I’m now only investing in short term loans under 30 days, which is in line with my strategy of previous overweighting lease and long term loans to take advantage of the aforementioned campaign. The current portfolio distribution can be seen nicely in the charts below.

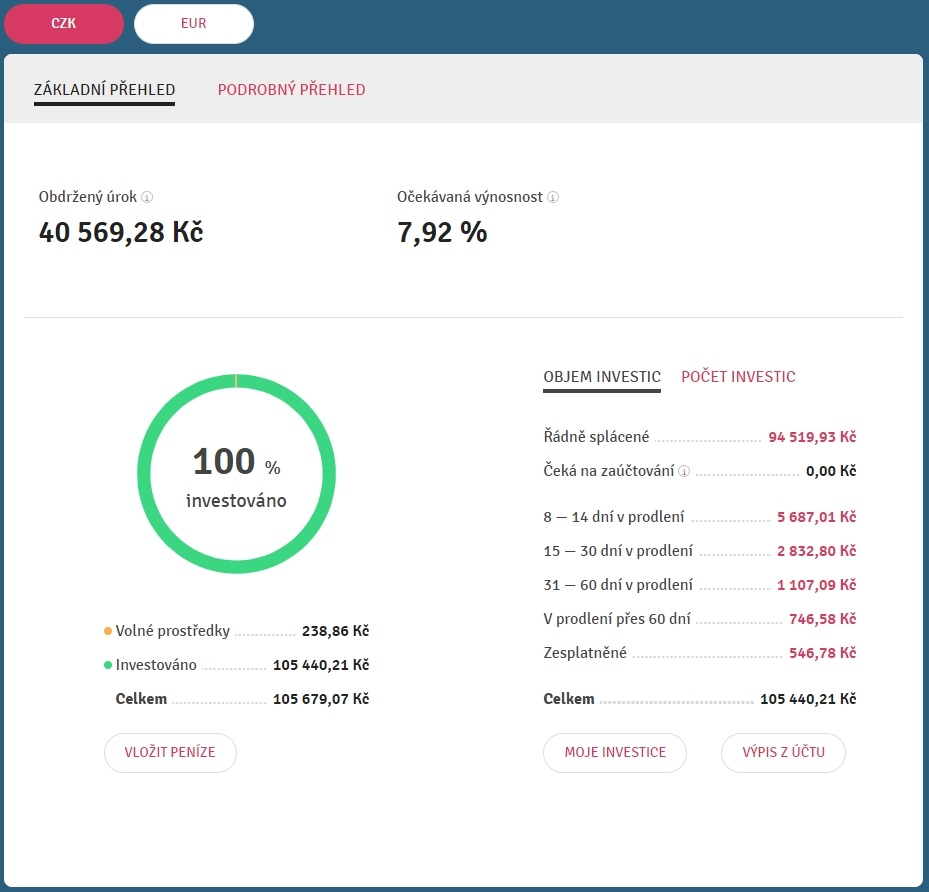

Peerberry continues its trend of transparent disclosures and sends regular newsletters to investors with the performance results of individual providers. This, in turn, is why I accept the declining yield and do not plan to withdraw funds for the time being. Also, payment discipline is excellent by P2P standards, with almost 94% of investments being repaid without delay.

Among other things, Peerberry has also recently modified the investor summary statistics screen. It’s now much closer to the overview you’ll otherwise only see if you install their mobile app.

You can find a page with everything about Peerberry on P2Ptrh here.

Lendermarket

Creditstar Group seems to have finally gotten its act together and announced that the auditor of the 2020 results will be the renowned KPMG. This is clearly a move for the better, although there are still a number of things missing to the complete satisfaction of discerning investors.

We were also able to learn a bit more about the background of the platform through an interview with Omayra Roig.

While on Mintos Creditstar makes rather rude use of interest-free pending periods, fortunately there is no such thing on Lendermarket and interest accrues nicely for every day of delay. Also, loan extensions on LM are not nearly as widely used as on Mintos. Yes, yields have already dropped from highs of over 16% to “only” 14%, but Lendermarket has thrown in a +2% cashback marketing promotion in return. This was valid until the end of June for new deposits and even for existing investors, so I moved some of the funds from Mintos. It should be noted that my account on the platform also jumped significantly thanks to several colleagues from P2Pforum approaching me for a refferal. Thank you very much for that, I take it as an appreciation and a nice feedback for my activity.

However, I have more funds on the platform now than I plan to have in the long term, so I expect there will be some reduction in the second half of the year.

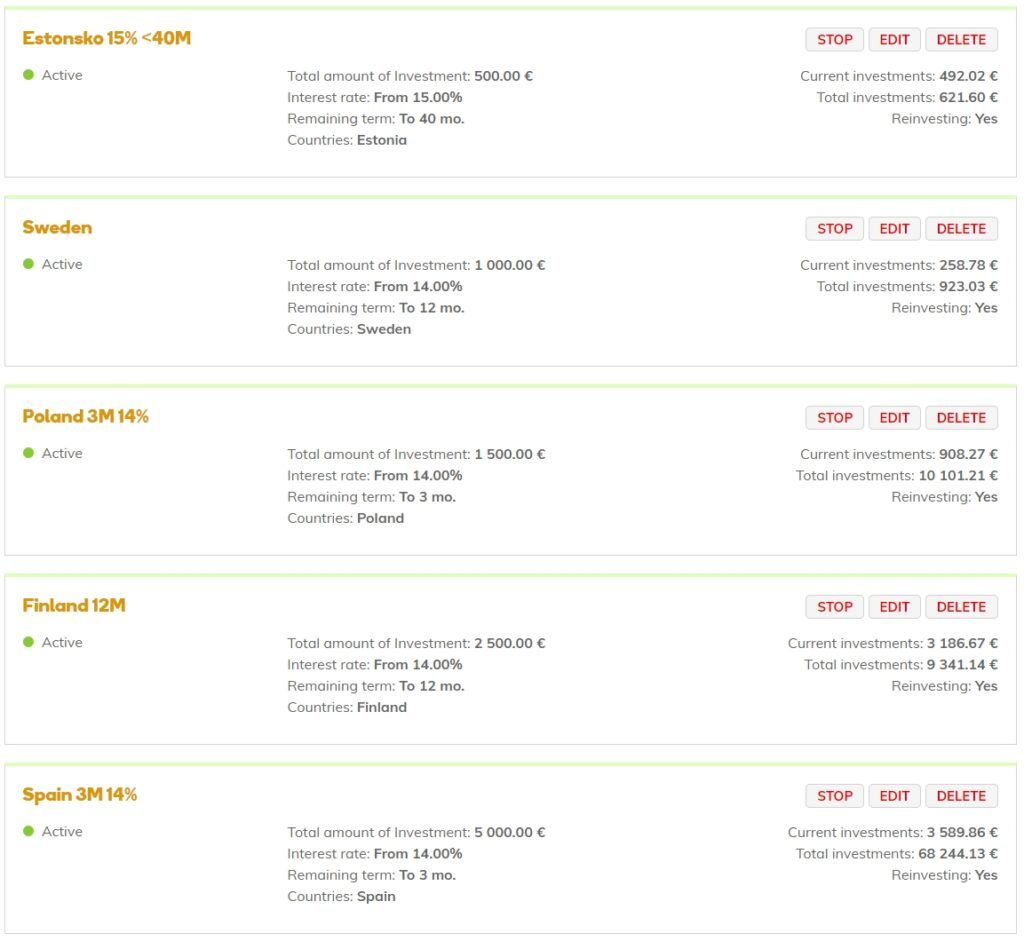

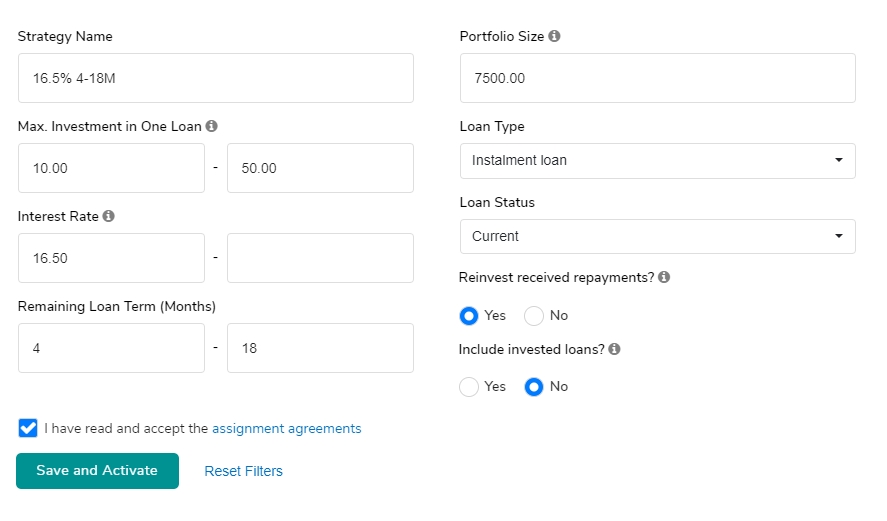

As you can see, the expected return on my invested loans is slowly climbing up as I have purchased more and more higher yielding loans. I have my autoinvest set to a minimum of 14% at the moment and prefer Spain + Finland. For each country I stick to having my own autoinvest. You can see an overview of my AI in the screenshot below. You don’t have to worry about their ranking because there is no prioritization working here and I haven’t figured out what key they are switched on yet.

For more information about Lendermarket, you can read our February review or visit the Lendermarket overview page.

Robo.cash

Robo.cash works for me in fully automatic mode, where I don’t have to spend almost any time on it. The drop in returns has stopped, I mostly buy 11% p.a. loans now. That’s not some miracle, but given that I have the lowest amount here in P2P and Robocash Group still reports excellent results, I keep it as a minor diversification.

I have not encountered similar problems (I have Fio Bank account), but it is worth mentioning that some P2Pforum users have had their Eur deposits returned. The support from Robo.cash does not bother with the solution and just refers you to send funds from another account. The main inconvenience is that some smaller banks use intermediaries for SEPA payments, so as an example even though Creditas is not listed as a “non-cooperating” bank, the transfer will not go through.

“Please be informed that AS BlueOrange Bank, which serves our account, does not cooperate with the following banks: Santander Group, ING BELGIUM, Keytrade Bank (Belgian branch), Banco de finanzas, S.A., Hrvatska Narodna Banka. Therefore we recommend you to send funds from another bank account of yours.“

In the case of Robo.cash I have only one autoinvest with very simple rules.

You can find out more about Robo.cash on the P2Ptrh overview page.

Afranga

Afranga caught my eye right after its launch and as it turned out, I was far from being the only one. As Yonko Chuklev, the CEO of the company himself, told us in an exclusive interview, within the first 2 months of its launch, the platform registered over 400 investors and more than EUR 1 million was invested. Today, Afranga has already a portfolio of over EUR 2 million and the pace of growth is not slowing down. Wer have noticed many of newly registered investors used our refferal link when they registered, I would like to thank you for your support.

Interest rates are a bit lower now, a few months after launch – the recent listing of new loans was at 16.4% p.a. (thanks to Namor for regular updates). However, these are still nice numbers and I have more than doubled my investment since the last report. This has taken my invested funds a bit higher than I had originally planned, but given that these are investments moved from Mintos as part of P2P, I don’t see this as a major problem.

Originally, I thought that maybe because of this increase, I was in the radar of the AML (Anti Money Laundering) department of Afranga, who emailed me and asked me to complete the information about the origin of the funds I invest on the platform. However, thanks to the P2Pforum community, it turned out that many more investors received a similar questionnaire. So this is a more mass action to comply with Afranga’s regulation.

Also, in the case of Afranga, I have only one autoinvest created – there is no reason to have more than one when there is only one provider on the platform so far. If anyone wonders why I have only selected investments for installment loans and not short-term ones, the reason is the option of unlimited extensions for short-term loans (as opposed to installment loans, which cannot be extended), as stated in the terms and conditions. However, since Afranga is planning to launch a secondary market within the next 3-4 weeks (the launch has dragged on quite a bit, but I like that they’re not lying and they admit to more complexity than they originally expected), this will soon no longer be a factor.

We have an overview page about the Afranga platform on P2Ptrh here.

Bondster

I haven’t made any changes to the Bondster platform since the last report. So that means I still haven’t agreed to the new terms & conditions and haven’t invested either. I’m slowly withdrawing funds from maturing loans.

However, that may soon change as a secondary market is due to launch on Bondster towards the beginning of July. I certainly won’t be investing in Euros here, but buying some of the older, well performing CZK loans from Acema is another matter. Apart from those previously defaulted, all of the loans I have bought continue to perform without delay and the default rate is also very low. If anyone is going to dispose of loans after the introduction of SM and it’s not at an excessive premium, I’ll be happy to help them with liquidity.

If you are active on Bondster, you can check out our overview page and leave a short summary for other users.

If you are wondering about anything in this report, or if you just want to ask anything about any of the mentioned platforms, don’t hesitate to write – for example in the discussion below the article or by email.

May you thrive and in the world of P2P investing especially,

Zbyněk