My approximately five-year evolution in P2P investing could be summarized as follows. The first 3 years of utter enthusiasm, zero diversification into other assets and testing dozens of new platforms. The next period was much more realistic and I rather reduced the number of P2P portals. I was more skeptical about new players on the market, and gradually left non-bank providers and started to focus on platforms that provide secured offers or developer loans. In addition to collateral, I could better leverage information from the construction industry, which I have been involved in for over a decade.

The EvoEstate platform is a project that, after a long time, has once again aroused in me an enthusiasm similar to the one I felt in the early days of investing through P2P lending. It brings a concept that makes sense, I can see interesting potential and additional added value to investors. However, it is also a new platform, with only around 5,000 registered users, so it can also be considered riskier.

In today’s review, I would like to introduce in particular the idea of aggregating loans from several marketplaces, which I found interesting. Although it is not a new concept, I will try to explain why I like the concept from EvoEstate.

EvoEstate and aggregation added value

If we look at P2P platforms across Europe, we find a lot of them. If we remove the biggest players from the list, in the remaining long tail we find a number of lesser known, local platforms and marketplaces with occasionally interesting offerings. From an investor’s point of view, these may be suitable entities and opportunities. However the problem of inclusion in the portfolio is the time and technical complexity.

In short, it doesn’t make much sense to track offers across ten platforms and make a registration and investment for one or two interesting opportunities here and there.

This is something that EvoEstate addresses very well by aggregating offers. Investors can invest in real-time crowdfunding across 14 different platforms across Europe, from one interface and marketplace. Particularly for a small portfolio, there can be a huge difference in time and ultimate profitability between single and multiple registrations – whether it’s signing up, reviewing offers, investing, setting up AI parameters, handling communications or tax filing. What’s more, we can much better manage diversification by country, project or loan type in one interface.

Basically, the only role that EvoEstate takes on is the creation of the marketplace. This means making sure that everything works technically well (and perhaps even better than on the target P2P platforms), there are some extra tools, the offers have a unified description and a wide diversification is allowed. Personally, after a short time of testing, I believe that EvoEstate fulfills this quite well and I was even pleasantly surprised by a few features.

Auto Invest and secondary market

I’ll start with the basics of any good P2P portal, two tools – AI and SM. Auto Invest offers a very decent range of options. Of course, it is possible to have a different order set for each platform. Worth mentioning is the risk scoring parameter, which is an independent rating of each project by EvoEstate. The platform states on this that it is not a binding recommendation as more of an additional informative resource, and you need to do your own research and conclusions as well. However, the AI does include this parameter.

What I really like is that if AI invests in the loan, the investor has a 24 hour window to exit the participation for free. It’s a kind of insurance against unexpected AI behavior – in other words, the investor has the last call. What I would have appreciated on the other hand is the possibility to change the order of individual orders. Unfortunately I have not found that.

The secondary market is not very liquid for the time being. A few thousand investors are not enough to move trading on EvoEstate significantly, and the 2% seller fee and controlled expiration of bids and offers are not helping. Still, there are definitely a few things worth noting here. Probably the most interesting one is that there is a buy and sell side. This means that offers can be made to sell, but at the same time, inquiries can also be made to buy a particular historic project. It is also possible to take advantage of discounts or premiums on both sides.

The whole concept looks interesting, unfortunately there are not so many offers to buy for “par”. If I currently count all such offers there are only 40 that can be bought at a 2% premium or less. Regrettably, EvoEstate does not provide any detailed statistics for further evaluation of SM and its liquidity. On the other hand, it should be noted that many of the crowdfunding portals whose offerings are available on the marketplace have no secondary market or auto invest at all.

In practice, I wouldn’t rely so much on selling off projects for the time being, and if so, it is necessary to calculate with a greater loss.

Risk scoring

I mentioned the risk scoring above, which I’d like to discuss separately, as it seems to me to be a good feature with added value. EvoEstate offers two different ratings – for the platform and for the project (links to each methodology). In practice, it looks like for each platform and each offer, the investor has a rating on a scale of A+ – D, which serves to give a fairly quick idea of the strengths and weaknesses.

The ranking table for each platform can be found here. For my part, I read each offer separately and take the ratings as informative only, but it’s quite nicely done and if the investor is active on some platforms, maybe this benefit is worth even an unverified registration.

Crowdfunding progress

The minimum amount per participation is €100. That’s not a little, but it’s not a lot compared to other platforms. For example, the Rendity platform requires 5x that amount, and if a smaller investor were to diversify meaningfully across the market, they are unlikely to be able to do so without EvoEstate. This is another advantage of EvoEstate because it lowers the barriers to entry. Crowdfunding takes place simultaneously on both the parent platform and EvoEstate. If an investment is made on one of the sites, the amount is credited on the other within minutes.

Concept sustainability

The biggest question is whether the concept can be sustainable. EvoEstate has transparent data for each project on how many investors have put money into a given investment. Just add “/investments” to the url for any opportunity (besides current funding). For example, it’s clearly visible at this link. As a rough count – investors put about 10,000 EUR into an offer and if the offer is marked as SITG (skin in the game by EvoEstate), the stake tends to be about triple.

EvoEstate acts as a single investor and profits primarily from the interest rate differential for the higher volume of funds invested on the parent platform. This approach is commonly seen on the EstateGuru platform, for example. If EvoEstate’s profit is 2%, then by the simple calculation it makes 200 – 600 EUR p.a. per offer. With 350 offers in 2 years it is really not a lot of money. Especially with the need to invest in the user interface and technical background of the platform.

It can therefore be assumed that EvoEstate, like any other platform, is heavily loss-making in its early days. It is funded by the founders and the startup Wise Guys, which also invested in the aforementioned EstateGuru. Expanding the user base is then crucial for further growth. And that’s a rather difficult task. The platform can’t promote its own opportunities (it’s basically copied content) and can’t afford to pay referral partners in large amounts due to lower potential profits. The only option is to grow incrementally, invest in the platform and build goodwill.

Which platforms am I active through EvoEstate

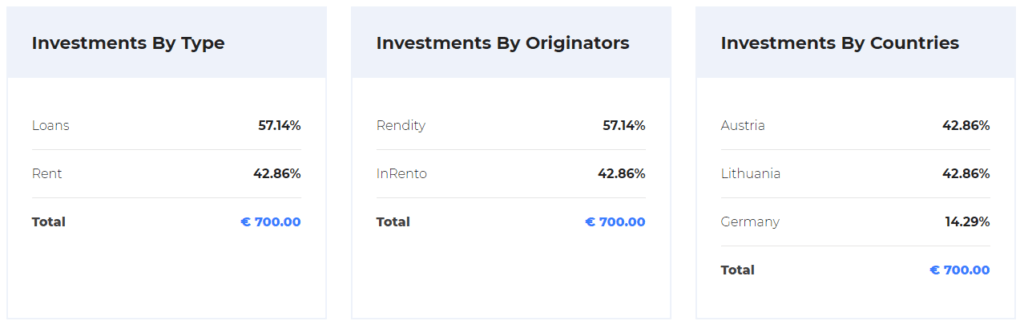

The reason I opened an account with EvoEstate was to diversify to the EstateGuru platform. Where I am in terms of country representation in Estonia (about 46%), Latvia (45%) and Lithuania (9%). Then on EvoEstate I am active in other countries like Austria and Germany (currently 7 participations of 100 EUR each). Which, by the way, is a completely different approach and philosophy to housing than what is seen in the Baltics.

I liked the Rendity platform the most, where projects make philosophical sense to me (even though the yield is at 6.5-7%). It is about reconstruction and renovation of apartment buildings in the centers of large cities and for example superstructures in the form of attic apartments. Often these are developers who have used Rendity repeatedly and have a good track record, which again reduces risk.

The other platform that caught my eye is InRento, which is an investment in buy-to-let mortgages, i.e. for rent. Again, it’s a little bit different than what EstateGuru offers. In the future, I’m considering bringing in some loans from HeavyFinance, which I see as riskier. I also like something from the Profitus platform from time to time. I’m certainly curious about future lenders as well, and for me personally there is an added benefit in the cross-platform tracking of offerings.

EvoEstate – investor experience

We gather the experience of other investors on our website. We also aggregate other interesting information and links about platforms and non-banking companies. This should help the potential investor to gather as much information as possible in a short time. Simply put, we don’t want to represent only one view for the sake of objectivity. We would be happy to read your insights and experience as well. For more structured information about EvoEstate, please visit this page.

Investors rating

EvoEstate – Experience and Investors Ratings

Reviews, links

EvoEstate – Reviews and Other Links

Relevant links:

- EvoEstate – Originators rating methodology

- EvoEstate – Projects risk scoring methodology

Did you know?

EvoEstate – Did you know?

Downloads

EvoEstate – Downloads

Bonus

EvoEstate – Bonus

EvoEstate offers 0,5% cashback to new investors for their invested deposits during 6 months after their registration. To receive the bonus the registration through the link below is sufficient.

By registering through the link below, you will also support this project.

If you want to learn about active bonus campaigns or just to check if there is no better offer at the moment, write to us and we will be happy to to get back to you.

Summary

EvoEstate is, for me, a successful project after a long time. However readers should not automatically confuse that with the suitability of investing there. The whole platform tempts to simplify crowdfunding heavily through ratings, but it has to be said that two projects with similar ratings and returns can have different and unequal risks. Therefore, I would definitely recommend interested investors to study the parent platform first instead of EvoEstate and get an idea of the offering and history.

Paradoxically, my registration on EvoEstate was preceded by registrations on Rendity and InRento and reading the materials there. It will be no different with HeavyFinance and Profitus if I decide to invest. So, in conclusion, although EvoEstate is trying to build a comprehensive marketplace, some offerings can only be better understood after studying more context.

The point I am trying to make is that while the platform does everything it can to simplify investing, virtually no one has knowledge of 14 different markets and countries. So from my perspective, EvoEstate is more suited to advanced investors looking for some form of simplification of their portfolio. Alternatively to beginners, however, who will study each platform and opportunity step-by-step. For my part, I have no major objections to the concept of aggregation as such and I am curious to see if the platform catches on.