The New Year – despite all the wishes and covid’s releases – has not started happily at all and there can be no thought of any worry-free investing.

The Kazakh riots in January were a small prelude. There, however, there was a very quick intervention by Russian troops and an almost immediate calming of the situation. The panic thus lasted “only” about a week or two. It is after the outbreak of the conflict in Ukraine that we may well be facing a lengthy war directly in Europe, which may threaten to escalate for many months to come.

Thanks to the conflict itself and of course the subsequent sanctions, almost all asset types are either directly or indirectly affected. P2P investments – although at first glance it may seem that some platforms may not be geographically affected by the war at all – are no exception. To avoid unnecessary repetition on individual platforms, I will now highlight the biggest implications of current market events on the P2P industry in a few points.

Ukrainian providers’ problems

In a wartime situation, with foreign troops sweeping the country and many civilians leaving their homes and trying to get to safety, it is understandable that loan repayment would not be the borrowers’ main concern. Therefore, repayment problems can be expected immediately for all lenders who have exposure of their business in Ukraine. For lenders where Ukrainian loans form a major part of their business, compliance with any buyback guarantee cannot even be expected.

Russian providers’ problems

After the Russian aggression, it did not take long for Western countries to introduce various anti-Russian sanctions in large scale. A major step was the cutting off of a number of Russian banks from the SWIFT payment system. This made it difficult for providers to make payments to individual platforms. The question, of course, is what is the will to pay these obligations at all. In retaliation to the sanctions, Russia has introduced strict rules for the exchange of rubles into foreign currencies, and it may not be easy for providers to access the exchange at all. Related to this is the fall in the value of the rouble. Investors who invested directly in rubles may as well write off tens of percent of the value of their portfolio. Plus lenders who are not currency hedged and have to repay in Euros will now collect nominally much lower amounts from Russian borrowers. The case of Turkish lender Wowwo on Mintos recently illustrated how this can play out.

Increase in “pending payments” from Russian, Kazakh and other providers

Following on from the above, it is clear that payment transfers take longer. This also affects providers operating in countries other than those directly affected by the war. For example, the Kazakh IDF Eurasia used a bank in Russia as a correspondent bank for Europayments. On the Peerberry platform, they automatically activated the crisis plan, paid part of the repayments from the guarantee fund and promised to repay the rest within 2 years. However, investors’ money will no longer bear interest during this period. It can be expected that some Russian/Ukrainian providers will see a portion of their portfolio gradually go into default and never be repaid.

Money outflows from P2P (investors withdrawing funds), sell-offs on secondary markets

Any crisis automatically leads investors to exit risky assets and flee to safety. Whether into bonds or even straight into cash. P2P investments are high risk and it is clear that many more conservative investors are withdrawing their funds. But beware – even the more risk averse investors may withdraw their funds. Indeed, along with the outbreak of conflict, stock markets have fallen and many investors now see better opportunities there.

The first signs of investor withdrawal can be clearly seen in all major platforms with at least minimal exposure to the war zone as early as February – see the table from the P2P-banking website. I expect this trend to deepen in March.

[Source: https://www.p2p-banking.com/tag/loan-volume/]

Not all platforms have a secondary market, but where investors can use it, they do. The initial panic seems to have calmed down, but loans were commonly available at a 10-20% discount. On Mintos, where the secondary market is allowed to continue trading with Russian providers, it was then no problem to speculate on buying at a discount of up to 50%.

Increase in interest rates offered, reintroduction of cashback campaigns

The decline in funds from investors or even, for some of them, the exit from the sector has caused supply to exceed demand. We have not had such a situation since the covid March 2020, and for the first time in a long time, the interest rates have reversed their course. Almost all platforms have already responded to the outflow of investors and are offering higher, more attractive, yields. Cashback campaigns go hand in hand with this, with Mintos, for example, offering an unprecedented 10% bonus when buying loans from the new South African lender Planet42.

So much for the extended introduction and let’s move on to the individual platforms.

Mintos

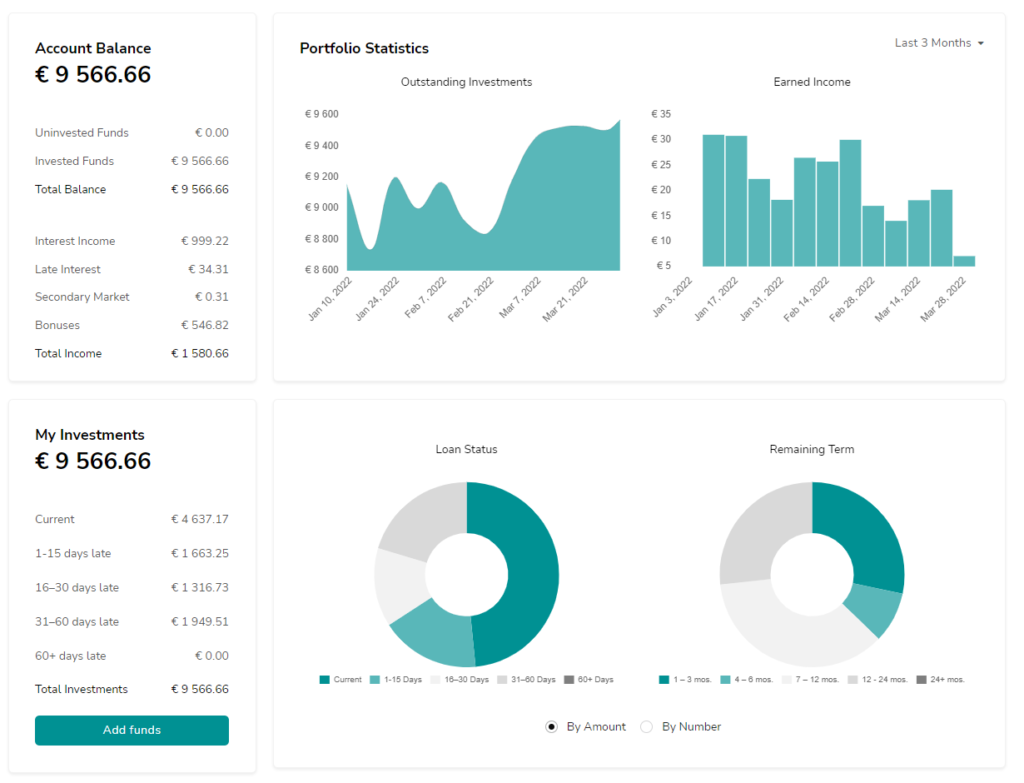

I started the quarter with small withdrawals on Mintos. But I gradually stopped these and finally replenished what I had withdrawn in March. The reasons are simple – interest rates have risen significantly on Mintos. Then, for those who want to speculate on the further development of Russian and Kazakh lenders, the secondary market is literally packed. Cashback campaigns are also tempting, with ID Finance, for example, currently offering +1% cashback on loans with a maturity of 30 days (although yes, they can be extended and fall into delay). The short maturity and 1% bonus then results into a final interest rate of over 20% p.a..

I speculated back in January, when I managed to sell Kazakh IDF Eurasia on the secondary market first at a low discount. I bought them back at discounts of more than 10% after the situation escalated and investors panicked. Now IDFE is under pressure again because of Russia, so we’ll see over time if this was a good move on my part. It hasn’t paid off for me in the past with Wowwo.

The Turkish provider is dead silent. Three months have passed like water and not a single euro of the recovered money has landed in investors’ accounts. Repayments from other defaulted providers have not been significant either. The only one that occasionally succeeds is Armenia’s Finko (formerly Varks). And there I fear that if the situation in Nagorno-Karabakh escalates into armed conflict again, it will mean further deterioration in repayments. So, on the positive side at least, Mintos is already publishing specific amounts and specific numbers of loans in “in recovery” that have been repaid in the past month. This makes the process a bit more transparent. Interested parties can find this information at https://www.mintos.com/en/funds-in-recovery-updates/.

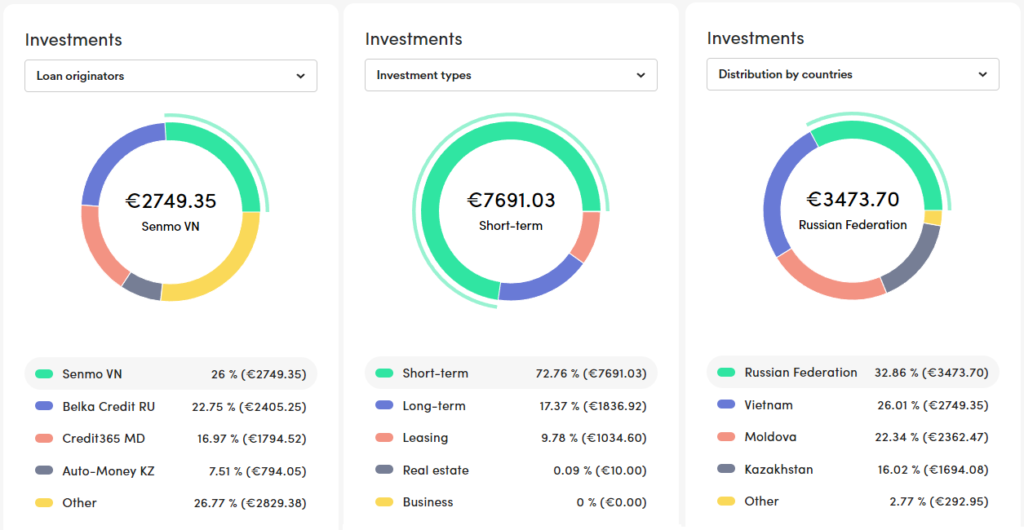

For the record, Mintos had 15% of its portfolio in the countries affected at the time the conflict broke out. The huge diversification across providers, even geographically, helps.

My January return in EUR shows clearly that I managed to almost triple my average monthly profit in that month thanks to my “discount” purchases. I also made a few purchases in March and the return was also boosted by the cashback bonus credited for investing in Planet42 loans during their campaign.

In terms of the rouble portfolio, RUB loans were completely delisted from the primary market. However, trading is still open on the secondary market. This is the right decision from my point of view and I always try to buy with all the funds available. Not that I’m that much of a stuntman, but the spare rubles in investors account are automatically converted to Euros from time to time without any possibility of intervention. At the exchange rate that Mintos is able to negotiate, I prefer to opt for a longer exposure and faith in a better tomorrow.

You can find our overview page with everything about Mintos on P2Ptrh here and our review from January this year here.

Peerberry

The most war-affected platform in my portfolio is clearly Peerberry. While the platform and the providers on it (especially Aventus Group) have long been among the most profitable players in the P2P market, they are the best communicating and most transparent players. Unfortunately, you can have systems set up absolutely brilliantly and if you have 1/3 of your loans coming from Ukraine and Russia territories, the impact is huge. On the positive side, the platform and Aventus Group CEO Andrey Trofimovas are clearly doing their best to keep things going, at least as far as possible, and to ensure that investors are repaid. (You can read Trofimovas’ perhaps almost heartbreaking post about the impact of the war on Aventus Group and his determination to counter it on the Peerbery blog).

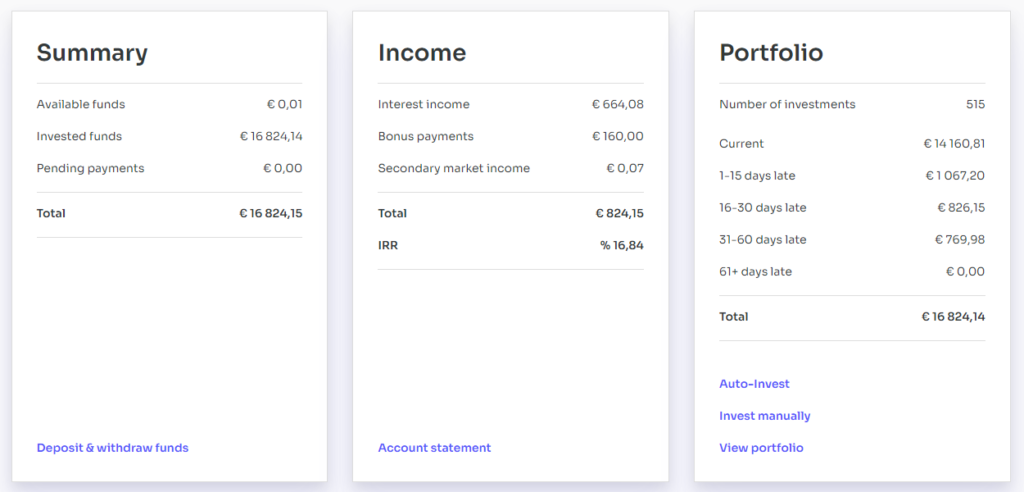

A portion of the loans were repaid from the reserves of the lenders Aventus and Gofingo. Further repayments are planned. The platform has also selected a group of 30 investors who are invested in problematic loans. They will form an oversight committee and help transparency in repayments. However, in order to manage the situation, Peerberry has also resorted to unpleasant steps. Understandably, the “Buyback Guarantee” for loans that fall more than 60 days into delay will not be honored. Also, all interest on such loans stops accruing after 60 days of delay. The horizon within which the platform would like to have all problem loans repaid has been set at 2 years. Surely there will be many investors who will whine to Peerberry and lament over the 2 years of lost liquidity and interest. It’s not pleasant. On the other hand – a realistic view of the concerned companies’ business – if this relief helps them to survive and the investors will eventually see all their claims repaid, then it is a logical and correct step (at least from my point of view).

However, the situation on the whole platform remains uncertain, so it is no wonder that some investors are leaving Peerberry. The drive to retain clients has then led to a double increase in the interest rates offered by the remaining providers, as well as a promise to launch a secondary market. This will offer investors a quicker (albeit more expensive in the form of having to sell loans at a discount) exit in the event of problems.

I am partially reducing my investments on the platform myself. So I don’t withdraw everything that comes back from the repayments, but I always partially withdraw. If everything goes as the platform announces with the repayments, I would like to get to the 10k Eur limit (i.e. the loyalty bonus limit) and keep these funds working on the platform. The thing I have to give Peerberry a definite praise for is the speed of withdrawing funds to my account. During working hours, it happened to me repeatedly that a withdrawal entered to my account on Revolut was done within 5 minutes. That’s great, and other platforms have a lot of catching up to do here.

In the last P2Preport I devoted a paragraph to my concern about the high number of my loans from Russia. At the beginning of this year I had over 12 thousand Euros in Russian lenders on Peerberry. Today I am very glad that I did not underestimate the risk and as early as January started investing mostly in other countries. My exposure has dropped significantly and I am sleeping better now as a result.

You can find a page with everything about Peerberry on P2Ptrh here. We have also reviewed Peerberry platform here.

Lendermarket

Lendermarket experienced a relatively quiet quarter thanks to its geographic focus and the absence of a secondary market that would accelerate the possibility of investor exits in times of panic. Interest rates are at a high of 14-15% p.a. This is a very solid, but not so great offer compared to other platforms. In fact, many platforms have increased interest rates and often even dramatically.

On the one hand, it would seem that Creditstar can afford to do so thanks to its established name and good economic results (4Q2021 profit of EUR 1.8M, earnings EUR 8M – more here). But then why does it offer Estonian and Finnish loans on Mintos at a higher interest rate than on its own platform. Whatmore with a cashback campaign (up to 2%) on Mintos? Once it has been written that Creditstar’s offers on LM will always be the best deals on the market, the management should stick to that. Unless Mintos is behind it by subsidizing loans to stop investor outflow. However, given the lack of any ownership interdependence between Creditstar and Mintos, this does not seem likely to me.

I made one deposit during 1Q and one withdrawal at the end of March. So the amount invested remains almost the same. Unlike Peerberry, the withdrawal here is definitely not instant and you wait a good while for the funds – in my case LM sent the amount to my account after 3 business days.

For more information about Lendermarket, you can read our review or visit the Lendermarket overview page.

Robo.cash

Robo.cash is registered in Croatia and does not offer any loans from Russia or Ukraine, so it would seem that there is no reason to worry.

However – the successful Robocash Group, which places its loans on the platform, is itself heavily tied to the Russian business. The platform itself is consequently very active in communicating to investors, holding various webinars, Q&A sessions and emphasizing on explaining the situation and reassuring investors. The platform emphasizes that the funds of the individual subsidiaries are kept separate and thus investors are not at any risk due to possible sanctions on the Russian part of the business.

“Neither the Robocash platform itself, nor its loan originators (none of which are based in Russia) have any relationships with Russian banks. All related transactions, as well as loan disbursement activities of the companies are done through the respective local banks. Therefore, we assure you that none of the money invested on Robocash is in any way transferred to or from Russia, and is not affected by any political tension and resulting sanctions.”

[Source: https://robo.cash/news/takeaways_from_robo_talks_live_webcast_of_march_11]

For those more interested, I recommend reading a nice summary of the last recorded webinar from March.

Still… When you consider that 60% of Robocash Group’s business is generated in Russia, it certainly doesn’t add to the peace of mind.

In terms of the interest rates offered, the development corresponded exactly to geopolitical events. First, rates were falling, and further reductions were planned. But then the war broke out, the rate cut was cancelled, and then the rates were increased instead.

After considering the situation, I decided to continue with the invested funds on the platform without reducing them.

I also reviewed the platform last year, you can read my observations here. An informative page on P2Ptrh is here.

Afranga

Although Bulgaria is not directly affected by the military conflict, Afranga has not managed to escape the outflow of investors. Ironically, this helped the platform to offset the imbalance that existed in the marketplace. The earlier shortage of loans has now been resolved, with hundreds of loans on the primary market and, as an added bonus, the interest rates offered have been increased to 14%.

Stikcredit also published its 2021 results and investors can be satisfied. The group is doing exceedingly well.

Income from interest: 15,9m (vs. 10,0m 2020)

Profit: 5,1m (vs. 4,6m 2020)

Total liabilities: 12,6m (vs. 5,6m 2020)

Total equity: 15,9m (vs. 11,9m 2020)

Total assets: 28,4m (vs. 17,6m 2020)

Loans to customers: 21,6m (vs. 12,2m 2020)

Stikcredit’s key financial indicators for 2021 (in BGN, approximate exchange rate 2 BGN ≈ 1 EUR)

So for the investor on Afranga, this time there is positive news. Therefore, I did not withdraw the funds from the platform and kept them working.

Afranga overview page on P2Ptrh can be found here, review here.

Esketit

Esketit can be said to have been affected by the current situation the least of all the platforms I monitor in my review. Investments run nicely automatically, there have been no changes in the interest rates offered over the past period, the newbie cashback bonus has been paid to me without delay and there are plenty of loans available. So nothing has led me to withdraw the funds. On the other hand, I also did not increase my investment because I already have a large amount on the platform.

For more information about Esketit platform visit its overview page or read our review.

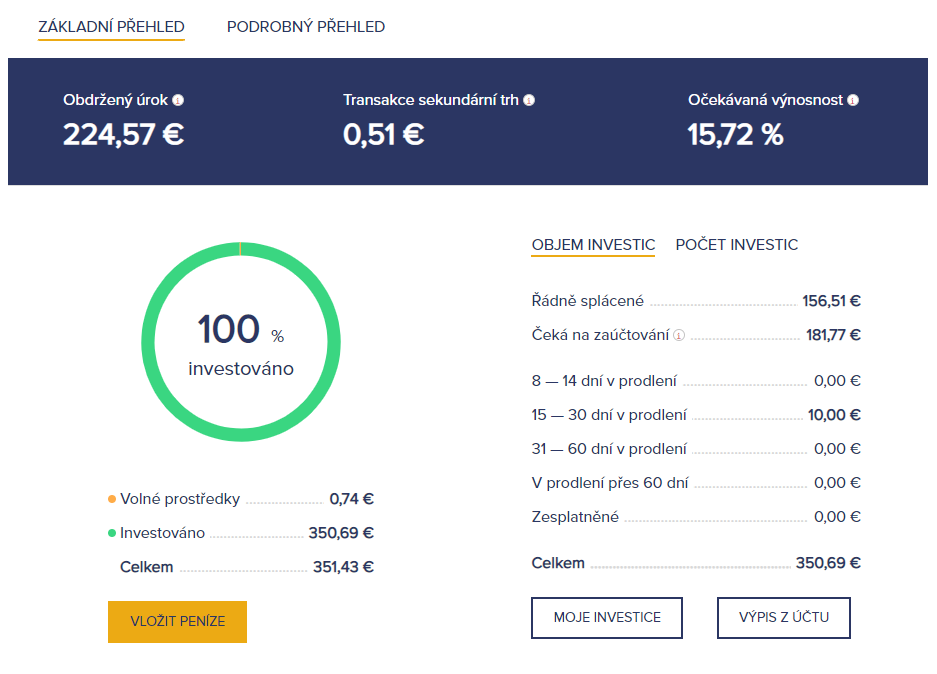

Bondster

On Bondster I continue my strategy of investing in Czech crowns and especially in loans from ACEMA. The impact of the start of the war and the increased number of loans offered for sale on the secondary market was also evident on Bondster. I took advantage of this, slightly increased my total deposit and bought already established, secured and timely repaid loans with 9+% interest. I consider these to be relatively safe and the interest in crowns (although unfortunately not covering current inflation) is appropriate for this risk for me. Note that even though I have been on the platform for 4 years, my loan repayments – thanks to the right loan selection – are at an absolute minimum.

On the contrary I don’t increase my activity on Bondster in EUR market and I don’t foresee myself preferring Bondster to other alternatives in the near future.

I If you are active on Bondster, you can check out our overview page and leave a short summary for other users.

1Q2022 summarized

The start of 2022 makes it clear to investors that there are no certainties and diversification is the only way to go. Not just through individual asset classes, but within them. It is also important to look at the geographical spread of investments. This often overlaps in my portfolio and if I compare the situation a year ago and today, I am somewhere else. Not always voluntarily, as I wouldn’t give up representation of Latvia or Moldova from quality providers Delfin Group / Iute Credit if it weren’t for forced redemptions. And so, thanks to Lendermarket and Esketit, I have 25% P2P exposure to Spain. This seems to be no problem today, but 25% is a lot and who knows if in the next economic crisis it won’t be Spain with its high unemployment that will be the country most affected…

The distribution of my P2P portfolio by % is shown in the map below, it is zoomable, so even the hidden little Singapore, where I have a solid exposure via Robo.cash, can be traced.

If you have trouble viewing the map in any browser, you can go to the original version here.

Finally, an updated table with an overview of the interest rates currently offered on each platform.

| Platform | Maximum interest currently offered |

|---|---|

| Afranga | 14,00% |

| Bondster CZK | 16,00% |

| Bondster EUR | 16,00% |

| Esketit | 14,00% |

| Lendermarket | 15,00% |

| Mintos EUR | 16,00% |

| Mintos RUB | x |

| Peerberry (without loyalty bonus) | 13,50% |

| Robo.cash (without loyalty bonus) | 13,00% |

To those who have read this far, thanks for your perseverance and hopefully we'll be back next quarter with more cheerful news.

As always, we welcome any comments, sharing your own experience or questions. You can write to us, for example, in the discussion below the article.

Zbyněk

All previous P2PReports can be found here.