It was already looking like a smooth ride throughout whole 2021. Unfortunately, a few days before Christmas, the problems of Turkish provider Wowwo on Mintos escalated. What the loss will be cannot be estimated yet, but it is sure now 2021 will not be passed with flying colours. That’s also why I’m glad that I have managed to diversify P2P significantly within it.

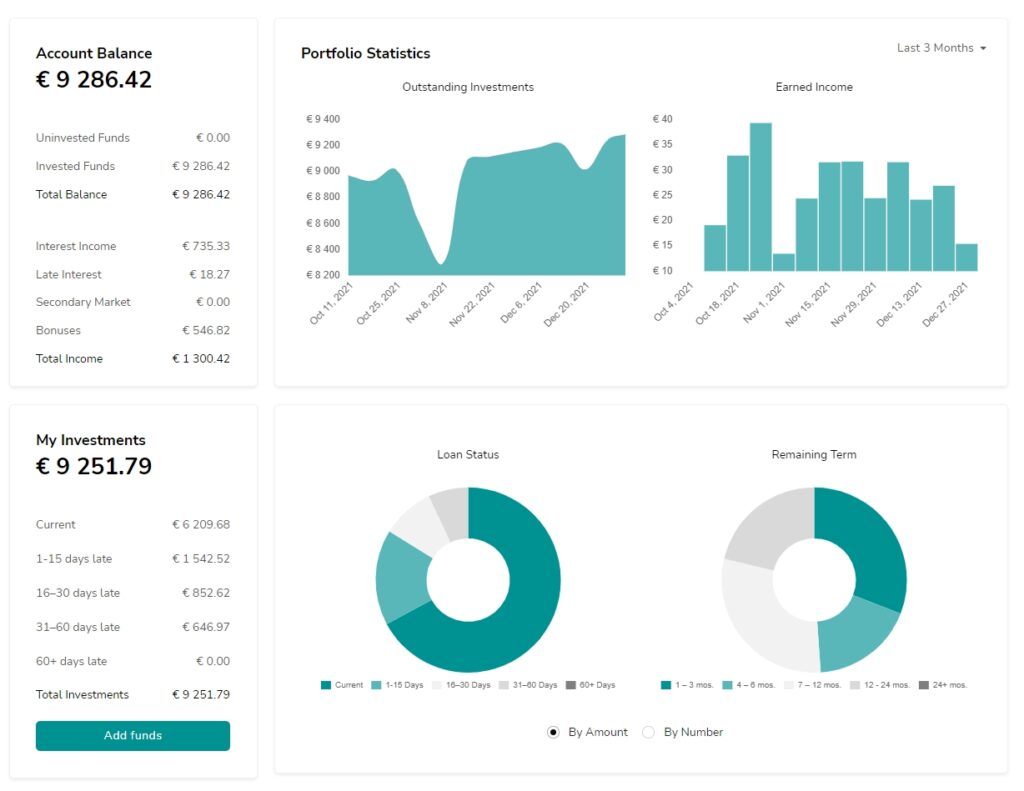

Mintos

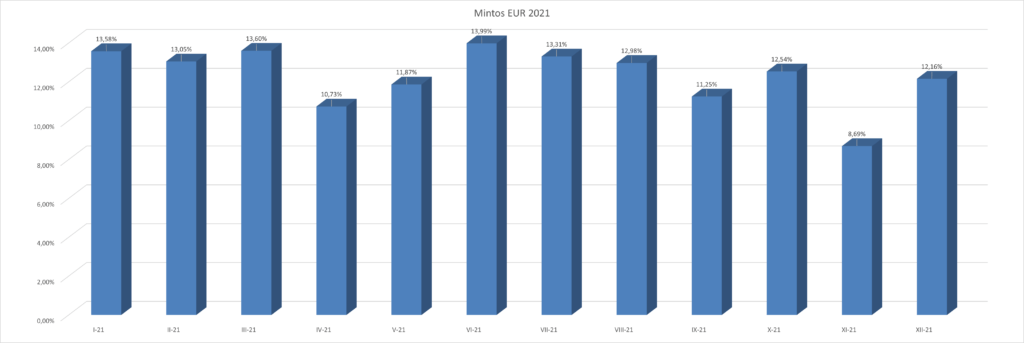

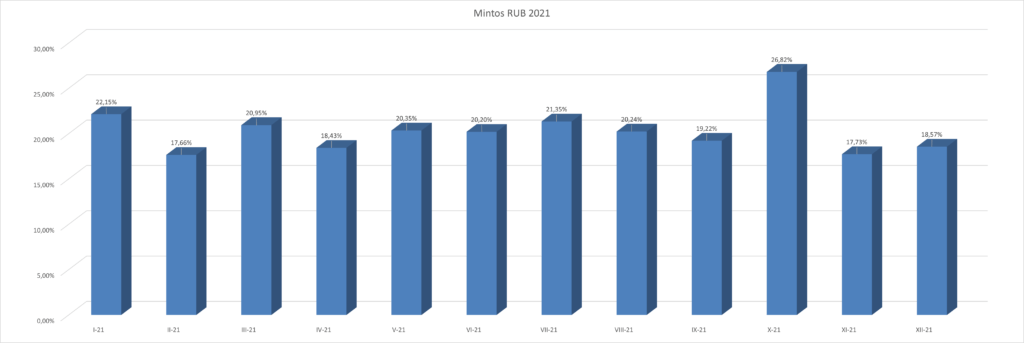

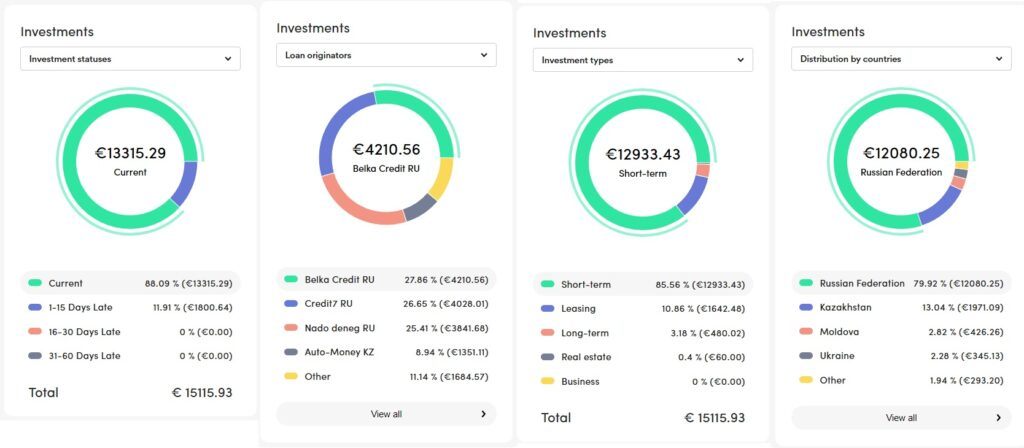

In the last quarter of 2021, I continued to gradually liquidate my positions on Mintos. This is because there were massive early redemptions of Iute Credit, Eleving, Delfin, Esto and other providers. Newly offered loans then rarely exceed double-digit yields. And that kind of yield/risk ratio doesn’t appeal to me at all.

The only provider I continue to invest in now is Kazakhstan’s ID Finance Eurasia. However, I already have quite a large amount in it, so I am withdrawing the remaining funds and moving them to other platforms. Since the beginning of now last year, my Mintos portfolio has decreased 65%.

More unpleasant news came in December when Wowwo’s loans trading was suspended on both the primary and secondary markets. The Turkish lira is in free fall thanks to Erdogan’s policies. This is not good news at all for companies whose borrowers repay in lira but whose investors are paid in euros. Moreover, Wowwo, in setting scenarios for future developments and determining strategy, has come to the conclusion that currency hedging is too expensive and not worthwhile. It has to be said that there were more warning signs for more attentive investors over time and the result is not that surprising in retrospect. I too have given up on Wowwo at one time and successfully sold my loans, even before the panic, without a discount. But what did it matter when my greedy self later emerged and bought Wowwo again at discounts of around 5% in the secondary market.

So if I consider the worst case scenario, not seeing another cent from my investment in Wowwo, then my profits on Mintos this year will be cut by about 40%.

As a matter of interest, I will mention here what Lukas wrote on the forum. Wowwo kept the rating from Mintos at 7/10. That’s very high, and also because of that its loans were bought in numbers by automated investment strategies. For example for those investors who didn’t want to bother with AI setup and chose a “low risk” conservative strategy. Please note conservative strategy gives a return of 9% p.a.. Wowwo’s representation in Luke’s automated strategy was 15% of his portfolio. So you can calculate for yourself what impact a total collapse of the company would have on his returns.

Mintos is certainly not maintenance-free, and higher returns are more likely to be achieved by investors who follow what is going on and choose the providers themselves.

What about Mintos and next year? In my case, probably a continued downsizing. I don’t want to exit Mintos completely yet, but if the returns on offer don’t increase and the bureaucracy around it continues to get more complicated (which is a credible risk with the arrival of Notes), then I may reconsider this decision and leave the remaining funds to work elsewhere.

You can find our overview page with everything about Mintos on P2Ptrh here and our review from January this year here.

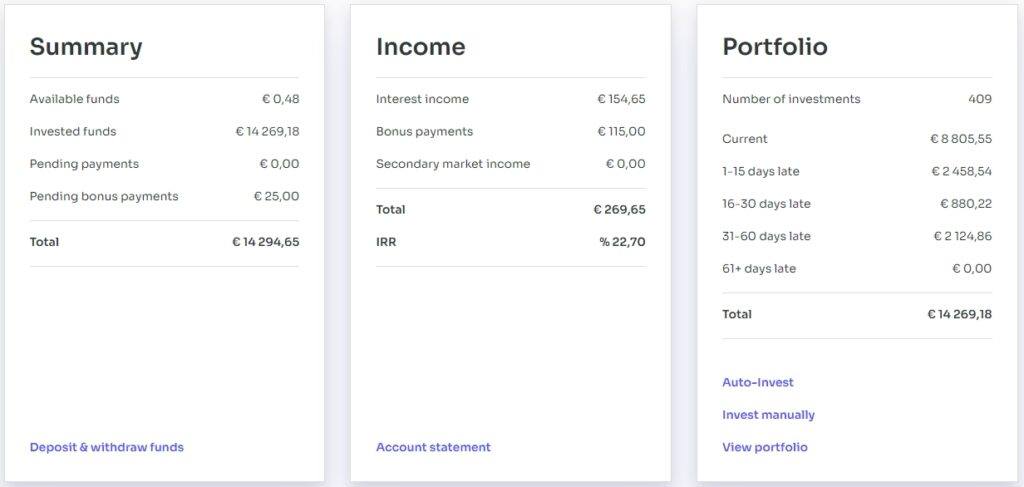

Peerberry

I did not conduct any incoming or outgoing transactions on Peerberry in the past quarter. Nothing major happened on the platform during the quarter, which I consider positive. Loan supply increased in the run up to Christmas, although this did not affect rates.

Thanks to the mobile app, the investor gets a notification when uninvested funds are available in their account. While this is somewhat annoying to do manually, unfortunately in the case of leaving autoinvest, I used to end my day with a higher balance. It didn’t get invested until the next day, but by then the repayments for other loans had come due again. So to maximize profits, I sometimes invest manually.

The second thing I will mention here is the large proportion of loans issued in Russia. The Aventus Group is running smoothly, they are profitable and there are no concerns here. However – learning from the developments in Turkey – I am a little worried here about what would happen in the event of an escalation of the conflict on Russia’s border with Ukraine. What sanctions will the EU/US impose against Russia? The threat of restricting SWIFT payments has also been made. What impact would this have on Russian providers?

So, in summary, I am not going to increase my investment in Peerberry in 2022 because of the above. If everything works as it is now, then I will keep them at a constant level plus reinvest the interest earned.

You can find a page with everything about Peerberry on P2Ptrh here. We have also reviewed Peerberry platform here.

Lendermarket

One of the few P2P platforms that hold attractive rates (14-15% p.a.) and yet are backed by a relatively solid and large lender is Lendermarket. Moreover, in November Lendermarket came up with another cashback promotion. All investors (even existing ones) got +2% on top of the amount they increased their deposit by and invested. This is a suspiciously good offer at a time when all other platforms are reducing their returns and when the scissors between the interest offered elsewhere and on LM are widening. I was therefore worried about what the long-delayed 2020 results audit would show.

We finally saw it in December this year and it did not reveal any scandalous skeletons in the closet. The biggest problem (and the reason for the delay in issuing the audit) is the contradictory valuation of intangible assets. While this is certainly not good news, it is also not something that should threaten the group’s operations at the present time.

“The Group has recorded intangible assets at fair value as at 31 December 2020 amounting to 8 491 thousand EUR and 31 December 2019 amounting to 5 335 thousand EUR. Management has not stated these intangible assets at acquisition cost less accumulated amortization but has stated them solely at fair value based on external valuation report, which constitutes a departure from Estonian financial reporting standard. During the audit we were unable to determine the effect of departure from Estonian financial reporting standard on the consolidated financial statements.”

So for 2021, we can hope for a faster audit and hopefully a resolution of these contradictions.

Creditstar Group also managed to place a EUR 30M bond in December with a yield of 10.5-11.5%, which should stabilize the company’s financial situation in the short term.

In any case, Lendermarket doesn’t require your attention, the auto-investment setup works and with the cashback campaign I decided to take advantage of the bonus percentages and increase my deposit. The original idea was to pull the deposit back again after the New Year, but with the current situation in the P2P market, I’ll see what the offers are on other platforms and maybe let the deposit work longer.

For more information about Lendermarket, you can read our review or visit the Lendermarket overview page.

Robo.cash

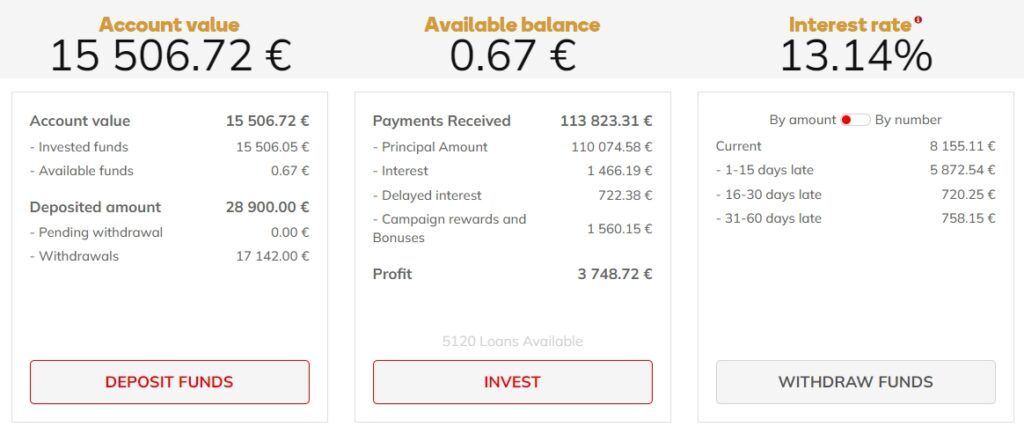

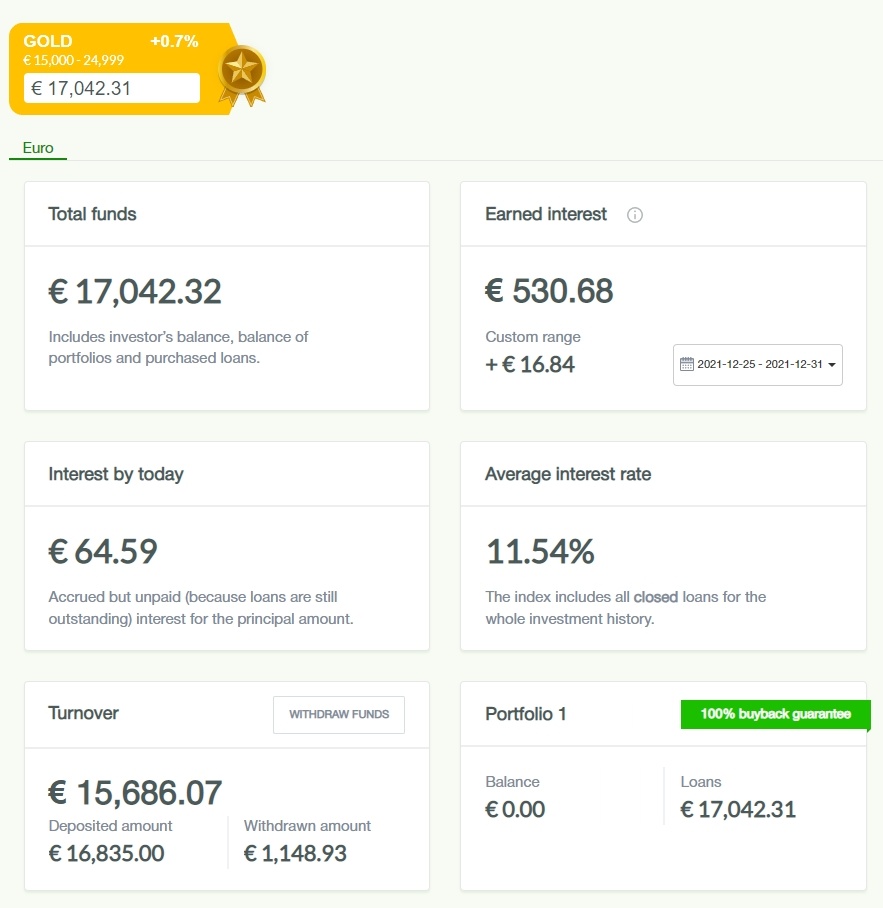

Robo.cash has in retrospect become my (and according to the results of the Czech P2Pforum Awards poll also according to many voters) P2P platform of the year. Zero maintenance (complete automation), very solid results presented, regular communication. When you add to that the relatively decent interest offered, then satisfaction is justified.

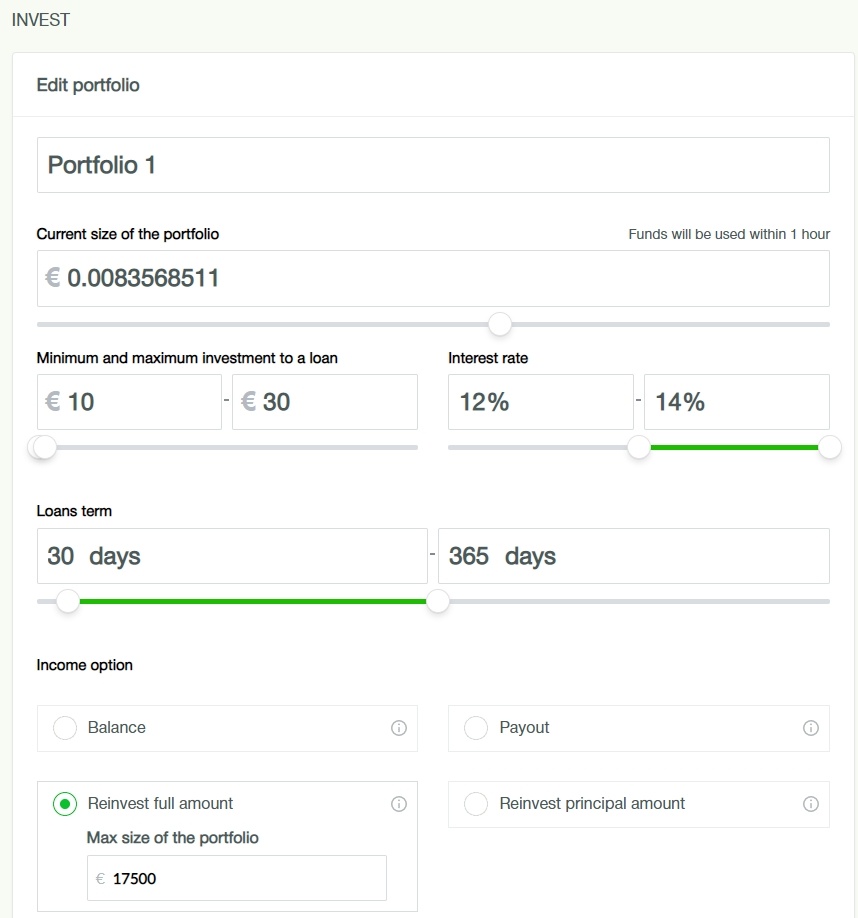

During the quarter, I decided to increase my deposit significantly to get a gold bonus for the amount of my investment (+0.7% to the base rate). To do this, I also adjusted my autoinvest strategy, where I am now buying loans maturing in up to one year. This means that the interest rate will climb to a nice 12.7% bonus included.

The current invested funds – in the context of other P2P platforms – seem to me to be just right now. Of course, it would be nice to receive a +1% bonus, and at minimal time cost. On the other hand, diversification between platforms is important and here are all the loans invested in Robocash Group companies. Therefore, I would prefer to use a different/new platform in 2022 for the money withdrawn from Mintos. But we’ll see if a suitable one comes along and if it doesn’t end up outweighing the advantages of Robocash and raising the deposit here even more.

I also reviewed the platform in August, you can read my observations here. An informative page on P2Ptrh is here.

Afranga

Sadly, Afranga has not offered a single positive news in the past 3 months. Interest rates continue to fall – we are now at 12% p.a. This goes hand in hand with the fact that loans are in short supply. Investors have overwhelmed the platform with their appetite on the investment demand side, and because Stikcredit is a fairly small provider, the supply is not scalable enough.

Therefore, all available funds are regularly not invested (cash drag) and the return of all investors decreases. The secondary market does not help the situation; on the contrary, speculators appear who immediately offer freshly purchased loans at a premium.

Afranga is aware of the imbalances in the marketplace and will need to start working on them quickly. In my opinion, organic growth of Stikcredit will hardly do the trick, so hopefully the platform will agree to work with one of the other providers. If not Afranga will be another candidate for a reduction in invested funds next year.

Afranga overview page on P2Ptrh can be found here, July review here.

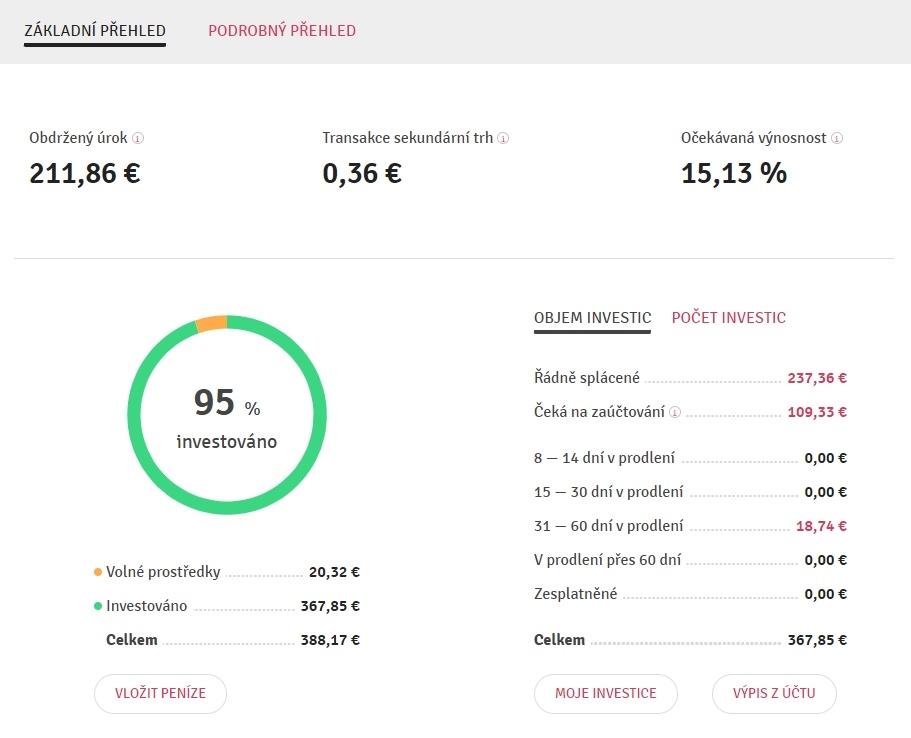

Esketit – new platform in my P2P portfolio

I have been looking for P2P platform Esketit, which is owned by the owners of Creamfinance group, as a portfolio addition for quite some time. The funds withdrawn from other platforms finally swayed me. As I described in a recent review, my original intension was to invest a lower amount (say up to 5 thousand Euros). However, this changed with the increasing rebuys on Mintos and I ended up with a much higher amount on the platform.

The positives of the platform are the flexible support, the simple interface, the good financial results of Creamfinance Group for Q3 2021 and the secondary market. There are currently loans from Jordan (a non-Creamfinance provider) and then the Spanish and Czech branches of Creamfinance. It was the Czech one that I initially invested the vast majority of my invested funds in. The interest rate offered was 12%, maturity up to 3 months.

The stupid thing is that in December the offered yields for Czech loans were reduced to 10%. While Jordan still offers 14%, they lack the group guarantee – they are riskier. Spanish loans at 12% wouldn’t be a bad alternative, but I already have significant Spanish P2P exposure thanks to Lendermarket.

As a result, I am not sure if I will not at least slightly lower the amount for Esketit next year.

For more information about Esketit platform visit its overview page.

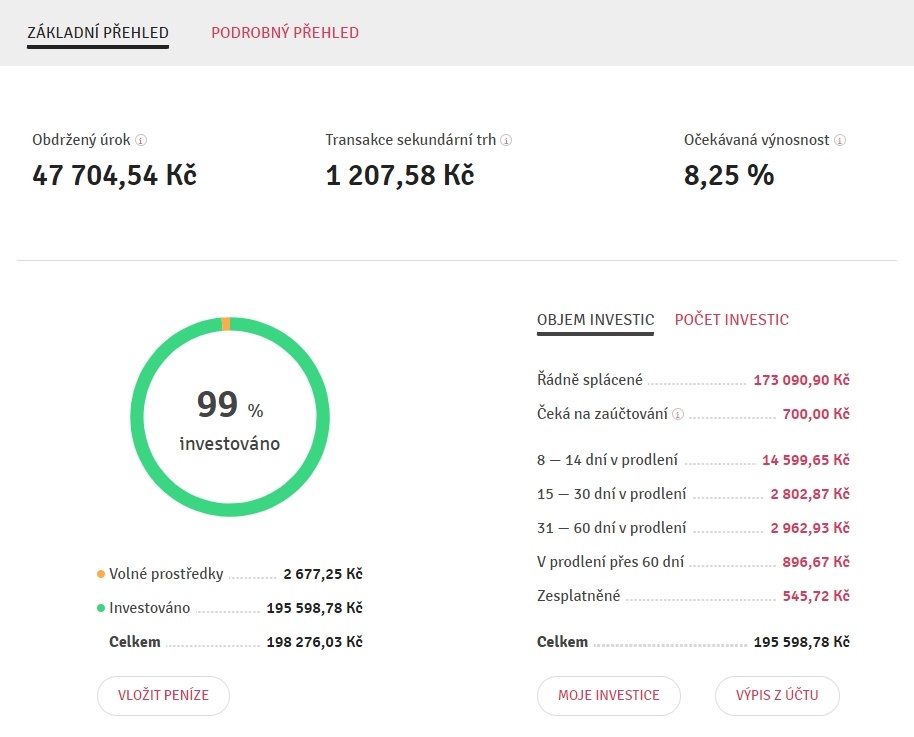

Bondster

Also on Bondster, I let the deposited funds work throughout the quarter without any deposits or withdrawals. Attractive secondary market offers have dwindled, now most of them are speculative with premiums. But it doesn’t really matter. Thanks to the fact that I have loans mainly from ACEMA and with a maturity of several years, the turnover in the account is not high. I consider it a definite positive that there are no frequent repurchases of older, established loans.

I also invested a few hundred crowns in short-term loans from Gocredit. Almost all of them subsequently fell into default and were only resolved by a buyback guarantee. At the offered interest rate of 6%, I do not find this lucrative and so will not reinvest here.

Otherwise, however, I am quite satisfied with the investment opportunities in CZK, the secondary market has substantially improved the possible exit from the loan and I will definitely continue next year.

I see the situation with EUR loans on Bondster differently. Although the offered interest rates are high (currently up to 16% p.a.), the quality of the providers does not inspire confidence in me. Therefore, I do not plan to increase my tiny EUR account.

I If you are active on Bondster, you can check out our overview page and leave a short summary for other users.

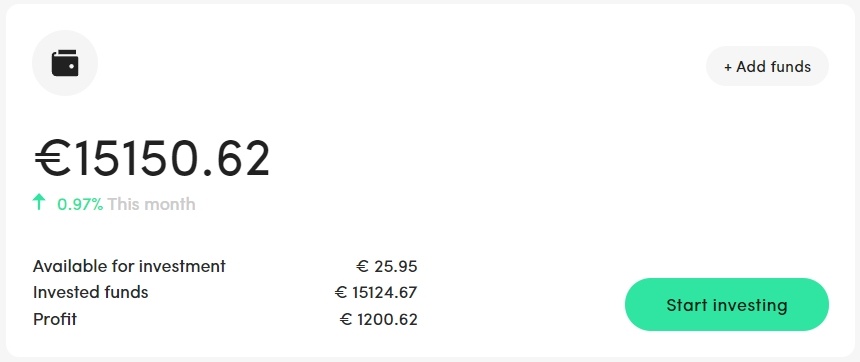

Year 2021 summarised

When 2021 started, I certainly didn’t plan for such a significant reduction on the Mintos platform. On the contrary, in terms of ease of management, the possibility of broader diversification on one platform and already some certainty of legislative anchoring, I would rather believe that I will move funds from other platforms to Mintos.

But the reality is quite different. The interest rates offered on Mintos have dropped significantly. It has added bureaucracy, which only makes it harder for investors to calculate the actual return and forces them to click more. Previously easily accessible filters are hidden under another button. Account statement to make the investor search by clicking through each tab.

Other P2P platforms do not offer such a significant opportunity for diversification within their platforms. That’s why I started 2 new platforms in 2021 (Afranga, Esketit) and returned to one previously abandoned one (Robo.cash). I see this as a good move at the moment. Yes, there will be a bit more work with tax declaration. But I’ve managed to keep returns at a solid 12+% and have diversified more broadly.

| Platform | Maximum interest currently offered |

|---|---|

| Afranga | 12,00% |

| Bondster CZK | 10,00% |

| Bondster EUR | 16,00% |

| Esketit | 14,00% |

| Lendermarket | 15,10% |

| Mintos EUR | 11,00% |

| Mintos RUB | 16,10% |

| Peerberry (without loyalty bonus) | 11,00% |

| Robo.cash ( without loyalty bonus) | 12,30% |

Outlook to 2022

In 2022, I would like to keep the value of my P2P portfolio at a stable level, with a dream appreciation of 12% p.a. I am willing to reduce this slightly for established and stable platforms, but not below 11%. With the supply being what it is in recent months and returns steadily declining, it is quite likely that I will be looking at moving funds between platforms and probably opening an account on one of the others (I would be happy for any tips you may have). This is the only way I may be able to allocate all the withdrawn funds, keep the portfolio diversified and keep the returns at the level mentioned.

Did you like the article? Do you have different view on topics discussed? We would be grateful for any comments, your opinion or any other word in the comments section.

I wish you many (and not only investment) successes in 2022.

Zbynek

All previous P2PReports can be found here.