Rendity – Platform Introduction

Rendity is a startup from Austria that works on the principle of investment crowdfunding. When compared to a number of portals, the yield on Rendity is lower (6-8% p.a. compared to the relatively common 12% p.a.), but it can be said that these are higher quality projects. Development projects from Austria and Germany in particular with an investment horizon of 12-36 months are available for investment on the platform.

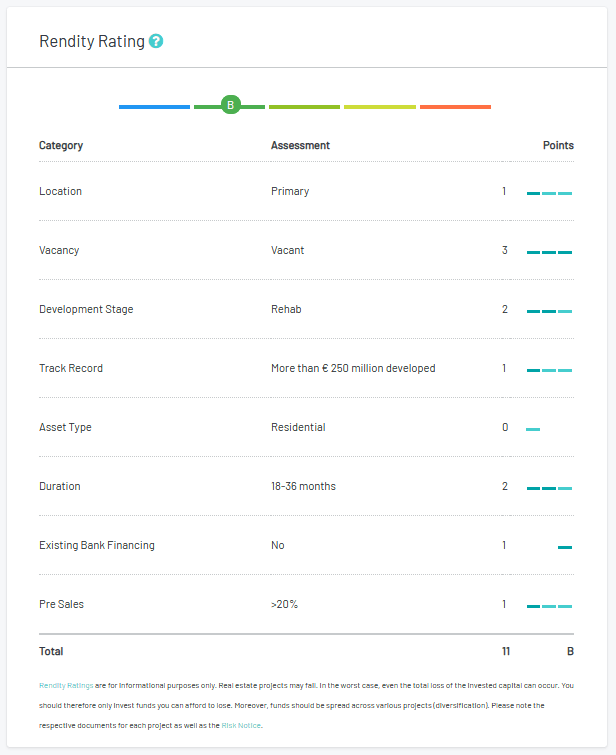

The investment documentation is very good and shows a lot of work. Basically, these are informative documents that are qualitatively comparable to the Czech platform Upvest and at the same time are graphically at a very high level (fact sheets, developer references, site models, etc.). Each project is then scored and assigned the appropriate rating and corresponding interest. More information on the rating methodology can be found here.

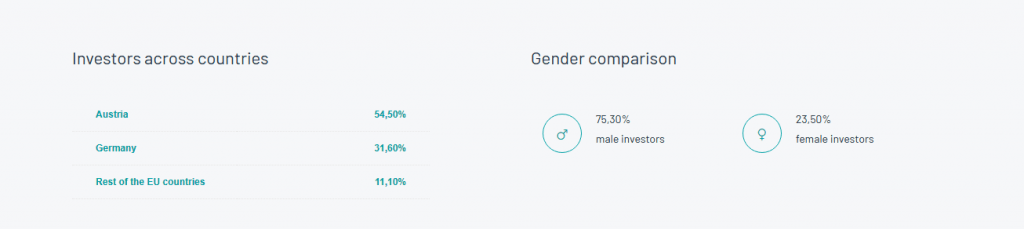

A more fundamental disadvantage is the lack of access to the secondary market and the relatively high minimum participation amount of EUR 500. The investor receives interest annually and the principal only at the end of the elapsed period. This setup is in line with the philosophy of more long-term and, let’s say, more mature, wealthy and older investors (which can be seen by looking at the statistics of the platform) who do not intend to sell from one day to the next. Monitoring the platform on a daily basis makes no sense whatsoever.

A compromise may be to invest in Rendity through the EvoEstate aggregation platform, which reduces the minimum participation amount to EUR 100 and makes the secondary market that exists within this aggregation platform available. Occasionally, you may also come across a participation on the local SM that is sold at a low premium due to the elapsed term of the loan.

The platform is mainly known in the Austrian and German markets. For investors, it is free of additional fees (Rendity takes these on the developer’s side). In case the crowdfunding amount is not reached, the investor gets his money back, but without interest.

In addition to development loans, it is possible to invest in real estate through Rendity Income, whereby the investor receives a regular rental income of around 4.5% p.a. every 3 months.

More videos can be found on Rendity’s official channel.

Rendity – Basic Overview

- Establishment: 2014

- Supported currencies: EUR

- Average interest rate: 6,5 %

- Average maturity: 12-36 months

- Minimal investment per participation: 500,- EUR

- Investor fees: X

- Auto Invest: X

- Secondary market: X

- Buyback obligation: X

- Option to sell participations prematurely: X

- Official website: https://rendity.com

Rendity – People

The platform does not have a representative who would consistently speak on its behalf.

Investors Ratings

Rendity – Experience and Investors Ratings

Reviews, links

Rendity – Reviews and Other Links

P2Ptrh information:

Other sources information:

- 10/2020 Marco Schwartz: Rendity Review: My Results after 16 Months

Did you know?

Rendity – Did you know?

- There is a “Request a free callback” button on the platform at every opportunity, which allows you to answer your query by phone.

Downloads

Rendity – Downloads

- Educational ebooks from Rendity on crowdfunding, fintech and specifically real estate crowdinvesting.

Bonus

Rendity – Bonus

The Rendity platform offers investors a start-up bonus of +25 EUR. From time to time, the platform offers other interesting account opening promotions (currently 100 EUR), which are a bonus to the minimum invested participation of 500 EUR.

By registering through the link below, you will also support this project.

If you want to learn about active bonus campaigns or just to check if there is no better offer at the moment, write to us and we will be happy to to get back to you.

Rendity – Alternatives

This page was last updated on 06/2021.