When we talk about P2P, we tend to throw together platforms based on different principles and compare them with each other, whether in terms of profitability, payment behaviour of borrowers, etc. Therefore, in the upcoming series of articles we would like to offer our insight into how we perceive and differentiate the whole P2P universe. If you have a different perspective, feel free to post it in the comments, there are many perspectives and we welcome discussion.

We decided to split the topic into several parts due to its length. We will gradually discuss the most common types of platforms and their main characteristics, as well as how we view them in terms of risk, regulation or returns. A regulation will be looked at in particular detail, as it is a hot topic that divides investors these days. In the last article, we will take a closer look at the EstateGuru platform. Not in a form of a classic review, but we will try to illustrate everything we will write about in the first three parts on this platform. We will add some statistical and background information on where the platform is heading, what to expect from it in the future and whether we think it makes sense to invest here.

We hope that this series of articles will be useful for beginners – today’s episode, for example, to make them aware of the differences and show how diverse P2P investing can be – as well as for more advanced investors.

Types of P2P platforms

Leaving aside a few platforms where you really lend to specific people at an agreed interest rate, most of the popular P2P platforms can be segregated into several types.

A) P2P Marketplace

Typical representatives: Mintos, Bondster, Debitum Network, Income Marketplace and others

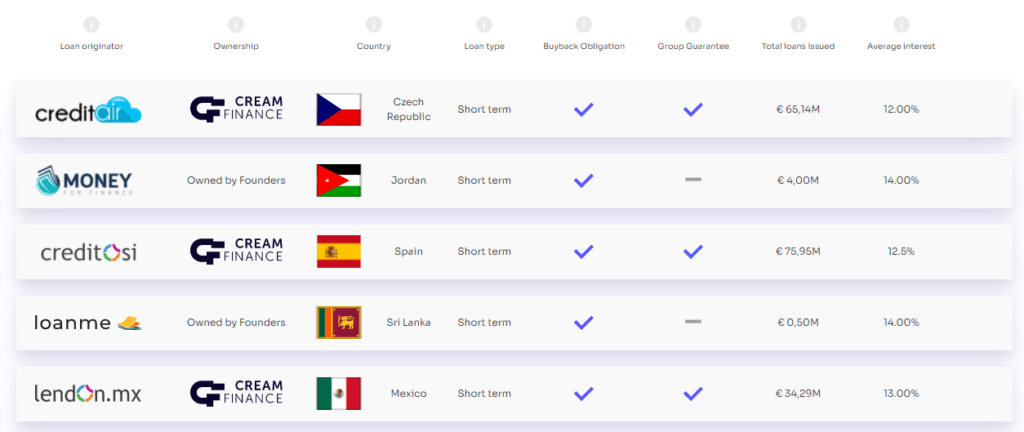

Here, the platform serves as a marketplace where various non-bank loan originators (LOs) offer consumer loans they have originated for investment at a certain interest rate. Most of these loans are unsecured, some LOs offer, for example, collateral in the form of a car. However, for the investor, the most important link here is not the borrower himself, but the LO, as it is the LO that handles your money. For a sense of security, LOs usually offer a so-called buyback guarantee (obligation). With this, they commit to rebuy the delayed loans to the investor after a certain period of time (typically 60 days). With that the investor does not bear the loss from the uncollected debt. In the event of problems or outright bankruptcy of the LO, the platform normally seeks to engage on behalf of the investor. This can be done either through communication/restructuring or, in the worse case, through the legal process.

Recap – P2P marketplace

- Marketplace with multiple LOs.

- Standard consumer unsecured loans, in most cases with a buyback guarantee (commitment).

- The investor has an indirect relationship with the borrower -> you are effectively lending to the LO and you are dependent on the borrower’s financial situation (unless the platform has an advanced system of transferring repayments directly from the borrower to the investor).

- To maintain investor trust, platforms actively communicate with LOs and take steps to benefit investors and their money (unfortunately not always successfully).

B) P2P platform with loans from a specific loan originator

Typical representatives: Robocash, Moncera, Afranga, Lendermarket, Esketit and others

Unlike the previous case, the platform is linked ( by ownership, personnel, financially…) to a specific LO and offers primarily its loans. The LO’s motivation for this move is to get rid of the intermediary in the form of a marketplace platform (type A) that charges fees for its services. Again, loans on these platforms are commonly characterized by a buyback guarantee. If a non-banking group is divided into several smaller LOs, then we also see the concept of a group guarantee. There all LOs falling under one group commit to help each other in case of problems with one of the providers.

In terms of structure, when you make an investment, you lend money directly to that LO, which uses the funds to make new loans. The loan you invest in on the platform is already issued at the time of the investment, so logically the borrower will not receive your money. At the same time, the maturity date is usually governed by the LO’s optimised cash flows rather than the borrower’s actual repayment.

Recap – P2P platform with loans from a specific loan originator

- It offers loans of one LO or multiple LOs under one owner / one group.

- The relationship between the platform and the LO can take several forms.

- Again, the structure of the loans tends to be indirect.

- By having its own platform, the group gets rid of the intermediary of a marketplace, thus saving on fees.

- It offers unsecured loans as standard, in most cases with a buyback guarantee or a group guarantee.

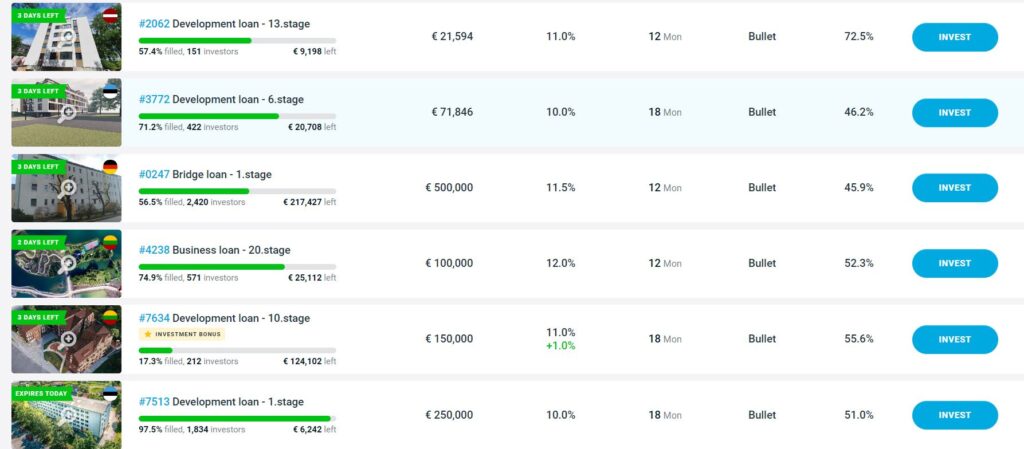

C) Platforms with loans for specific projects

Typical representatives: EstateGuru, Lande (formerly LendSecured), Reinvest24, Bulkestate, EvoEstate and others

These platforms are often referred to more as crowdfunding/crowdlending platforms, as investors subscribe to finance specific large loans – real estate projects, bridge loans, business loans, agricultural loans, etc. The major difference with type A) is that there is no LO, the platforms in this case act as intermediaries between investors and applicants for funding. At the same time, they offer services such as debt recovery for investors. This is because loans are typically secured by collateral – a pledge that can be sold in the event of the borrower’s default and thus recover the invested funds. Collateral can be real estate, land, heavy machinery, grain, etc. For logical reasons, these platforms do not offer a buyback guarantee. There is no one to give you this guarantee except the borrower (the platform is an intermediary, not the LO). However, you still have collateral, which is a much more tangible insurance in case of default than a mere promise of a buyback. Loan maturities are typically somewhere between 6-24 months.

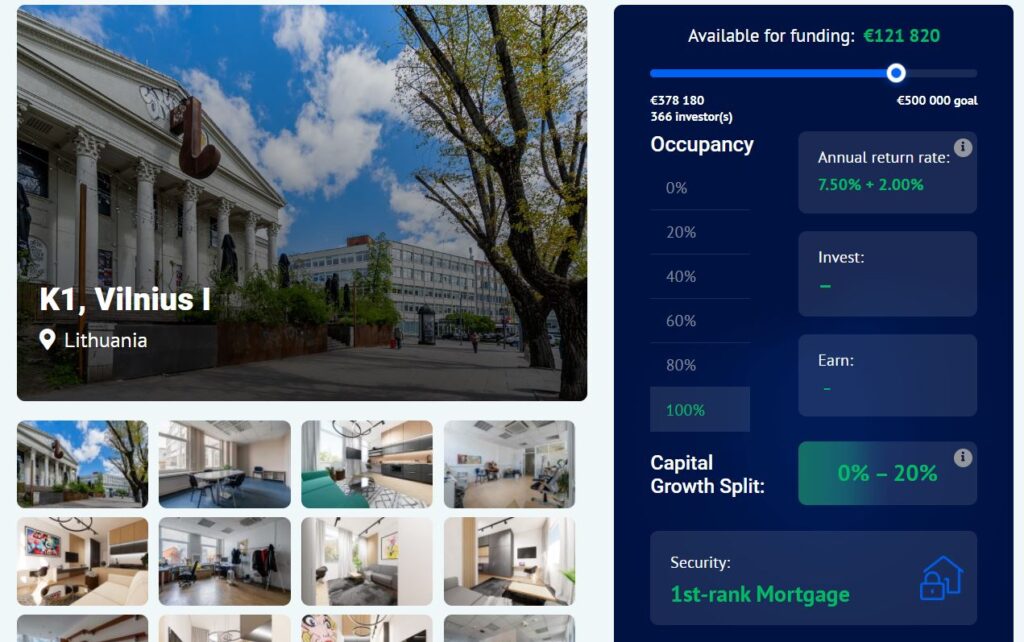

D) Buy-to-let platforms and equity crowdfunding

Typical representatives: InRento, Brickstarter, Urbanitae and others

A certain subtype of platforms, which is close to category (C) but based on different principles, are buy-to-let platforms. Here you help finance the purchase and possibly the renovation of a property. As investors, you participate from the rents and, in some platforms, also from the potential profit on the future sale of the property. InRento, Brickstarter, partly Reinvest24 are good examples of such platforms.

In this category we would also mention investment platforms where you invest in equity projects. For example, these are financing development projects, but instead of a fixed term and interest, you become co-owners of the project. This allows you to earn a much higher interest rate, but you also bear the risk of a failed investment. Also, there is no form of collateral. Furthermore, the investment period is only approximate and will depend mainly on how the project performs. An example is the Spanish platform Urbanitae, known mainly to investors on EvoEstate.

Recap – crowdfunding and buy-to-let platforms

- Loans are secured by collateral such as real estate. In the event of default, the collateral can be sold and paid out to investors.

- Development loans, business loans, bridging loans.

- There is no buyback guarantee as it does not make sense for this type of investment.

- The platform recovers defaulted and unpaid loans on behalf of investors by standard refinancing or through legal proceedings (sale of collateral).

- A special newer form of crowdfunding platforms are buy-to-let investments or equity crowdfunding.

E) Factoring P2P platforms

Typical representatives: Roger and others

The last category of platforms to mention are those that intermediate investments in factoring. A classic representative is the already proven Czech Roger. On the one side, it offers companies the factoring of invoices (in most cases these are invoices of smaller companies against large companies), and on the other side, investors the opportunity to invest in these invoices.

Bidding for investors is often handled in the form of an auction. Here investors compete with each other to see who will invest the offered invoice. The investor who offers the lowest interest wins.

Recap – factoring P2P platforms

- They provide factoring services to companies. The invoices are then passed on to investors.

- Beware, investors are often misled. They incur a claim on the selling company, but in most cases the investor does not know the company (only the buyer’s details are disclosed).

Offered interest rates for each type of platform

We can see a huge variance in the interest rates offered by these types of platforms. For unsecured consumer loans, we are talking about 11-16% (depending on the macro situation and the riskiness of the LO, so we can also see interest above and below this range), and for crowdfunding, most often 8-12% (in more western EU countries, even less, or even 14-15% for riskier loans). In our opinion, it is not ideal to decide on a platform based solely on the interest offered. In investing in general, the return is directly proportional to the risk, and this is no different here. It is the risks of the different types of P2P platforms discussed today that we will look at next.

| P2P marketplace | 11-16% |

| P2P platform with loans from a specific loan originator | 11-16% |

| Crowdfunding and buy-to-let platforms | 8-12% |

| Factoring P2P platforms | 4-7% |

As usual, we’d be happy to receive feedback, any questions about the article or anything else you’re interested in. For example, you can use the comments below the article.

Lukáš “Cupi” Cupal

Other articles: