Half of 2022 is behind us, so this time without any longer introductions, let’s take a look at the summary of my P2P investments over the last 3 months.

Mintos

By the end of June, the last of the loans offered were withdrawn and from July it is only possible to invest in Notes. Mintos is promoting them heavily, and is also trying to educate clients more vigorously. The problem is, however, that it will hardly succeed with many investors. The slow repayment of some defaults, the zero progress in recovery for Wowwo for example, the increase in pending payments…

I would hate to be a bad prophet, but given the recent significant increase in the interest rates offered, the return of the affiliate program for new investors, and the offer from Mintos CEO Sulte for individual chats on individual forums, it seems to me that Mintos has taken a big blow with Notes and investors’ patience has run out.

Quite illustrative is the table maintained by fellow P2Pforum member LuckyLuke. For June, we may still have some minor gains, but compared to last year we are at a third!!! of the invested volume.

I myself invested in loans until the last minute, campaigning for Delfin Group, which I consider to be a top provider, and eventually took advantage of the discounts offered on the secondary market during the loan period before it closed.

What do Notes mean for an investor?

- Legislative anchoring of Notes = increased security of investment + increased transparency

- Insurance of uninvested money on Mintos up to EUR 20,000

- Secondary market for loans will end completely, investors will have to let their purchased investments run until they are repaid, new secondary market will be for Notes only

- Every investor will automatically have withholding tax deducted when interest is paid. This is normally 20%, but can be deducted by up to half if documentation of tax residency is provided. However, you will need to send the document to Mintos every year, pay for the verification and lose some time in the process. For smaller investors, this makes it not worthwhile at all.

- The minimum possible investment on the primary market is going up from EUR 10 to EUR 50. Also, the possibility to choose to invest in one specific loan is no longer available; everything will now be “bundled”.

When I sum everything up, I have decided to quit Mintos as of July 1, 2022. Notes brings extra bureaucracy, unfavorable taxation, more revenue cuts that become less and less transparent. Some providers don’t pay interest on late payments, some abuse grace period/pending payments, you get tax deducted immediately on payout… I haven’t calculated how much the real yield will differ from the stated one, but I know I don’t want to watch such “mess”.

It’s all the more disappointing knowing that Mintos excels with a huge range of originators and that the platform could have gone much further if it hadn’t accumulated so many anti-investor decisions in a relatively short period of time.

I will let the loans run out gradually, hopefully some amount currently in recovery will come back and I will move the money elsewhere within P2P. Who knows, maybe the situation will turn around and I will be happy to return to Mintos one day.

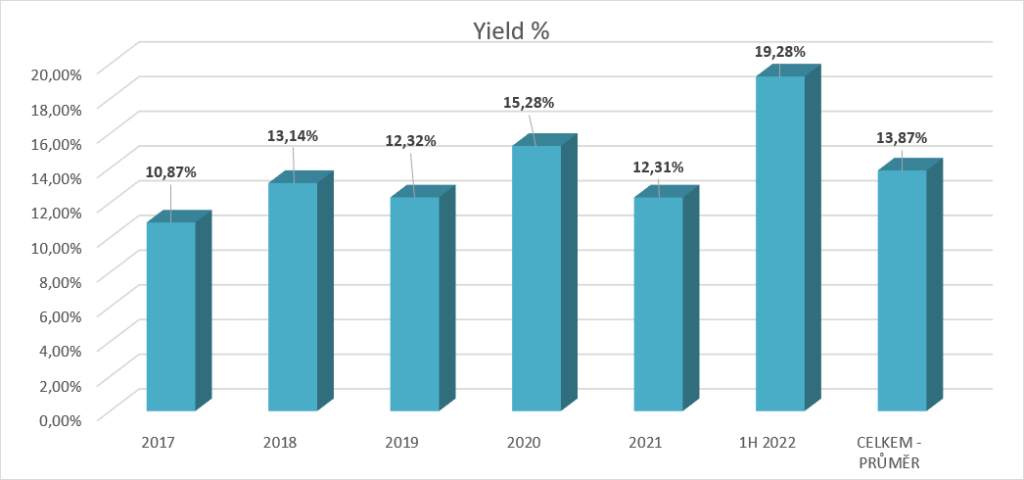

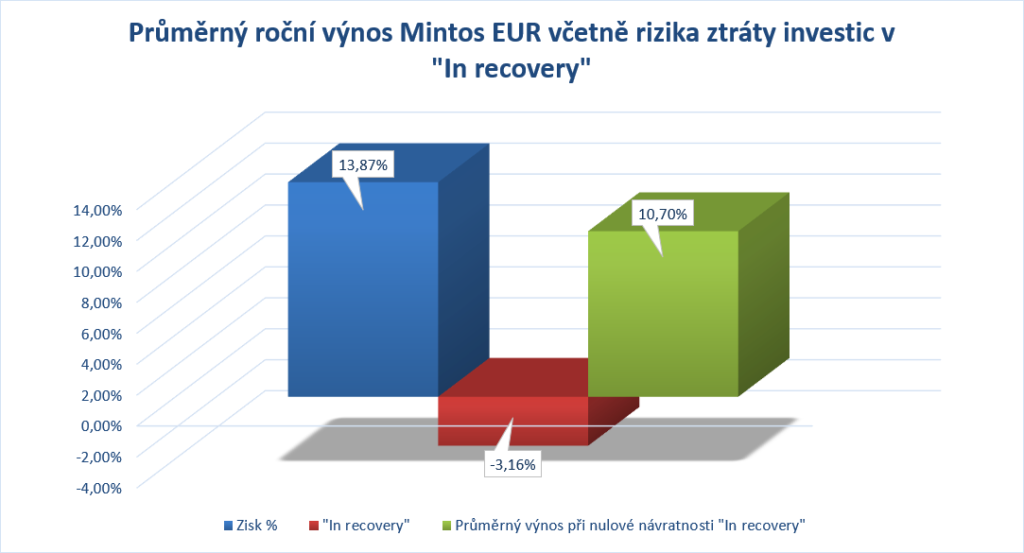

Overall, I can’t say that investing on Mintos was a mistake. This year’s first half was even significantly more profitable in percentage terms – thanks to significant discounts on the secondary market. If I then take my investments from the very beginning until today, even with all the In Recovery write-offs (and I hope I still get some payback), the average profit is over 10%. Yes, there is still a risk that some other provider will go bankrupt and my numbers will still move down significantly.

What about you, will you continue on Mintos? Write to us in the comments below the article.

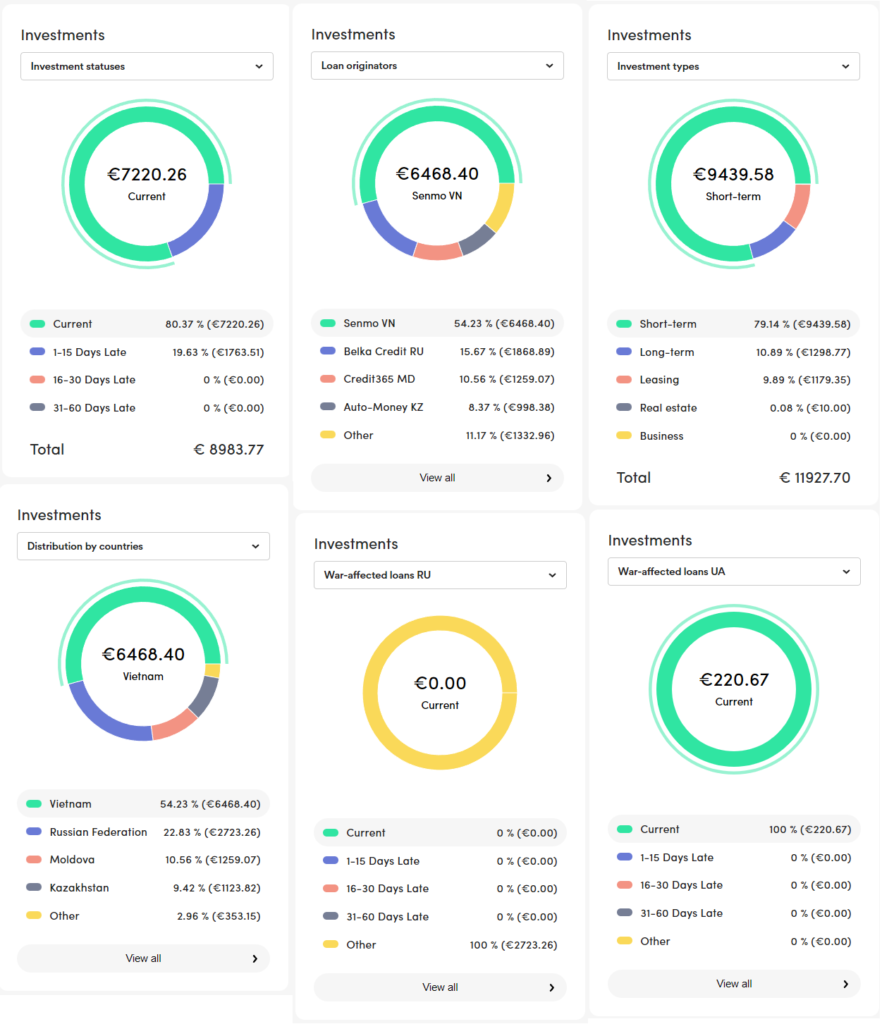

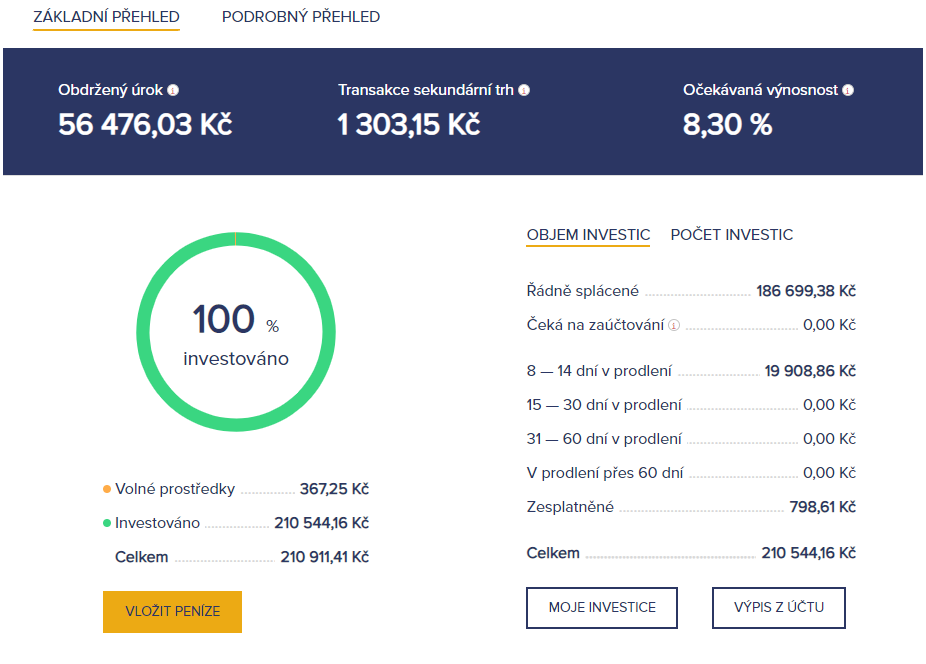

Peerberry

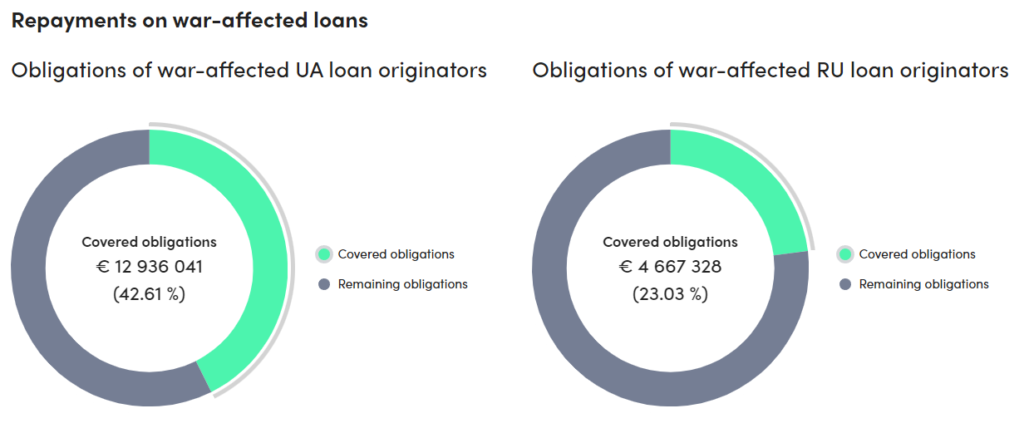

What is simply amazing about Peerberry is how, in the face of inconveniences like blocked funds in Russia and Ukraine, they managed to build a transparent repayment system and use it to their advantage. They have started repaying with vigour, already 1/3 of the affected money is back in investors’ accounts. Moreover, they regularly send them the conclusions of the independent commission that monitors the redistribution of the repaid money.

Everyone can see how the platform is doing directly on their statistics page, which is freely available and shows the status of debt repayment.

The platform itself then also published its results for 2021. There, of course, the aforementioned problems did not yet exist, but it showed solid growth in all the indicators monitored.

Of course, my real yield is gradually decreasing, for the last quarter it was only 8.87% p.a. This is due to the amount in recovery, which is no longer interest-bearing. I withdrew some holiday money from Peerberry first, and after paying everywhere with a Revolut card with transfers from CZK anyway, put most of it back in. The current level of allocation on the platform suits me fine.

You can find a page with everything about Peerberry on P2Ptrh here. We have also reviewed Peerberry platform here.

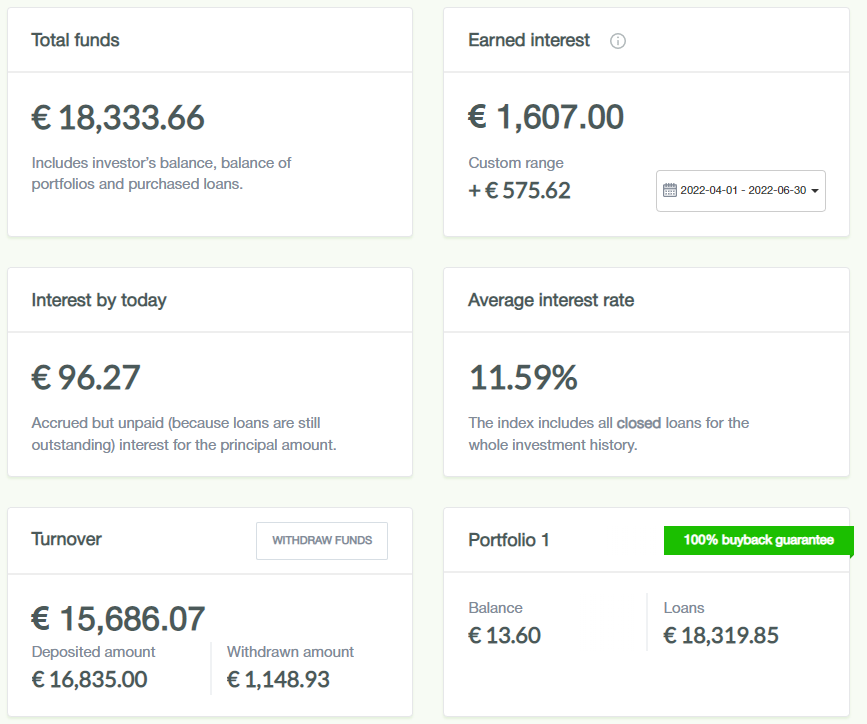

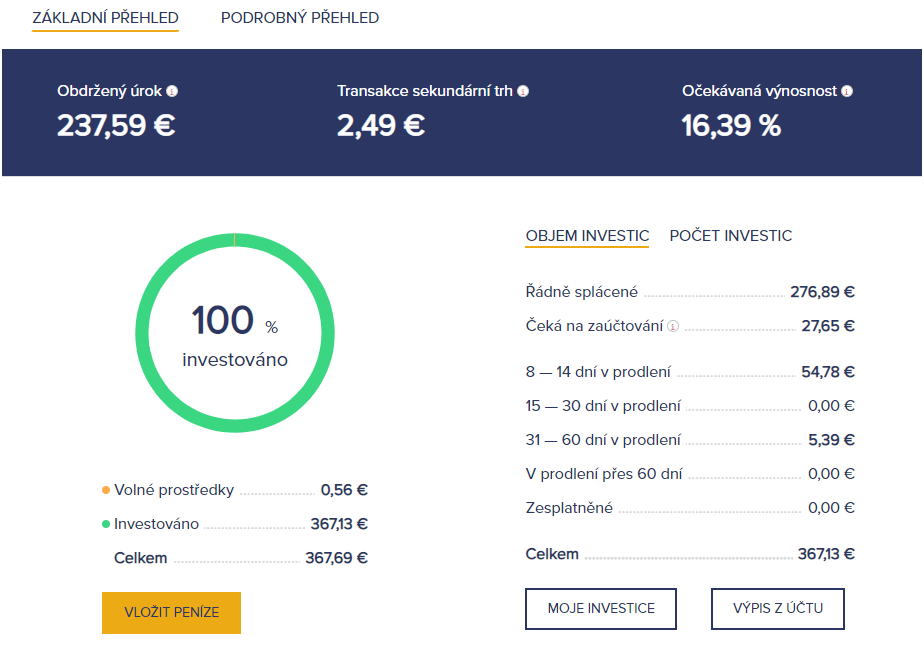

Lendermarket

Although at first glance it may seem to investors that everything at Lendermarket is going along the same old lines, this is not entirely true. There has been a change in the work team, but mainly a change from the Creditstar Group monoplatform to a classic multi-lender marketplace. The first swallow of the new providers was Credory from Estonia. It specialises in corporate loans secured by real estate. For more information, you can view their presentation or Q1 2022 results.

However, for now at least, Creditstar remains absolutely the flagship provider on the Lendermarket. The latter – entirely in line with its historical track record – has again struggled with cashflow in the second quarter. It failed to raise the maximum possible EUR 40m in newly issued bonds (yet it did raise EUR 24m in bonds for Creditstar at a pretty solid 11.5-12.5% interest rate). As a result, LM investors saw several cashback events.

The new management has also let it be known several times that the launch of the secondary market is imminent. I would certainly see that as a positive. On the other hand, it is important to remember that the strength of the secondary market like Mintos had is incomparable and in case of any problems on LM, SM would only save the investor in case of a very quick reaction. Even so, it is a step to increase liquidity and I might consider a higher allocation to longer term loans.

Reinvestment within my portfolio runs automatically, I’m quite happy with that.

For more information about Lendermarket, you can read our review or visit the Lendermarket overview page.

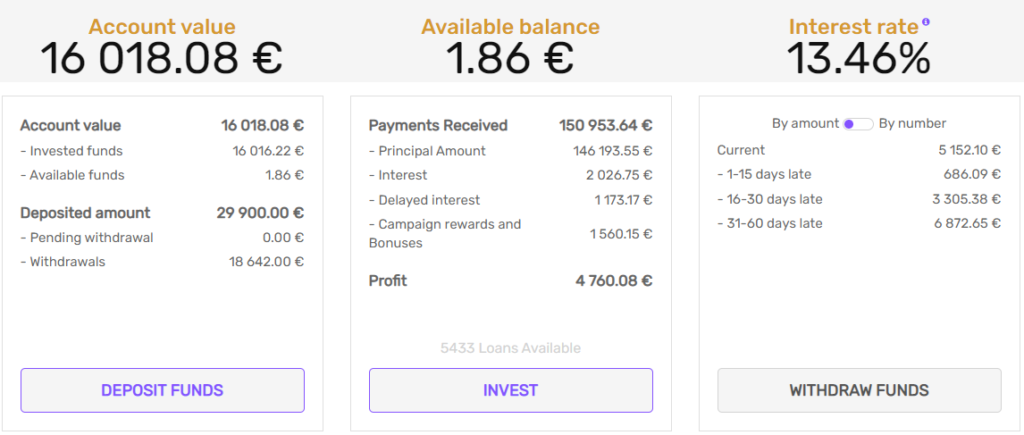

Robo.cash

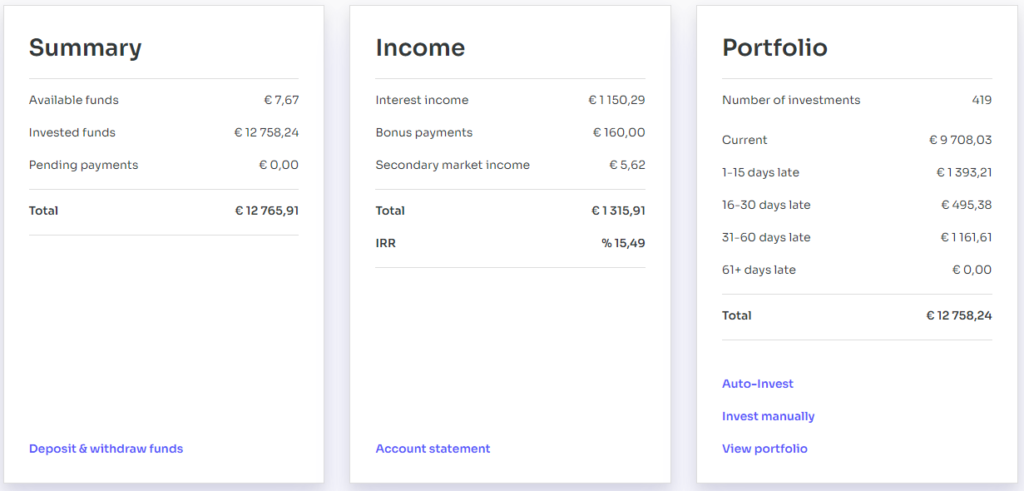

After my planned exit from Mintos, Robocash will become my biggest P2P exposure. Deservedly so from my perspective. No problems have affected the platform so far, I only need to check my account once a month, everything runs itself.

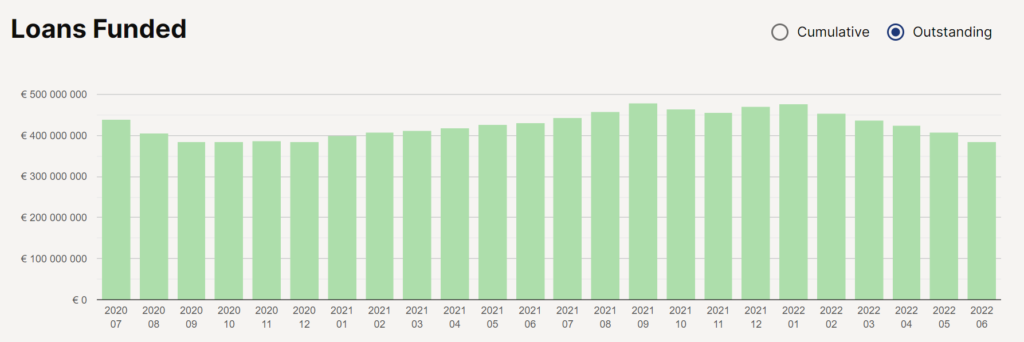

According to the monthly volume invested, Robocash has not been affected by the outflow of investors, and on the contrary is growing steadily.

I will probably not increase the deposit due to the higher exposure, but I do not plan to reduce the volume due to my overall satisfaction.

I also reviewed the platform last year, you can read my observations here. An informative page on P2Ptrh is here.

Afranga

Intermittently cloudy. That’s a brief description of the new loan offer on Afranga. During the quarter, we had a period when the primary market was well supplied, with interest rates rising to 14% p.a. However, in June, there was a reversal again, with supply fluctuating between 12-14% and again the occasional cash drag phenomenon – uninvested portions of available funds due to a lack of loans.

Stikcredit, the only lender on Afranga, has confirmed its already published 2021 results with a successful audit and they are well on track for a strong start in 2022. The key numbers are summarised nicely by Cupi on P2Pforum.

Stikcredit audited results for 2021

“Interest income up 58% vs 2020, interest expense up 86%, due to portfolio increase + higher LO debt… = net interest income up 57%. Net total profit up only 11% vs 2020, due to higher expenses – mainly personnel (up almost 300%) and administrative (up 44%, with the biggest increase in legal/audit).

Balance sheet – interest portfolio grew from BGN 12.2m to BGN 21.5m. Total assets are BGN 28.8m (vs. 17.6m in 2020). Equity grew slower than debt (BGN 11.9m -> 15.9m), debt grew from BGN 5.7m to 12.9m. Of the total assets of 28.8m, BGN 3.9m is held in cash and equivalents. Virtually all debt is funded through p2p platforms. Almost 50% of the debt has a maturity of 3-12 months and only about 16% of the debt has a maturity of more than a year.

Although StikCredit is using more debt than before to grow, the debt is still lower than the company’s equity alone (0.81 ratio), so a very healthy balance sheet by p2p standards, as always. Profit margin greater than 30% is still very nice despite the decline. A profit of €2.5m on a LO with assets of about €14m is a luxury. Too bad they didn’t use a higher profile auditor, but I understand that would probably be quite expensive for their size.

Shareholders have paid themselves a dividend of BGN 1.0m for 2021.”

Analysis of Stikcredit results for 2021 by Cupi on P2Pforum

Stikcredit results for 1Q2022

“To add to the 2021 information, at the end of 2021, 54% of loans were repaid on time, 18% were 0-90 days delinquent, and the remainder were 90+ days delinquent. Almost 30% 90+ strikes me as a pretty big number. By comparison, Iute or Placet are around 10%.

The results for Q1 2022 show beautifully how the larger portfolio is starting to bear fruit, not just expenses. Interest income of BGN 5.6m (full year 2021 BGN 15.9m), slightly higher staffing, interest and admin expenses, but thanks to the large income, net profit for the quarter is BGN 2.4m, compared to BGN 5.1m for full year 2021, where expenses were the biggest factor, income from the larger portfolio is only now bearing fruit.

Balance sheet – loan portfolio grew from BGN 28.8m to BGN 31.9m in the quarter, cash and equivalents grew from BGN 3.9m to BGN 4.2m. Debt a little higher (12.9m -> 13.6m) and equity grew due to the addition for net profit (15.9m -> 18.3m). Debt to equity down to 0.74, balance sheet looks even healthier than it was at year end. More cash on hand is also reassuring.

For me, great results, Afranga has no problem with investor confidence and they are not running away. That, a lot of cash on hand and low debt are in my opinion extra important nowadays, when we see problems e.g. on Mintos with heavily indebted LOs. The only minus I see is the morale of the borrowers, those loans in default are statistically quite a lot and they probably have to deal with higher APR and fees. For the record, LO’s interest income is about 4 times less than fee income (for loan origination, late fees, etc). Compared to LOs like Delfin, Iute or Placet, they are after all targeting an even poorer class. However, the loss on loan write-offs was only 6% of revenue.”

Analysis of Stikcredit results for Q1 2022 also by Cupi on P2Pforum

I’m not transferring new funds to Afrang yet, but I’m not moving away either. In my excel calculated return is just under 14%, sometimes when I check the account I have uninvested maximum low percentages of the portfolio and otherwise the platform works without interference on its own, no worries.

Afranga overview page on P2Ptrh can be found here, review here.

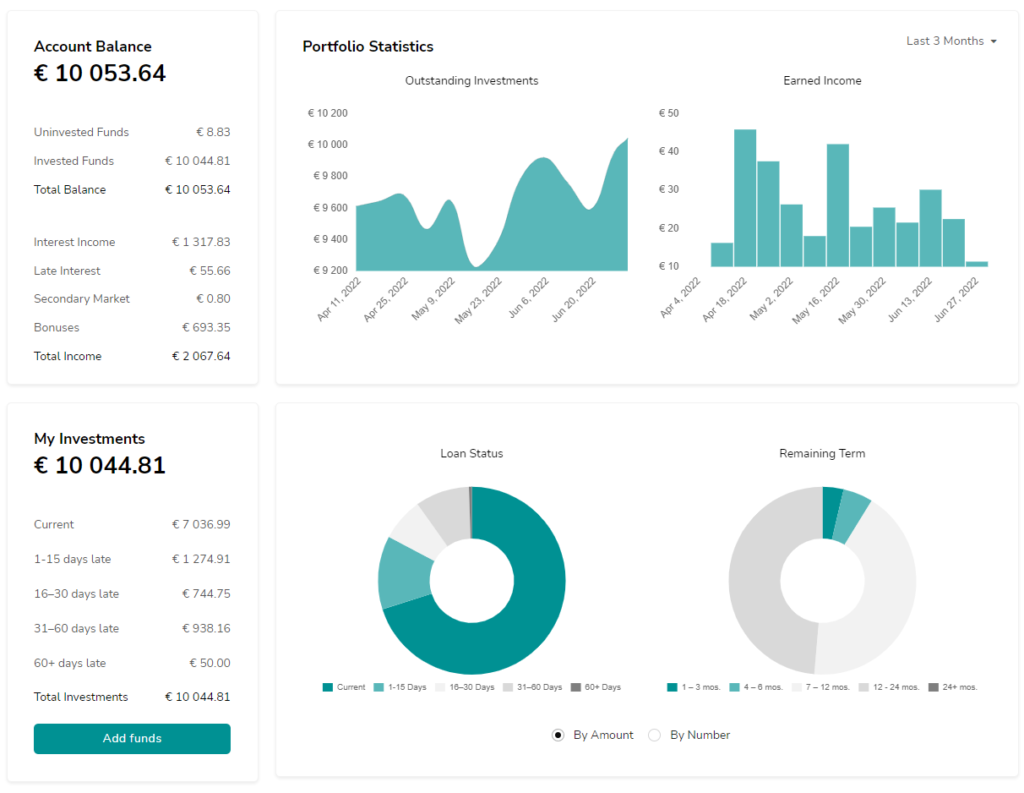

Esketit

In April, Esketit launched its own loyalty program with 2 levels. A gold investor (investments over EUR 25,000) receives a bonus interest rate of +0.5%, while a platinum investor (investments over EUR 50,000) receives +1%. Apart from the fact that the levels are quite high, the fact that the bonus interest only applies to Jordanian loans is also demotivating. Personally, therefore, I don’t see who Esketit is targeting with this program.

After a few withdrawals myself (moving to Mintos in April due to higher interest rates), I’m continuing on the same path. The offer of loans from the Czech Republic has gone back up from 10% to the original 12%. This is not a miracle compared to the competition, but Esketit works independently, reliably and I like the diversification into Czech loans. Currently, I’m about 2/3rds of the way there and supplementing the remaining third with riskier loans from Jordan.

For more information about Esketit platform visit its overview page or read our review.

Bondster

As those of you who read P2Preports regularly already know, I follow a strategy of buying Czech secured loans on the secondary market on Bondster. In doing so, I maintain a very high success rate of on-time repayment loans. However, I have hit a different limit. In fact, after the first few months after the launch of the secondary market, those investors who had planned to do so left Bondster. The supply of SM fell off. Even so, there were some interesting offers that I was happy to wait a few days for. However, over the last quarter, almost no loan can be found on SM that meets my criteria (7+% interest, secured by real estate, no premium) such that I am no longer invested in it. I don’t really want to increase the funds in one loan, so I may have to do a little cashing out in the next few months as the loans get paid off over time.

The second inconvenience is the huge inflation. The CNB (Czech National Bank) keeps raising rates and the interest rates offered on some banks’ savings accounts are rising along with it. Getting 7% on Bondster with moderate risk and worse liquidity or liquid 5% in the bank is not such a difference anymore. However, what discourages me from withdrawing funds is the fact that inflation can be expected to decline in the longer term (+1 year) and then return to 2-3% over an even longer period of time. Most of the loans on Bondster are multi-year and 7% interest can be very attractive again in 2 years. Now when I factor in the time cost of selling these loans, gradually rolling them over elsewhere… I just assessed it wasn’t worth bothering with.

I’m not increasing activity in euros, and I still don’t foresee myself preferring Bondster over other alternatives here in the future.

I If you are active on Bondster, you can check out our overview page and leave a short summary for other users.

What next?

In the second half of this year – if nothing unexpected happens – I will be releasing funds on Mintos. I want to move some of it to already established platforms, but at the same time I would not be reluctant to expand my portfolio with something new. The criteria are simple – a solid reputation and background of the platform in question and an offering that matches the current market (ideally at least 14%). I haven’t come across such a platform yet. I’m slightly flirting with Lande (formerly Lendsecured) recently reviewed by Cupi. It would also make sense in the context that, with central bank rates rising and a recession expected, we can expect a deterioration in borrower payment morale and therefore an increased risk of problems for consumer lenders. This could be solved by platforms with offerings secured by real estate. However, I have not yet decided to sign up.

Alternatively, if you have any tips, I’d be happy to share.

Be well and enjoy your summer,

Zbyněk

All previous P2PReports can be found here.